- United States

- /

- Specialty Stores

- /

- NYSE:LOW

A Fresh Look at Lowe's (LOW) Valuation Following Recent Stock Gains

Reviewed by Simply Wall St

Lowe's Companies (LOW) stock has seen some movement recently, with shares slipping slightly over the past day but gaining nearly 8% during the past 3 months. Investors are watching how the company's fundamentals hold up this quarter.

See our latest analysis for Lowe's Companies.

Lowe's share price has been edging higher in recent months, supported by long-term investors who are still benefiting from a solid 3-year total shareholder return of 34%. Although performance has softened over the past year, recent quarterly gains suggest that momentum may be picking up again.

If you're curious where the next wave of opportunity might come from, this could be a great moment to broaden your horizons and discover fast growing stocks with high insider ownership

With shares trading around $243, still nearly 16% below most analysts’ price targets, the question for investors now is whether Lowe’s is undervalued at current levels or if the market is already factoring in its future growth potential.

Most Popular Narrative: 13.6% Undervalued

Lowe’s is attracting attention as the latest consensus narrative values the stock notably above its last close of $243.53. This narrative reflects optimism about future growth, weighed against recent performance and current share price.

The acquisition of Foundation Building Materials (FBM) sharply accelerates Lowe's access to the large Pro contractor market, especially in key underserved regions (California, Northeast, Midwest). This unlocks new revenue streams, greater ticket sizes, and a larger share of the $250 billion Pro market. These developments are expected to drive above-market sales growth and improve diversification of revenue over the coming years.

Curious what bold, quantitative assumptions push this fair value far beyond the market price? Discover how strategic bets on sector growth and margin expansion could power a valuation few saw coming. The numbers behind this narrative might just surprise you.

Result: Fair Value of $281.84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant risks remain. These include the complex integration of recent acquisitions and the potential for ongoing labor cost pressures to erode margins.

Find out about the key risks to this Lowe's Companies narrative.

Another View: What Does the SWS DCF Model Say?

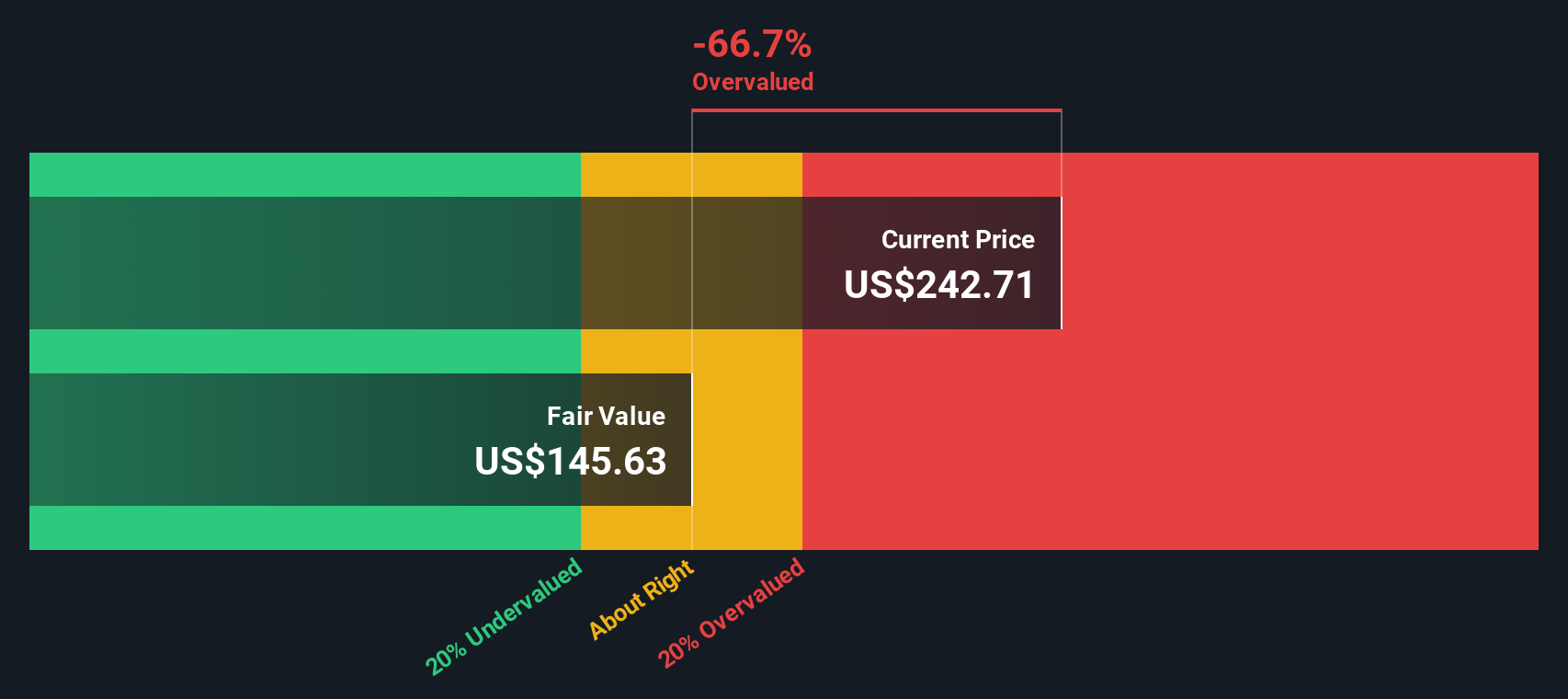

While many analysts see upside based on future earnings potential and margin gains, our DCF model paints a more conservative picture. It suggests that Lowe’s is actually trading well above its calculated fair value. This raises questions about whether the market may be more optimistic than the fundamentals justify.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Lowe's Companies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Lowe's Companies Narrative

If you want to see the story from your own angle, dive into the figures and shape a unique outlook in just a few minutes. Do it your way

A great starting point for your Lowe's Companies research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stand still. Take control of your next move and check out these hand-picked opportunities that could help you stay ahead of the market curve.

- Unlock fresh income streams by tapping into these 17 dividend stocks with yields > 3%, which consistently offer yields above the benchmark and can strengthen your portfolio’s cash flow resilience.

- Capitalize on the accelerating future of medicine by targeting these 33 healthcare AI stocks, a leader in breakthroughs in healthcare automation, diagnostics, and patient outcomes.

- Secure unmatched value potential by zeroing in on these 876 undervalued stocks based on cash flows, which are poised for growth based on strong cash flow fundamentals and attractive pricing today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LOW

Lowe's Companies

Operates as a home improvement retailer in the United States.

Established dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives