Back-to-Back Earnings Surprises Could Be a Game Changer for Macy's (M)

Reviewed by Sasha Jovanovic

- In the past quarter, Macy's reported a very large earnings surprise, significantly exceeding analyst expectations for the second quarter in a row.

- This consistent outperformance has led analysts to adopt a more bullish stance, as reflected in a positive Earnings ESP and renewed confidence ahead of the upcoming results.

- With analysts signaling increased optimism based on Macy's robust recent earnings surprises, we'll examine how this shift could influence its investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Macy's Investment Narrative Recap

To own Macy’s stock today, you need to believe the company can convert recent earnings momentum into lasting value despite challenges like ongoing store closures and soft store demand. The recent outsized earnings surprises have quickly shifted short-term expectations, but this run-up may not materially weaken the risk that Macy’s remains vulnerable to consumer shifts toward e-commerce and away from traditional in-store retail formats.

Of the company’s recent moves, the launch of a new customer fulfillment center is closely tied to these strong earnings surprises, as it signals efforts to improve efficiency and support both stores and online operations. In context, this investment may favor Macy’s in the near term by better balancing its omni-channel ambitions with evolving retail trends, though not all execution risks are resolved.

Yet, what some may miss is that even as results beat forecasts, the threat of declining brick-and-mortar traffic still…

Read the full narrative on Macy's (it's free!)

Macy's narrative projects $18.5 billion revenue and $663.0 million earnings by 2028. This requires a 6.5% yearly revenue decline and a $169 million earnings increase from the current $494.0 million.

Uncover how Macy's forecasts yield a $16.59 fair value, a 17% downside to its current price.

Exploring Other Perspectives

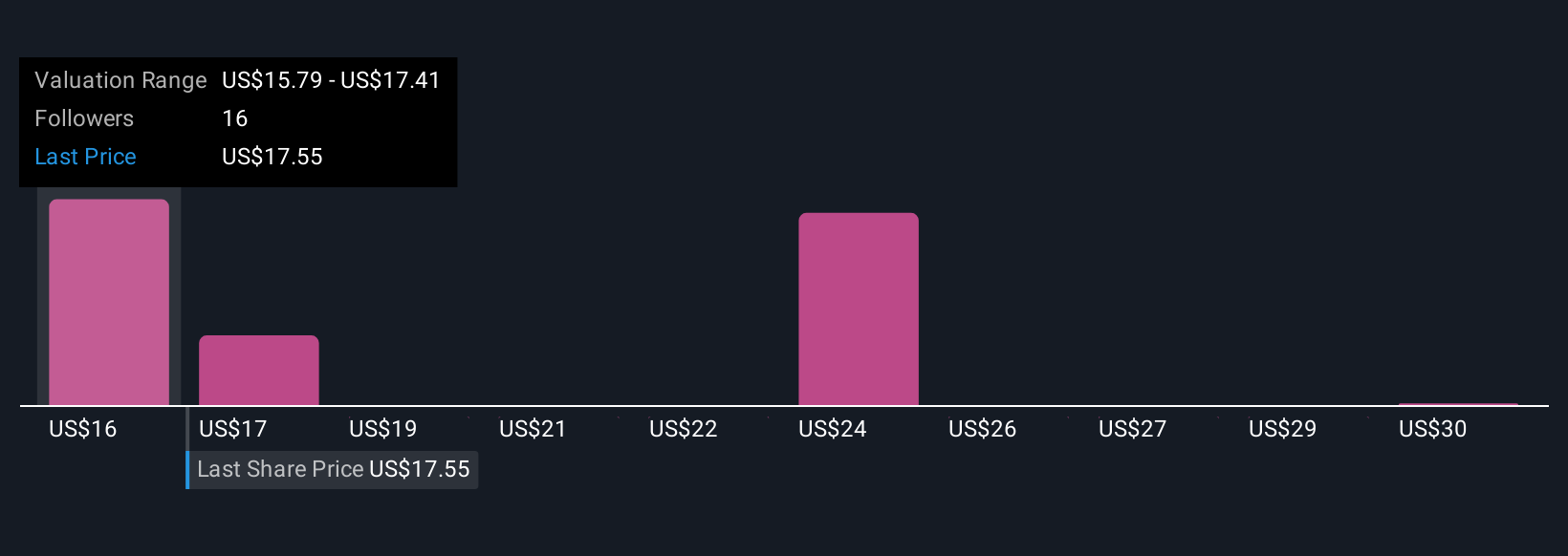

Four fair value estimates from the Simply Wall St Community put Macy’s between US$16.59 and US$32 per share. As you consider this wide spread, remember the continued risk that soft store demand and shifting consumer habits could hinder Macy’s growth, urging you to compare your outlook with alternative views.

Explore 4 other fair value estimates on Macy's - why the stock might be worth as much as 60% more than the current price!

Build Your Own Macy's Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Macy's research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Macy's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Macy's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:M

Macy's

An omni-channel retail organization, operates stores, websites, and mobile applications in the United States.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives