A Fresh Look at Macy's (M) Valuation as Analyst AI Optimism and Earnings Momentum Grow

Reviewed by Kshitija Bhandaru

Thinking about what to do with Macy's (M) stock after this week’s developments? You’re not alone. Fresh analyst commentary has named Macy's among the U.S. retailers most likely to unlock real gains from integrating agentic AI into their operations, and new research from Zacks suggests strong odds for the company to beat its next earnings expectations. The conversation around cost-cutting potential and possible profit boosts has clearly put Macy's on the radar for investors now weighing their next move.

The AI narrative arrives while Macy’s is already showing some momentum. The stock is up 24% over the past year and more than 58% in the past 3 months, a pace that’s well above its year-to-date gain. Over the longer term, the shares have also seen cumulative returns, despite annual revenue growth dipping and net income ticking higher lately. Factor in recent attention on dividends and strategic leadership appearances at industry summits, and you have a stock that’s seeing a blend of performance and potential.

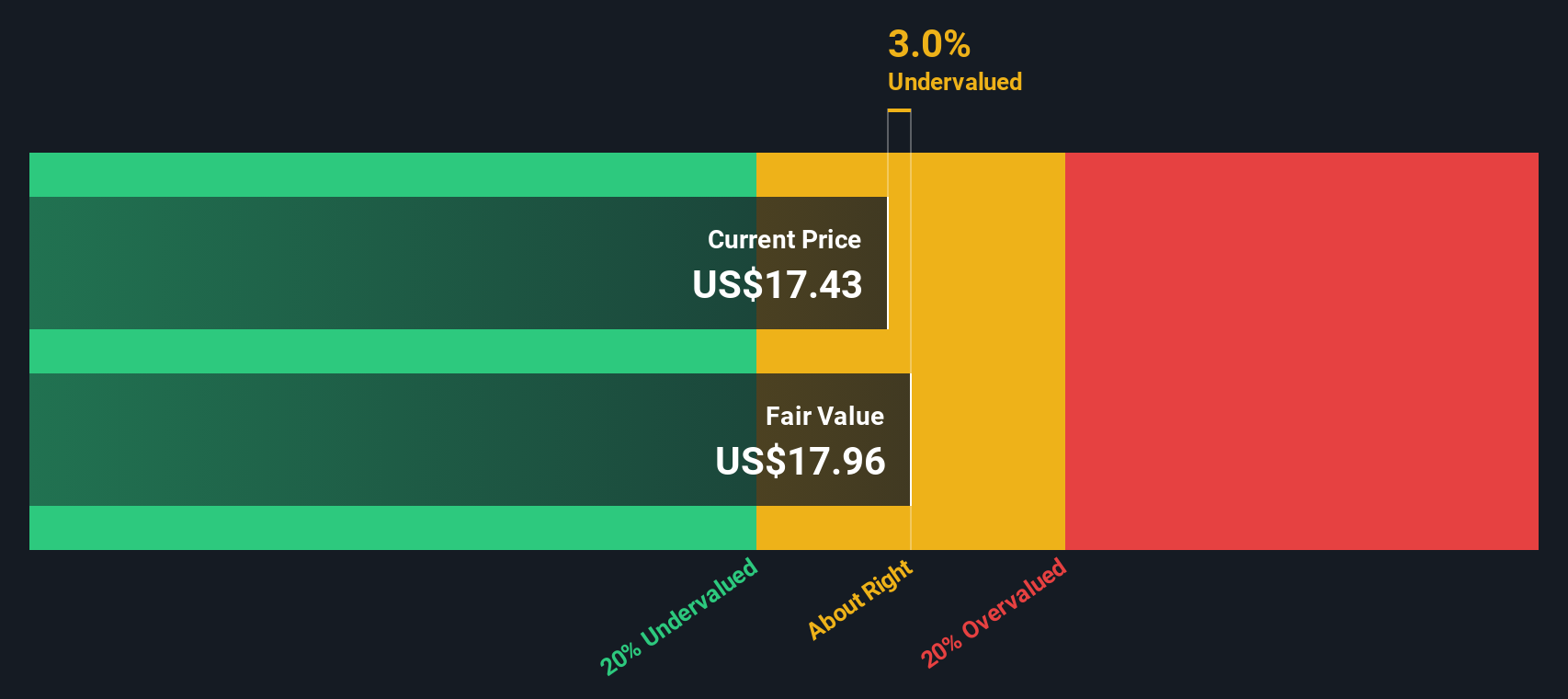

So, after this latest rally fueled by AI and earnings optimism, is Macy's trading at a bargain or are markets already pricing in all that anticipated growth?

Most Popular Narrative: 26% Undervalued

According to julio’s narrative, Macy’s stock is currently trading at a steep discount relative to its estimated fair value. This narrative positions the company as significantly undervalued, hinting at major upside if certain strategic moves play out.

Macy’s owns significant real estate that can be sold to provide liquidity, pay down debt, and finance new investments. The firm intends to raise about $600 million to $750 million from real estate sales over the next three years.

What if Macy’s turnaround is powered not only by tech, but also by hidden assets and unexpected profit levers? The narrative’s valuation is built on bold forecasts for key financial drivers, suggesting profit margins and future multiples you would not expect from a traditional retailer. The full story reveals which numbers could change the game for Macy’s.

Result: Fair Value of $24.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent declines in sales or a lack of takeover interest could challenge the bullish outlook and put pressure on Macy's shares in the future.

Find out about the key risks to this Macy's narrative.Another View: Discounted Cash Flow Model

While the narrative focuses on Macy’s potential upside if key strategies succeed, our DCF model presents a more restrained perspective. This approach suggests the stock may not be as undervalued as some believe. Which perspective offers the truest view?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Macy's for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Macy's Narrative

If you see things differently or want to dig into the numbers on your own terms, you can shape your own Macy's narrative in just a few minutes. Do it your way

A great starting point for your Macy's research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Standout Investment Ideas?

Why stop at one? Some of the best opportunities are only a click away. Stay ahead by checking out these handpicked trends lighting up the market right now:

- Unlock growth by targeting up-and-coming companies with strong financials. See which stocks are making waves with penny stocks with strong financials.

- Position yourself at the forefront of innovation by following trailblazing businesses in the artificial intelligence revolution through our curated set of AI penny stocks.

- Boost your portfolio’s income potential by spotting shares delivering standout yields. Find today’s top picks for solid returns with dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:M

Macy's

An omni-channel retail organization, operates stores, websites, and mobile applications in the United States.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion