- United States

- /

- Specialty Stores

- /

- NYSE:LAD

Lithia Motors (LAD) Is Up 8.0% After Strong Q3 Earnings and Capital Return Moves – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Lithia Motors reported third-quarter 2025 adjusted earnings above expectations, driven by growing unit sales and higher average selling prices, while announcing a scheduled dividend and share repurchase activity.

- Participation in AutoMobility LA 2025 highlighted Lithia's ongoing industry engagement and commitment to expanding its presence within the automotive retail landscape.

- We'll examine how strong quarterly earnings and renewed capital return initiatives are influencing Lithia Motors' current investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Lithia Motors Investment Narrative Recap

To be a shareholder of Lithia Motors, you generally need to believe in the company's ability to drive sustainable growth through acquisitions, technology investments, and expanding omnichannel retail. While the recent earnings beat shows resilience and robust unit sales, the 11.5% decline in share price and shifting market expectations mean this news does not materially reduce the ongoing risk around the company’s high SG&A costs and margin pressure, which remain the most pressing factors to monitor in the short term.

Of Lithia’s announcements, the active buyback program is most relevant in the context of recent share price weakness. The ongoing repurchase of 1.3 million shares and the expanded buyback authorization highlight management’s capital allocation efforts, yet the effectiveness of these actions in offsetting broader operational risks and sustaining valuation support is still in question as margin headwinds persist.

But against these capital returns, investors should be mindful of how margin pressure and elevated SG&A costs could still weigh on earnings if...

Read the full narrative on Lithia Motors (it's free!)

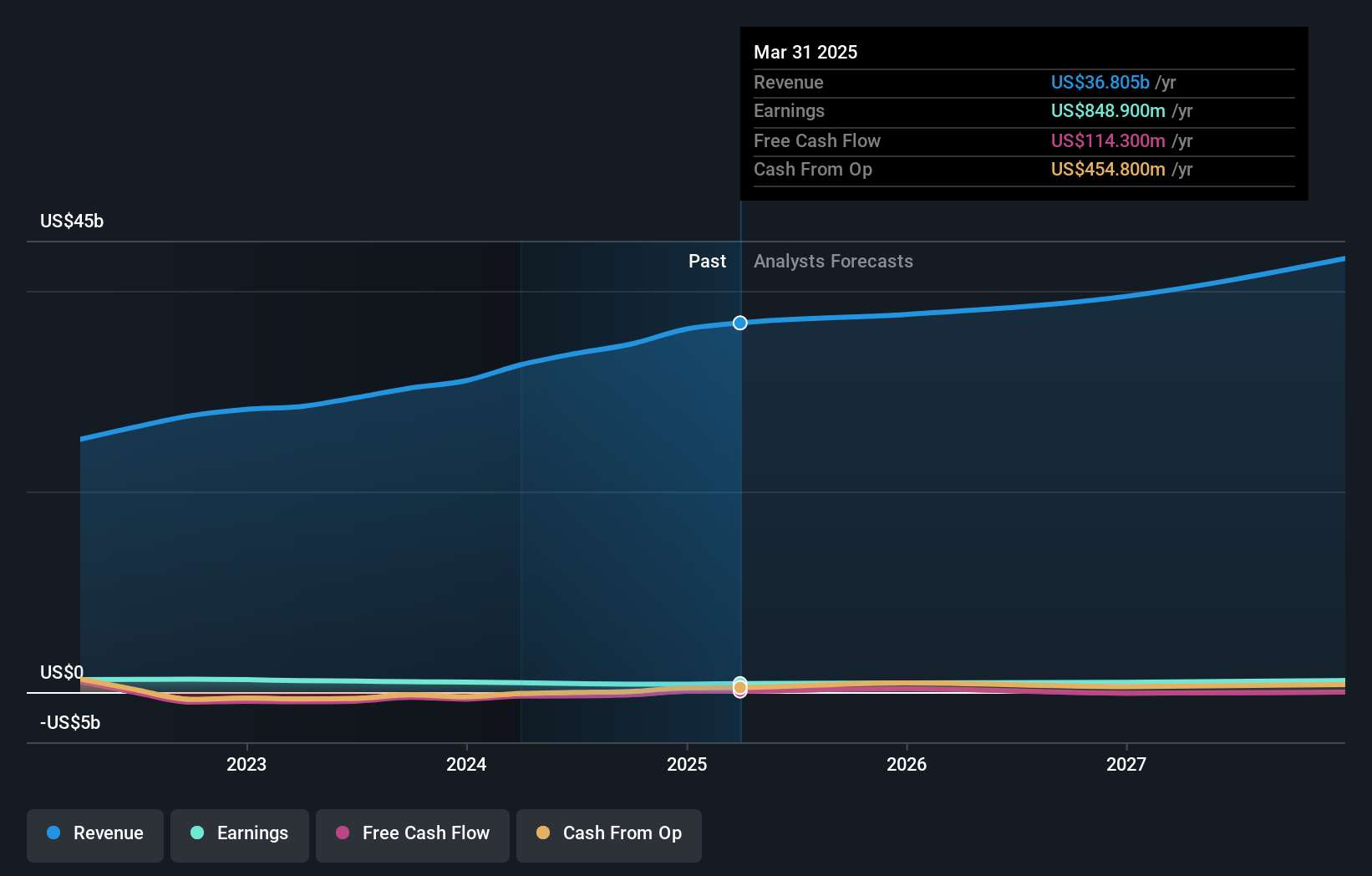

Lithia Motors' outlook anticipates $43.4 billion in revenue and $1.1 billion in earnings by 2028. This is based on 5.3% annual revenue growth and a $209 million increase in earnings from the current $890.9 million.

Uncover how Lithia Motors' forecasts yield a $390.13 fair value, a 23% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members set fair value estimates between US$390 and US$631, reflecting a broad range of conviction on Lithia’s potential. While some focus on recurring, high-margin aftersales growth as a stabilizing force, opposing views stress that margin erosion could challenge the company’s longer-term prospects; consider these differing outlooks as you form your own assessment.

Explore 2 other fair value estimates on Lithia Motors - why the stock might be worth as much as 99% more than the current price!

Build Your Own Lithia Motors Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lithia Motors research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Lithia Motors research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lithia Motors' overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LAD

Lithia Motors

Operates as an automotive retailer in the United States, the United Kingdom, and Canada.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success