New Automated Fulfillment Center Might Change The Case For Investing In Macy's (M)

Reviewed by Sasha Jovanovic

- Macy’s, Inc. recently celebrated the grand opening of its new 2.5 million-square-foot customer fulfillment and store replenishment center in China Grove, North Carolina, marking its largest and most technologically advanced facility to date.

- This major supply chain investment features high-performance automation and an advanced warehouse management system, positioning Macy's to deliver faster, more efficient service and improved customer experience across all product categories.

- We'll examine how Macy’s expanding automation and fulfillment capabilities may influence its long-term operational efficiency and investment outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Macy's Investment Narrative Recap

For those considering Macy’s stock, the core belief centers on the company’s ability to create value by modernizing operations and improving omni-channel efficiency, especially amid shifting consumer habits and competitive pressures. The recent launch of its China Grove fulfillment center strengthens its supply chain and could support operational efficiency, but does not fundamentally alter the near-term catalysts, such as achieving comparable sales growth, or mitigate key risks like margin pressure from ongoing tariff and pricing challenges.

Among Macy’s latest announcements, the accelerated rollout of small-format stores is closely connected to the fulfillment center’s enhanced logistics and delivery capabilities. This combination of new store formats with improved back-end support is intended to support faster service, boost customer satisfaction, and respond to changing shopping patterns, factors that speak directly to the company’s most important near-term catalysts but still leave room for execution risks.

Still, against these positive initiatives, investors should not overlook how margin pressure from tariffs remains an area that could...

Read the full narrative on Macy's (it's free!)

Macy's is projected to reach $18.5 billion in revenue and $663.0 million in earnings by 2028. This outlook assumes annual revenue will decline by 6.5% and earnings will rise by $169.0 million from the current level of $494.0 million.

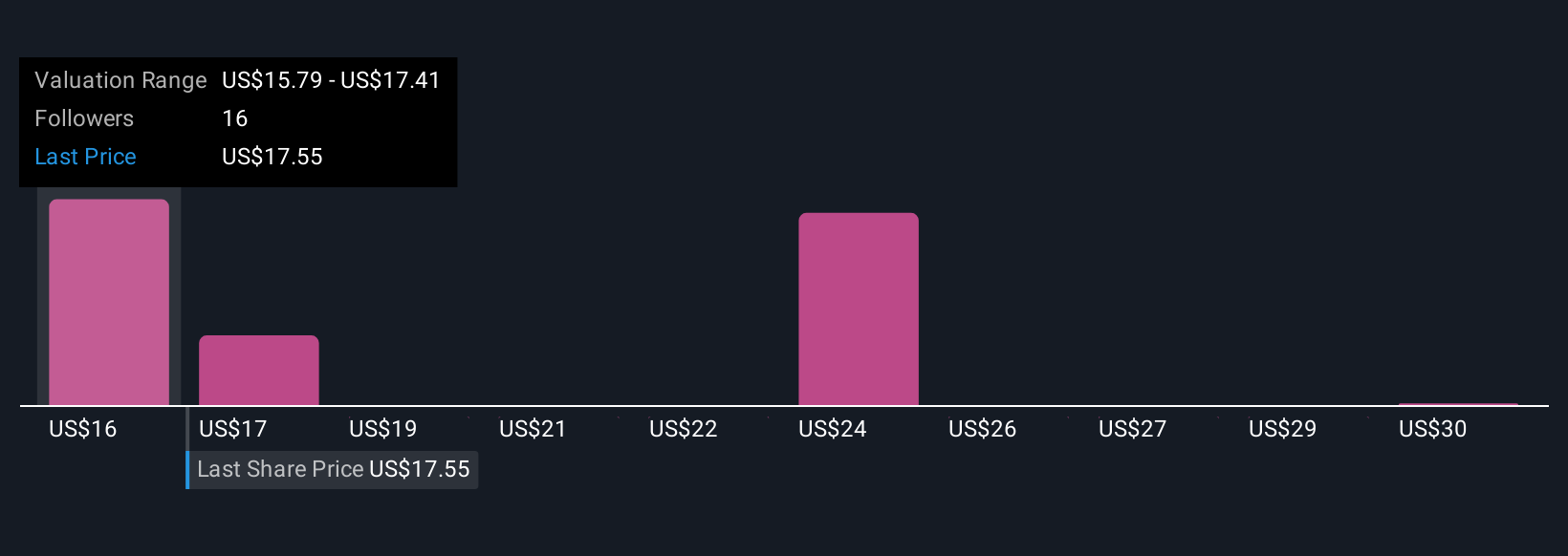

Uncover how Macy's forecasts yield a $15.79 fair value, a 12% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have fair value estimates for Macy’s ranging from US$15.79 to US$32, based on four distinct analyses. While some analysts see improved omni-channel operations as a source of earnings leverage, others highlight continued margin pressures, illustrating why your own view on risk and reward matters.

Explore 4 other fair value estimates on Macy's - why the stock might be worth as much as 78% more than the current price!

Build Your Own Macy's Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Macy's research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Macy's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Macy's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:M

Macy's

An omni-channel retail organization, operates stores, websites, and mobile applications in the United States.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives