Kohl's (KSS): Examining Valuation After Recent Share Price Momentum and Analyst Perspectives

Reviewed by Simply Wall St

See our latest analysis for Kohl's.

After a strong run over the past quarter, Kohl’s 21.6% 90-day share price return has caught the attention of investors, especially given earlier volatility in the retail sector. Despite noticeable short-term momentum and a year-to-date price return of nearly 20%, the one-year total shareholder return is essentially flat, reflecting that longer-term holders have yet to see meaningful gains.

If you’re weighing what else is moving in retail beyond the headlines, now is the perfect time to broaden your search and uncover fast growing stocks with high insider ownership

With shares rebounding but longer-term returns lagging, questions remain about whether Kohl’s is genuinely undervalued based on its fundamentals or if the recent rally means that future growth is already reflected in the price. This could leave limited upside for new buyers.

Most Popular Narrative: 7.3% Overvalued

Kohl's recently reported fair value rises to $15.61, just below the last close of $16.75. This up-to-date narrative weighs a modest recovery in profitability and incremental operational gains but signals that the stock may be running ahead of fundamental improvements.

"Despite a favorable quarter, sales trends remained weak and overall traffic declined. This signals persistent demand challenges that need to be addressed for sustained growth."

Which specific forecasts force analysts to temper their optimism, even after a strong earnings update? Find out what surprising revenue and margin assumptions make this turnaround story more complex than it first appears. The financial blueprint behind the current target just might surprise you.

Result: Fair Value of $15.61 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a meaningful recovery in core shopper demand or a successful Sephora rollout could quickly challenge the current cautious outlook.

Find out about the key risks to this Kohl's narrative.

Another View: Market Multiples Context

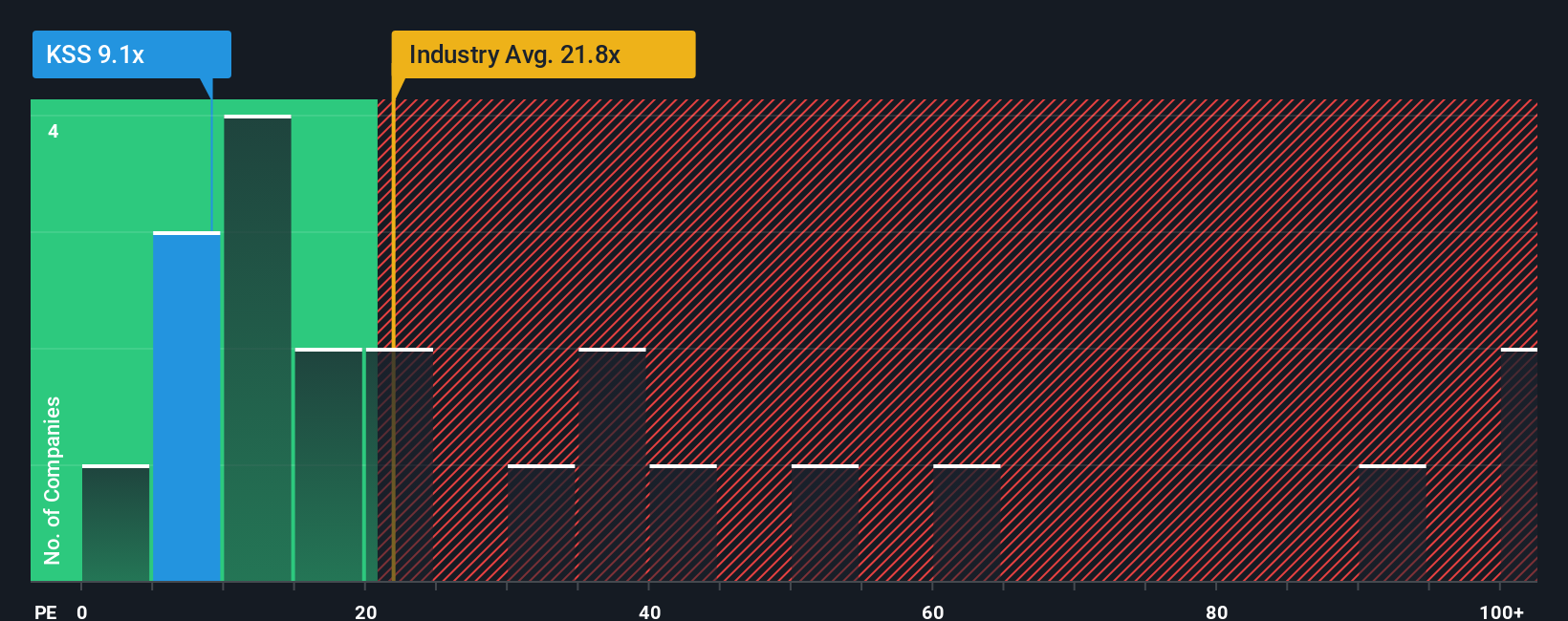

Looking past analyst fair value estimates, Kohl's also trades at a noticeable discount based on its earnings ratio. At just 9x, its valuation is far below both the industry average of 20.2x and its peer group’s 17.2x. The market’s fair ratio (21.5x) is even higher. This gap suggests investors may be pricing in significant risk or overlooking potential upside. But is the skepticism justified, or could sentiment turn quickly?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kohl's Narrative

If you see things differently or want to dig deeper into the numbers, you can shape your own perspective in just a few minutes with Do it your way.

A great starting point for your Kohl's research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Timely Investment Opportunities?

Smart investors always scan the horizon for their next move, and the Simply Wall Street Screener is your ticket to strategies others might overlook. Take the next step and tap into fresh stocks on the move.

- Tap into future-shaping companies by checking out these 25 AI penny stocks that are driving breakthroughs in artificial intelligence and automation.

- Capture hidden gems before the crowd by tracking these 879 undervalued stocks based on cash flows poised for a rerating based on strong fundamentals and market mispricing.

- Amplify your passive income with these 16 dividend stocks with yields > 3% featuring robust yields and reliable payments above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kohl's might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KSS

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives