- United States

- /

- Real Estate

- /

- OTCPK:LEJU.Y

Leju Holdings (NYSE:LEJU) Could Be Struggling To Allocate Capital

What underlying fundamental trends can indicate that a company might be in decline? More often than not, we'll see a declining return on capital employed (ROCE) and a declining amount of capital employed. Trends like this ultimately mean the business is reducing its investments and also earning less on what it has invested. And from a first read, things don't look too good at Leju Holdings (NYSE:LEJU), so let's see why.

What is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for Leju Holdings, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

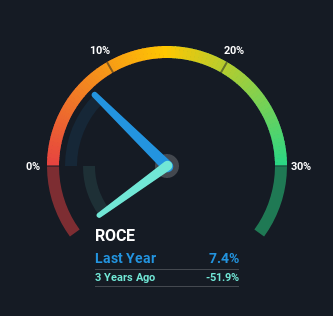

0.074 = US$24m ÷ (US$642m - US$317m) (Based on the trailing twelve months to December 2020).

Thus, Leju Holdings has an ROCE of 7.4%. In absolute terms, that's a low return and it also under-performs the Online Retail industry average of 14%.

Check out our latest analysis for Leju Holdings

Above you can see how the current ROCE for Leju Holdings compares to its prior returns on capital, but there's only so much you can tell from the past. If you're interested, you can view the analysts predictions in our free report on analyst forecasts for the company.

The Trend Of ROCE

The trend of ROCE at Leju Holdings is showing some signs of weakness. Unfortunately, returns have declined substantially over the last five years to the 7.4% we see today. What's equally concerning is that the amount of capital deployed in the business has shrunk by 27% over that same period. The fact that both are shrinking is an indication that the business is going through some tough times. Typically businesses that exhibit these characteristics aren't the ones that tend to multiply over the long term, because statistically speaking, they've already gone through the growth phase of their life cycle.

On a side note, Leju Holdings' current liabilities have increased over the last five years to 49% of total assets, effectively distorting the ROCE to some degree. Without this increase, it's likely that ROCE would be even lower than 7.4%. What this means is that in reality, a rather large portion of the business is being funded by the likes of the company's suppliers or short-term creditors, which can bring some risks of its own.

In Conclusion...

In short, lower returns and decreasing amounts capital employed in the business doesn't fill us with confidence. It should come as no surprise then that the stock has fallen 57% over the last five years, so it looks like investors are recognizing these changes. With underlying trends that aren't great in these areas, we'd consider looking elsewhere.

One more thing, we've spotted 1 warning sign facing Leju Holdings that you might find interesting.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

When trading Leju Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OTCPK:LEJU.Y

Leju Holdings

Through its subsidiaries, provides online to offline (O2O) real estate services in the People's Republic of China.

Moderate and slightly overvalued.

Similar Companies

Market Insights

Community Narratives