Kohl’s (KSS) Margin Squeeze Reinforces Bearish Profitability Narrative Despite Sequential Same Store Sales Improvement

Reviewed by Simply Wall St

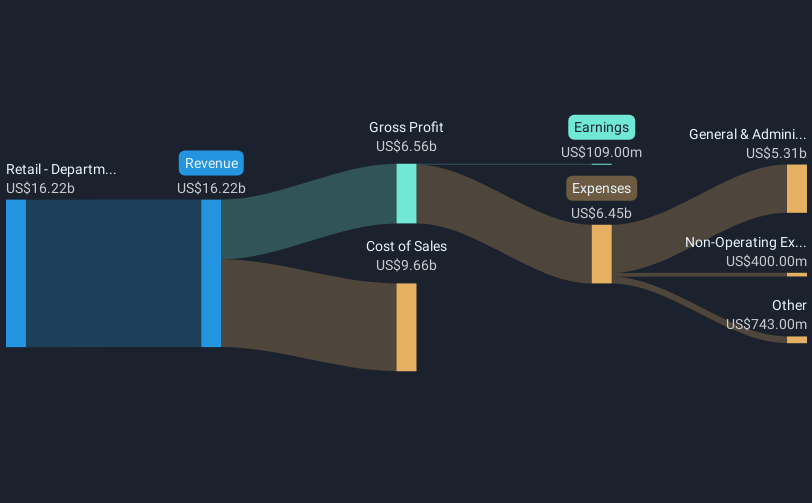

Kohl's (KSS) has reported its Q3 2026 results, posting revenue of $3.6 billion and basic EPS of $0.07, alongside net income of $8 million. Over the past year, revenue tracked from $16.8 billion in Q3 2025 to $15.8 billion in Q3 2026. EPS moved from $2.23 to $1.74, capturing a snapshot of shifting sales and earnings momentum. Margins compressed, reflecting the challenge of translating sales into sustainable profit in the current retail environment.

See our full analysis for Kohl's.Next up, we will compare these results with the narratives shaping investor sentiment, highlighting where the headline numbers support or contradict the story on Kohl's.

See what the community is saying about Kohl's

Profit Margins Squeeze to 1.2%

- Net profit margins slipped to 1.2% over the last year, down from 1.5%, underscoring persistent margin pressure even as revenue held near $15.8 billion.

- Analysts' consensus view notes that this margin compression, despite Kohl’s ongoing cost controls and digital investments, reinforces the core risk that higher labor costs and increased promotions continue to erode profitability.

- Consensus observes that wage inflation, rising labor expenses, and aggressive discounting directly weigh on margins.

- Even as efforts like inventory discipline and partnerships (such as Sephora) aim to support long-term growth, narrowing margins indicate that the path to sustainable earnings remains uncertain amid these pressures.

- To see how these margin trends align with the broader market perspective, dive into the Consensus Narrative for the full story. 📊 Read the full Kohl's Consensus Narrative.

DCF Fair Value: $62.91 vs. $24.10 Price

- Kohl’s stock trades at $24.10, which is roughly 61.7% below its DCF fair value estimate of $62.91 and well under the multiline retail industry average P/E of 18.9x (Kohl’s P/E is 13.9x).

- Consensus narrative highlights that while Kohl’s low price-to-earnings ratio creates a classic value argument, analysts remain cautious. Despite the discount, they expect only modest earnings growth and find that long-term headwinds limit upside potential.

- The below-peer multiple suggests investors see ongoing risks in revenue trends and profitability rather than just a market mispricing.

- Industry peers command higher multiples, driven by steadier growth paths and less volatile share performance, so Kohl’s discount persists for a reason.

Same Store Sales Improve Sequentially

- Same store sales fell by 1.7% in Q3 2026, which, while negative, marks a notable improvement from the 4.2% decline in the prior quarter and the 9.3% drop in Q3 2025.

- Consensus view draws attention to this narrowing decline, noting that while sequential improvement is a step in the right direction, it remains to be seen if renewed customer engagement and strategies like expanded own brands and Sephora shops are enough to drive a true rebound in traffic and sales.

- Encouraging signs include less severe drops quarter on quarter, suggesting that digital upgrades and merchandising efforts may be taking hold.

- Nevertheless, persistent negative same store sales indicate that structural challenges remain unresolved.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Kohl's on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the numbers? Share your perspective and shape your own narrative in just a few minutes with us. Do it your way.

A great starting point for your Kohl's research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Kohl’s shrinking profit margins, muted growth outlook, and persistent same store sales declines reinforce concerns about its ability to deliver stable and consistent performance.

If you want to target companies showing reliable earnings and steadier results, check out stable growth stocks screener (2075 results) and find stocks delivering stability where others struggle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kohl's might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KSS

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success