- United States

- /

- Specialty Stores

- /

- NYSE:SAH

What Recent Price Drops Mean for Sonic Automotive’s Valuation in 2025

Reviewed by Bailey Pemberton

Thinking about what to do with Sonic Automotive stock right now? You are not alone. The company has seen a wild ride lately, and many investors are wondering if it is time to buy, sell, or hold. After hitting a high earlier in the year, the stock is down 18.1% for the month and dropped 14.1% just in the past week. Still, if you zoom out, Sonic Automotive is up more than 96% over five years and 45.4% over the past three years. That sort of long-term outperformance grabs attention, especially when recent setbacks are paired with news that dealership technology initiatives and digital expansion continue to reshape the industry landscape.

Fueling these recent moves are a mix of sector headwinds, such as shifts in consumer demand and changing auto prices, and moves Sonic Automotive has made to steadily improve operations and capture market share in both traditional and digital spaces. While the short-term swings might raise your pulse, the long-term trends (and the company’s 3.2% gain year to date) show there is more to this story than the latest dip in the chart.

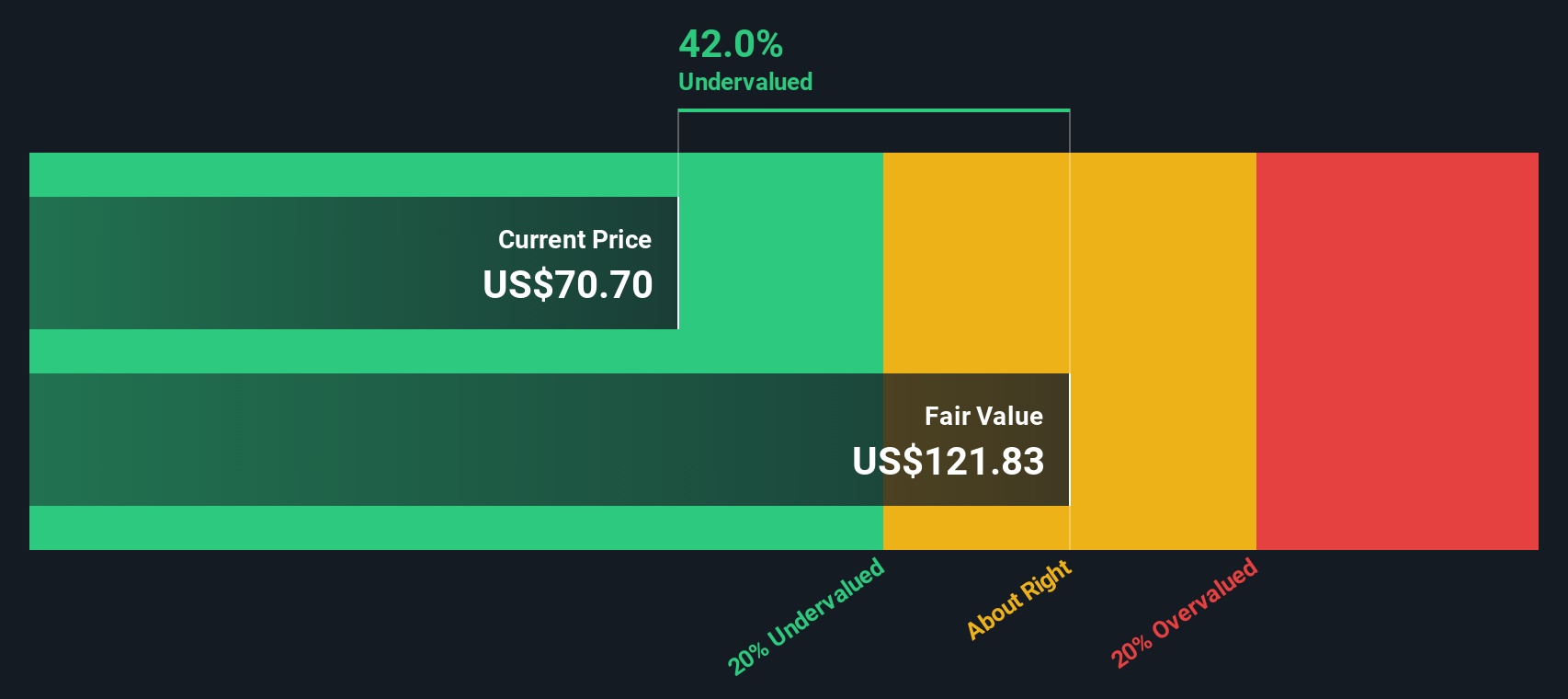

So is Sonic Automotive undervalued now, or is there more risk ahead? Using six common valuation checks, the company scores a 4, meaning it is considered undervalued in four out of six areas. That is definitely intriguing for value hunters, but numbers only tell part of the story. Let’s dig deeper into the major valuation approaches to see exactly what is driving these results, and stick around for a practical twist at the end that might completely change how you think about valuation.

Approach 1: Sonic Automotive Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model begins by forecasting a company’s future cash flows and then discounts those back to today’s value using an appropriate rate. This helps investors estimate what the business is really worth based on its future ability to generate cash.

For Sonic Automotive, the DCF approach uses a two-stage Free Cash Flow to Equity model. The company’s latest reported Free Cash Flow (FCF) sits at $393 million, with analysts projecting continued growth in the coming years. While analysts cover cash flows up to five years ahead, further projections up to 10 years have been extrapolated to capture long-term trends. For example, forecasted FCF in 2028 is $337 million, growing to $566.1 million by 2035 according to model estimates.

The DCF model arrives at a fair value estimate of $121.67 per share. Given the current share price, the model implies the stock is trading at a 47.1% discount, indicating it could be substantially undervalued at this time.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Sonic Automotive is undervalued by 47.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Sonic Automotive Price vs Earnings

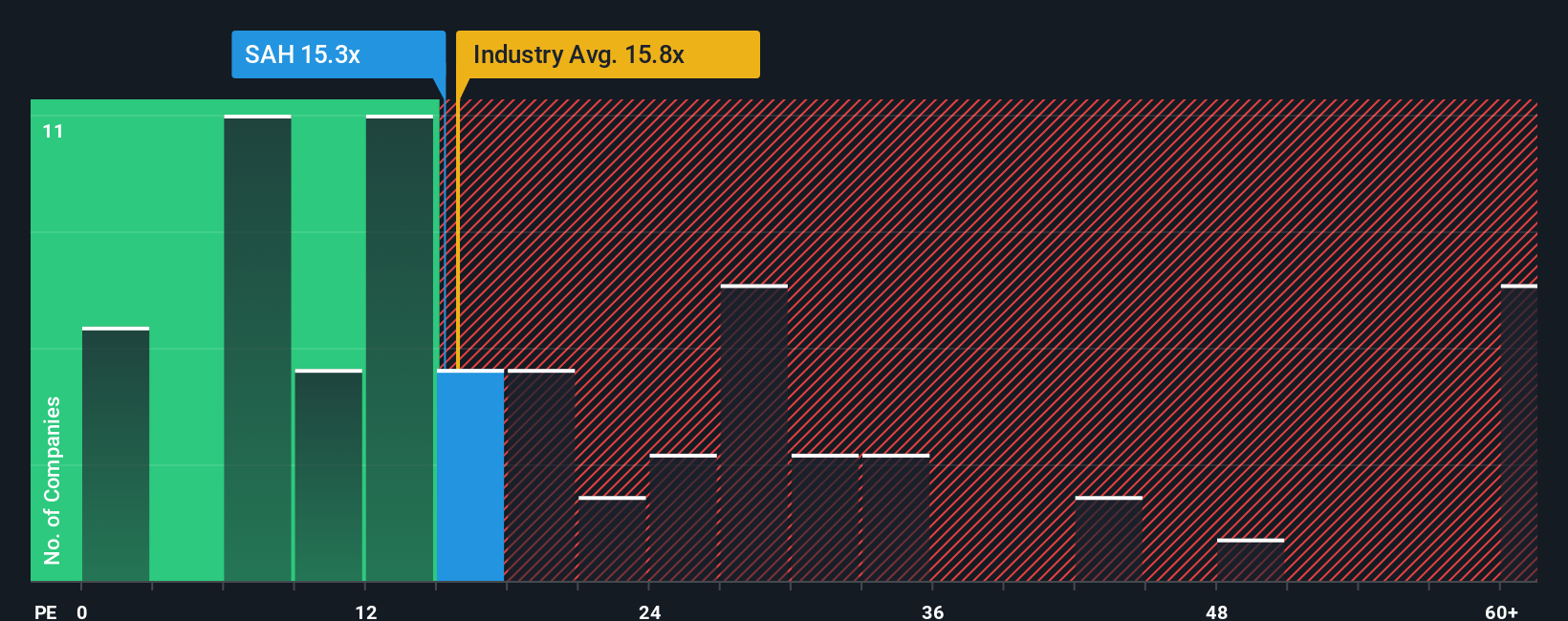

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Sonic Automotive because it directly relates a company's stock price to its earnings power. This makes it useful for investors wanting to know whether they are paying a reasonable amount for each dollar of earnings.

Of course, what counts as a “normal” or “fair” PE ratio depends not only on industry standards, but also the company’s expected growth rate and its risk profile. Higher growth prospects and lower risk typically justify a higher PE ratio, while more risk or slower growth point to a lower one.

Currently, Sonic Automotive trades at a PE ratio of 16.86x. That puts it right in line with the Specialty Retail industry average of 16.91x and a bit above the peer average of 11.99x. However, to deliver a clearer benchmark, Simply Wall St’s "Fair Ratio" calculates a PE of 19.57x for Sonic Automotive. This proprietary measure considers not just industry or market averages but also factors like Sonic's specific growth outlook, risk, profit margins, and market capitalization.

This Fair Ratio gives a more tailored and accurate sense of value compared to broad industry comps, allowing investors to see how the stock stacks up in a way that reflects its actual prospects. With the actual PE of 16.86x being noticeably below the Fair Ratio of 19.57x, this suggests that Sonic Automotive shares are still trading at an attractive valuation based on their earnings power.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sonic Automotive Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, powerful way to turn your perspective on a company into a tailored investment story by combining your own view of Sonic Automotive’s prospects with your assumptions about its future revenue, earnings, and profit margins. Narratives connect a company’s unique journey to dynamic financial estimates and a calculated fair value, so you can see both the story and the numbers clearly.

On Simply Wall St’s Community page, Narratives are created and updated by millions of investors, giving you an instant way to construct or explore different outlooks. Each Narrative shows how your chosen story influences the company’s fair value versus today’s price, helping you decide when buying or selling might be justified. Best of all, Narratives update automatically as news breaks or fresh earnings are released, so your outlook stays current.

For example, some investors tracking Sonic Automotive now estimate a fair value as high as $95.00 per share, reflecting optimism in digital expansion and margin growth, while others anticipate a more cautious $72.00, pricing in risks like EV disruption and slowing demand. Whatever your take, Narratives let you articulate, backed by data, what you believe and see how different possibilities might play out in real time.

Do you think there's more to the story for Sonic Automotive? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SAH

Sonic Automotive

Operates as an automotive retailer in the United States.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives