- United States

- /

- Specialty Stores

- /

- NYSE:LUXE

Investors Give MYT Netherlands Parent B.V. (NYSE:MYTE) Shares A 25% Hiding

The MYT Netherlands Parent B.V. (NYSE:MYTE) share price has softened a substantial 25% over the previous 30 days, handing back much of the gains the stock has made lately. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 115% in the last twelve months.

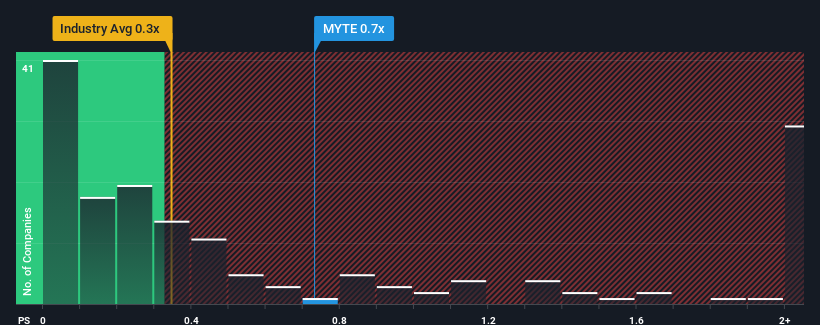

Although its price has dipped substantially, there still wouldn't be many who think MYT Netherlands Parent B.V's price-to-sales (or "P/S") ratio of 0.7x is worth a mention when the median P/S in the United States' Specialty Retail industry is similar at about 0.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for MYT Netherlands Parent B.V

What Does MYT Netherlands Parent B.V's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, MYT Netherlands Parent B.V has been doing relatively well. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on MYT Netherlands Parent B.V.Is There Some Revenue Growth Forecasted For MYT Netherlands Parent B.V?

MYT Netherlands Parent B.V's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a decent 12% gain to the company's revenues. Pleasingly, revenue has also lifted 31% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 10% as estimated by the five analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 4.9%, which is noticeably less attractive.

With this information, we find it interesting that MYT Netherlands Parent B.V is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From MYT Netherlands Parent B.V's P/S?

Following MYT Netherlands Parent B.V's share price tumble, its P/S is just clinging on to the industry median P/S. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite enticing revenue growth figures that outpace the industry, MYT Netherlands Parent B.V's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for MYT Netherlands Parent B.V that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:LUXE

LuxExperience B.V

Through its subsidiary, operates an online shopping platform in Germany, the United States, rest of Europe, and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives