- United States

- /

- Specialty Stores

- /

- NYSE:LOW

How Lowe’s Expanded Aqara Smart Lock Rollout Could Shape the Total Home Strategy for LOW Investors

Reviewed by Sasha Jovanovic

- Aqara recently announced the launch of its Smart Lock B50, now available at more than 500 Lowe’s stores and on Lowes.com, expanding Lowe’s connected home and security assortment for homeowners, landlords, and professionals.

- This collaboration underscores Lowe’s push to deepen its presence in higher-margin smart home solutions that can draw repeat traffic and increase project-based spending.

- We’ll now consider how the expanded smart lock offering with Aqara fits into Lowe’s Pro-focused Total Home strategy and broader investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Lowe's Companies Investment Narrative Recap

To own Lowe’s, you generally need to believe in its ability to compound earnings through a stronger Pro business, disciplined capital allocation, and steady home improvement demand. The Aqara smart lock launch is incremental rather than a major catalyst, but it supports Lowe’s push into connected home solutions that can reinforce higher basket sizes and repeat trips. The bigger near term swing factor remains execution on the FBM acquisition, while elevated debt and a still-muted project backdrop sit on the risk side.

Against that backdrop, Marvin Ellison’s recent update on the Foundation Building Materials deal stands out as more consequential for the Lowe’s story than the Aqara news itself. Strengthening Pro-focused distribution and services directly ties into the Total Home strategy and could matter far more for margins and earnings than any individual product partnership, even if smart home offerings help keep Lowe’s relevant to both DIY and professional customers.

Yet, while acquisitions like FBM can expand Lowe’s reach, investors should be aware that integrating complex operations and cultures across such a large platform...

Read the full narrative on Lowe's Companies (it's free!)

Lowe's Companies' narrative projects $94.0 billion revenue and $8.4 billion earnings by 2028.

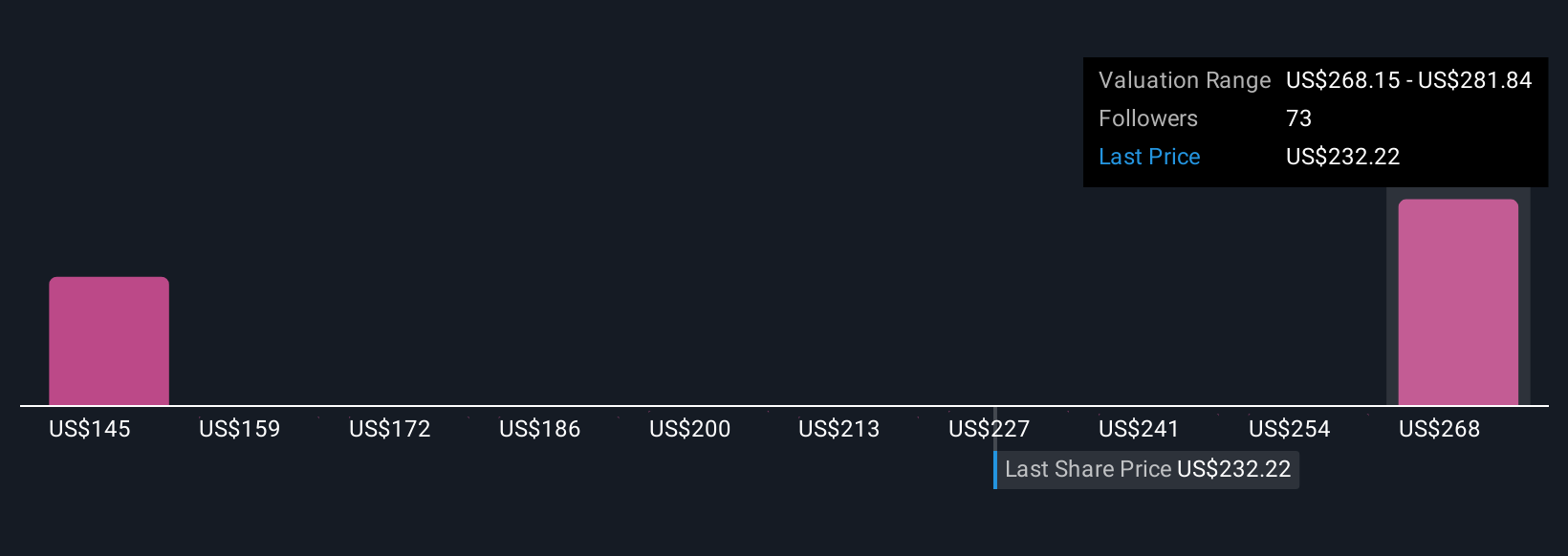

Uncover how Lowe's Companies' forecasts yield a $272.50 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community currently see Lowe’s fair value between US$234 and US$272.50, underlining how differently people weigh FBM integration risk and its potential impact on margins and returns.

Explore 5 other fair value estimates on Lowe's Companies - why the stock might be worth just $234.00!

Build Your Own Lowe's Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lowe's Companies research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Lowe's Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lowe's Companies' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LOW

Lowe's Companies

Operates as a home improvement retailer in the United States.

Established dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026