- United States

- /

- Specialty Stores

- /

- NYSE:LUXE

LuxExperience (NYSE:LUXE): Assessing Valuation After S&P Global BMI Index Inclusion

Reviewed by Kshitija Bhandaru

LuxExperience B.V (NYSE:LUXE) was just added to the S&P Global BMI Index, and that is the kind of move that usually gets investors talking. Being included in a major index is more than just a ceremonial milestone; it can change how big money players see the stock, as funds that track the benchmark are now required to allocate some of their portfolios to LuxExperience. For shareholders, this type of event often means a bump in liquidity and potentially a more stable ownership base, which could influence trading dynamics in the near term.

This spotlight moment comes after a year in which LuxExperience has made waves, with the share price delivering a dramatic 112% rise. That one-year gain stands in stark contrast to its negative 3-year return, highlighting what appears to be a resurgence in investor confidence and a shift in momentum back in the company’s favor. Alongside this latest index inclusion, double-digit annual growth in both revenue and net income has added new layers to the story, even as the company’s recent quarterly performance cooled off modestly over the past month.

With the stock riding high on short-term momentum and index-driven demand, some investors may be wondering whether there is still value left for new buyers or if the market has already priced in future growth expectations.

Most Popular Narrative: 26.9% Undervalued

According to the most widely followed narrative, LuxExperience B.V. is currently valued significantly below its estimated fair value. This suggests substantial upside potential if the company's ambitious growth trajectory is realized.

The recent acquisition of YOOX NET-A-PORTER significantly expands LuxExperience's digital luxury retail footprint and brand portfolio. This positions the company to benefit from the global increase in affluent consumers seeking exclusive, experiential luxury, supporting future revenue growth and market share gains.

Want a glimpse at why analysts think this company is poised for a breakout valuation? There’s a bold calculation behind the fair value. The estimate is rooted in extraordinary future growth assumptions and a profit margin shift the industry rarely sees. Curious which aggressive projections underpin this big discount to current prices? Find out what numbers are moving the needle in the full analysis.

Result: Fair Value of $11.28 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent macroeconomic uncertainty and LuxExperience’s reliance on affluent customers could present challenges to long-term growth expectations and disrupt the optimistic valuation narrative.

Find out about the key risks to this LuxExperience B.V narrative.Another View: Trading Above Intrinsic Value?

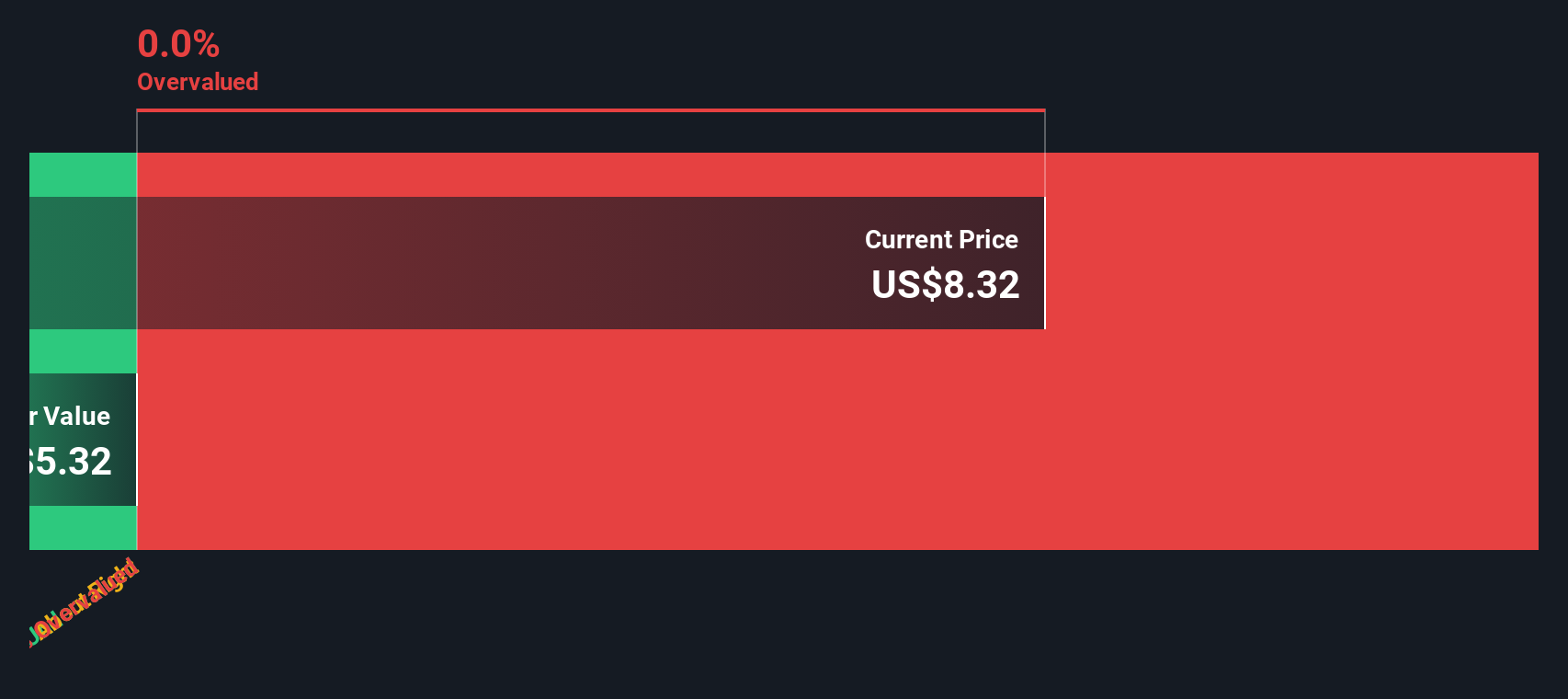

While analyst forecasts suggest LuxExperience B.V. could be undervalued, our DCF model takes a more cautious approach and indicates the shares may actually be trading above fair value. Which model offers the truer picture?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own LuxExperience B.V Narrative

If you see the numbers differently or want to shape your own outlook, you’re free to explore the data and craft your own take in just a few minutes. Do it your way.

A great starting point for your LuxExperience B.V research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Make your next move count by tapping into ready-made investment opportunities that others are already using to get ahead. Do not let potential winners slip by.

- Spot unique companies thriving with exceptional cash flow and see which undervalued stocks based on strong growth are featured in our undervalued stocks based on cash flows.

- Unlock income potential from market leaders providing attractive returns by checking out our list of dividend stocks with yields > 3%.

- Jump on cutting-edge breakthroughs as you zero in on innovative players in artificial intelligence and robotics with our AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LUXE

LuxExperience B.V

Through its subsidiary, operates an online shopping platform in Germany, the United States, rest of Europe, and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives