- United States

- /

- Specialty Stores

- /

- NYSE:LOW

Lowe’s (LOW): Assessing Valuation After Recent Share Price Slip

Reviewed by Kshitija Bhandaru

See our latest analysis for Lowe's Companies.

Lowe's share price has ebbed slightly after its earlier momentum this year, reflecting a more cautious tone in the market. However, when viewed over a longer period, total shareholder returns over three and five years have remained solid. This suggests investors continue to see value in its steady growth and reliable dividends.

If you’re watching how retail leaders adapt in today’s market, now could be a smart time to broaden your search and discover fast growing stocks with high insider ownership

The real question now is whether Lowe’s current dip signals an attractive entry point, or if the stock’s price already reflects expectations for its future growth. Is there value left for new investors, or is everything already priced in?

Most Popular Narrative: 12.2% Undervalued

Lowe’s valuation narrative places its fair value noticeably above the most recent close. Market watchers will want to dig deeper into the strategic assumptions underpinning this target before deciding what comes next.

Ongoing pent-up demand from delayed home improvement projects, combined with record-high aging U.S. housing stock and an estimated 18 million new homes needed by 2033, points to a significant runway for future growth in renovation, repair, and new construction. This will positively affect revenue and support sustained top-line expansion as the housing cycle recovers.

Curious what exactly justifies such a bullish fair value? The narrative’s ambitious outlook hinges on some eye-opening growth forecasts and robust profitability assumptions, but the projected margin lift alone might surprise you. Which bold assumptions move the needle most? Read on to find out.

Result: Fair Value of $281.84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including potential integration issues from recent acquisitions as well as pressure on margins from ongoing labor shortages and rising operational costs.

Find out about the key risks to this Lowe's Companies narrative.

Another Perspective: Multiples Paint a Different Picture

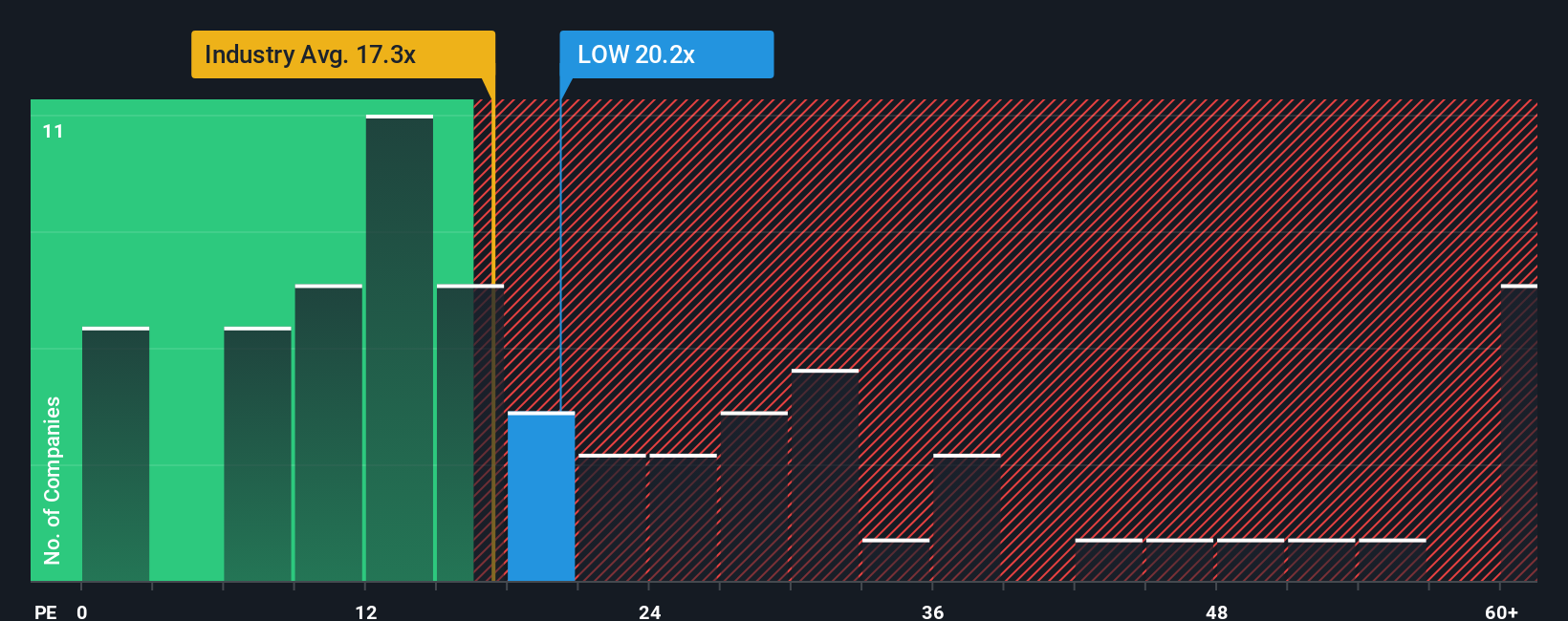

While the fair value narrative suggests Lowe’s shares are undervalued, a look at its current price-to-earnings ratio of 20.3x tells a more nuanced story. This ratio is above the industry average of 17.2x, but still beneath the peer group’s 48.3x benchmark and close to the fair ratio of 21.1x. This could mean Lowe’s is not as much of a bargain as it first appears, or perhaps the market is missing something. Where should investors look next?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Lowe's Companies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Lowe's Companies Narrative

If these narratives do not align with your outlook, or you would prefer to analyze the numbers yourself, it is quick and easy to craft your own viewpoint in just minutes. Do it your way

A great starting point for your Lowe's Companies research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for More Winning Ideas?

You owe it to yourself to jump on fresh investment opportunities that others might overlook. Don't wait. Put your money to work with smarter picks now!

- Capture future market leaders by tapping into these 24 AI penny stocks as they transform entire industries with artificial intelligence innovation.

- Boost your income potential and get portfolio stability by targeting these 19 dividend stocks with yields > 3% with juicy yields above 3%.

- Position yourself at the forefront of financial breakthroughs when you check out these 78 cryptocurrency and blockchain stocks disrupting traditional finance with blockchain and cryptocurrency solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LOW

Lowe's Companies

Operates as a home improvement retailer in the United States.

Established dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives