- United States

- /

- Specialty Stores

- /

- NYSE:RVLV

What Does the Recent Share Rebound Mean for Revolve Group’s Valuation in 2025?

Reviewed by Bailey Pemberton

If you have been eyeing Revolve Group’s stock, you are definitely not alone. With a closing price of $22.37, the company has drawn plenty of attention and no shortage of questions from investors deciding what to do next. Lately, the stock has shown flashes of both promise and caution. After gaining 2.1% in just the last week, Revolve Group has started to bounce back from a tough stretch, including a 6.2% dip over the last 30 days and a hefty 33.3% slide since the start of the year. But step back and you will notice this isn’t just about recent turbulence. Over three and five years, the stock has eked out gains of 1.2% and an impressive 23.3% respectively, reflecting the company’s resilience and ability to weather changing industry winds.

Much of this movement follows shifts in broader retail sentiment, with optimism around digital commerce and changing consumer patterns fueling some rebounds. Persistent volatility does raise some eyebrows, though, especially for investors focused on risk and long-term growth potential.

So, is Revolve Group a bargain hiding in plain sight or a stock priced just right? Using our standard valuation checks, we give Revolve Group a valuation score of 0 out of 6. This means it is not currently undervalued by any of our six key measures. Of course, there’s more to the story than a single number. Let’s break down those valuation approaches, and stay tuned, because we will reveal a more nuanced way to think about value at the end of this article.

Revolve Group scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Revolve Group Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a business is worth today by projecting its future cash flows and then discounting them back to the present. This helps investors get a sense of the company's intrinsic value based on its actual ability to generate cash in the years ahead.

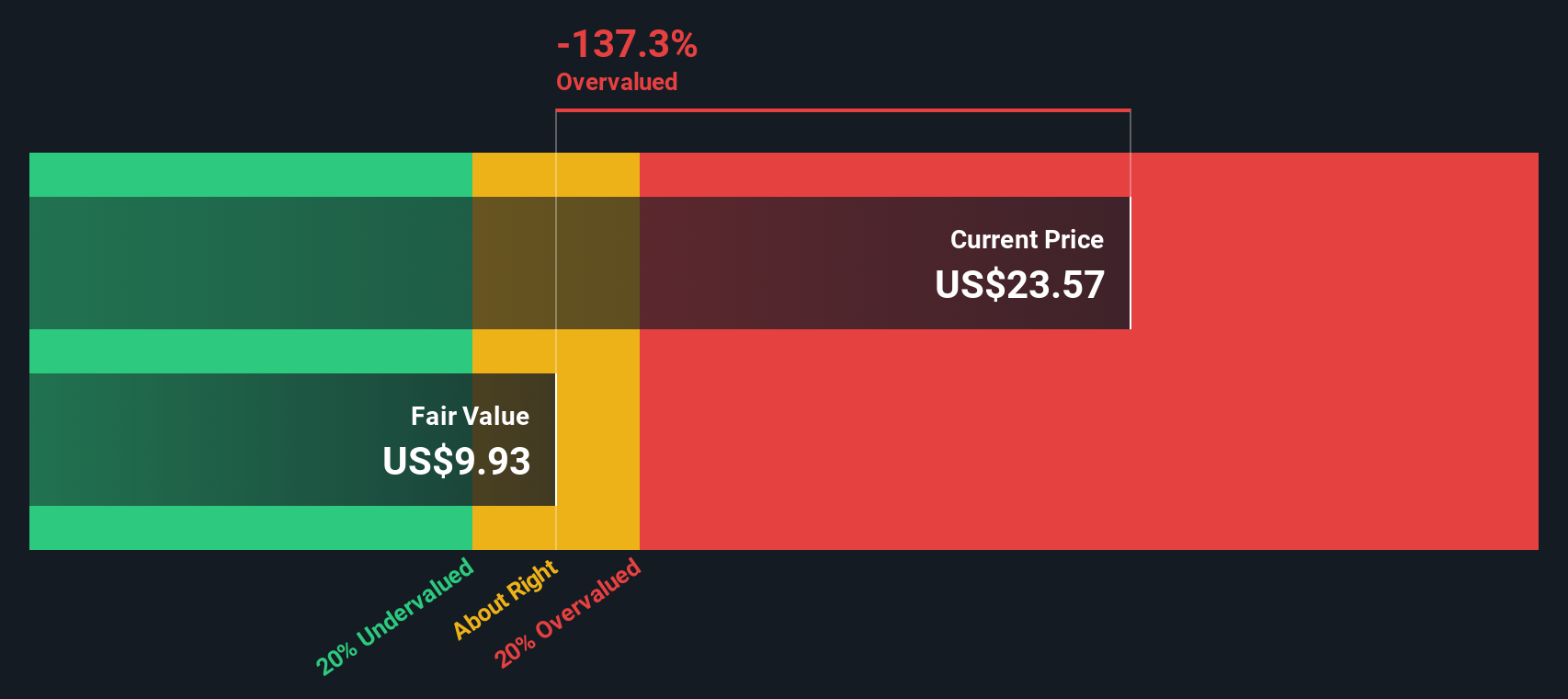

For Revolve Group, the latest reported Free Cash Flow stands at $64.88 Million. Analyst estimates project a dip in Free Cash Flow, with the 2026 figure expected to reach $50.5 Million. Looking ahead over the next decade, projections continue to trend slightly downward or remain stable, based on a blend of analyst consensus and in-house forecasting. By 2035, the forecasted Free Cash Flow is around $44.8 Million, all in US Dollars.

Applying the 2 Stage Free Cash Flow to Equity DCF model, this stream of projected cash is discounted to its present value. This results in an estimated intrinsic value of $9.90 per share. Compared to the current price of $22.37, this suggests that Revolve Group is about 126% overvalued based on this approach.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Revolve Group may be overvalued by 126.0%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Revolve Group Price vs Earnings

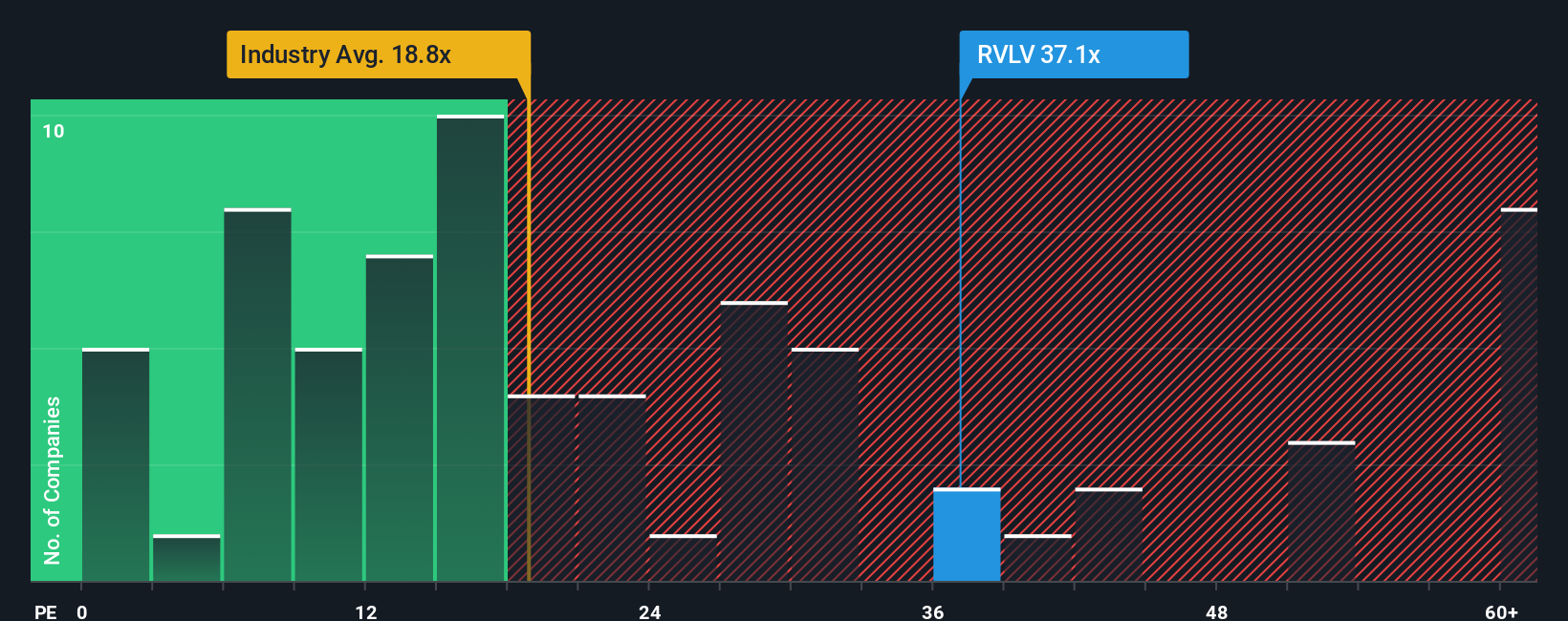

The Price-to-Earnings (PE) ratio is a key valuation tool for profitable companies like Revolve Group, as it connects a company’s share price to its earnings power. For investors, a company’s PE offers a straightforward lens into how much the market is willing to pay for each dollar of current earnings. Growth expectations and perceived risks play a significant role here. Rapidly expanding businesses or those in less volatile markets might command higher PE ratios, while slower-growing or riskier companies often settle at lower multiples.

Currently, Revolve Group trades at a PE of 35.2x. This stands well above both the specialty retail industry average of 17.3x and the peer group average of 15.1x, indicating that investors are pricing in a significant premium based on future growth or quality expectations. However, Simply Wall St’s "Fair Ratio," which blends together factors like expected earnings growth, industry context, profit margins, market cap, and company-specific risks, calculated a fair PE ratio for Revolve Group at 17.25x. Unlike generic peer or sector comparisons, the Fair Ratio is tailored to Revolve Group’s exact fundamentals and future prospects, offering a more nuanced benchmark.

Comparing the current 35.2x to the Fair Ratio of 17.25x suggests the stock is trading considerably above what its core characteristics would justify. Based on this model, the stock is viewed as overvalued by this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Revolve Group Narrative

Earlier, we mentioned there's an even better way to understand fair value. Let's introduce Narratives. Narratives are a simple but powerful tool that lets you connect your unique view of a company’s story to the numbers behind it, like future revenue, earnings, and profit margins. Instead of relying solely on standard ratios, Narratives help you build a reasoned, evidence-backed forecast that reflects your own outlook and see how that translates into a fair value for the stock.

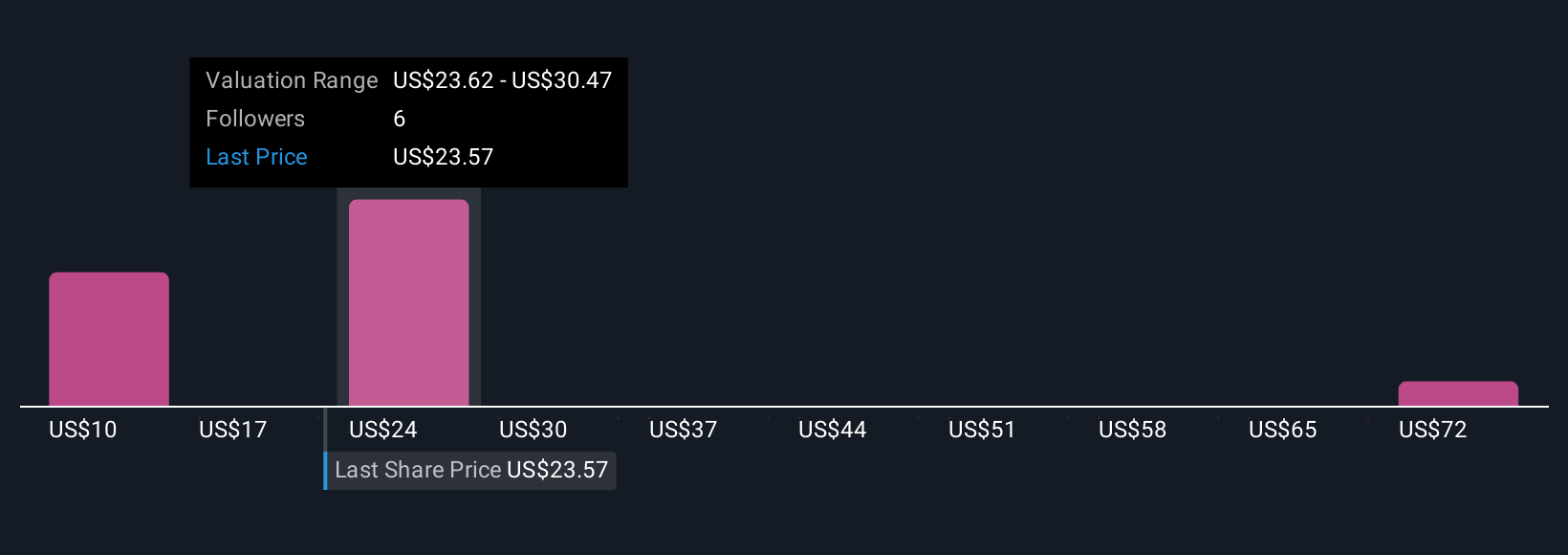

On Simply Wall St’s Community page, millions of investors can use Narratives to clearly lay out why they think a company is undervalued or overvalued, and instantly see how their assumptions stack up against the current share price. Narratives are dynamic and automatically refresh when new information, such as earnings or industry news, is released. This makes them a living reflection of investor sentiment and evolving facts.

For example, some investors see Revolve Group’s international expansion and digital strategy boosting growth and set a fair value as high as $30.00. Others point to profit margin risks and set their fair value closer to $19.00. Narratives allow you to turn your own perspective into actionable insights, helping you decide if now is the right time to buy, sell, or hold.

Do you think there's more to the story for Revolve Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RVLV

Revolve Group

Operates as an online fashion retailer for millennial and generation z consumers in the United States and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives