Kohl's (KSS): Evaluating Valuation As Shares Extend Their Recent Uptrend

Reviewed by Simply Wall St

See our latest analysis for Kohl's.

Kohl's share price has shown renewed traction this year, with a 16.75% rise year-to-date and a sharp 28.07% gain over the past three months. This suggests that sentiment around the stock is improving. However, the one-year total shareholder return is still down 7.82%, which highlights that longer-term investors remain in recovery mode as recent momentum gathers pace.

If you’re wondering what else is building momentum across the markets right now, broaden your investing horizons and discover fast growing stocks with high insider ownership

With shares rebounding and recent earnings showing signs of improvement, a key question emerges for investors: Is Kohl's truly trading below its intrinsic value, or have expectations for future growth already been factored into the price?

Most Popular Narrative: 9.8% Overvalued

With Kohl's last closing at $16.38 and the most widely followed narrative setting fair value at $14.92, the market appears more optimistic than the analysts behind this perspective. This creates a challenging debate on whether expectations have simply run ahead of fundamentals.

Persistent decline in core customer transactions and shifting shopping habits threaten future revenue growth and profitability for Kohl's traditional retail model. Increased promotional activity, higher labor costs, and slow digital transformation weigh on margins and hinder sustainable sales recovery.

Want to know the real reason this price target undercuts the market? It all comes down to bold revenue assumptions, steady profit margins, and a controversial future PE ratio. The narrative’s valuations rest on surprising financial projections that most investors would miss. Only by exploring the full storyline will you find the key numbers that could completely flip your view on where this stock is really headed.

Result: Fair Value of $14.92 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

Still, major risks remain, such as Kohl’s intensified brand investments or a successful Sephora rollout. These factors could spark stronger revenue growth than many expect.

Find out about the key risks to this Kohl's narrative.

Another View: Multiples Suggest Upside

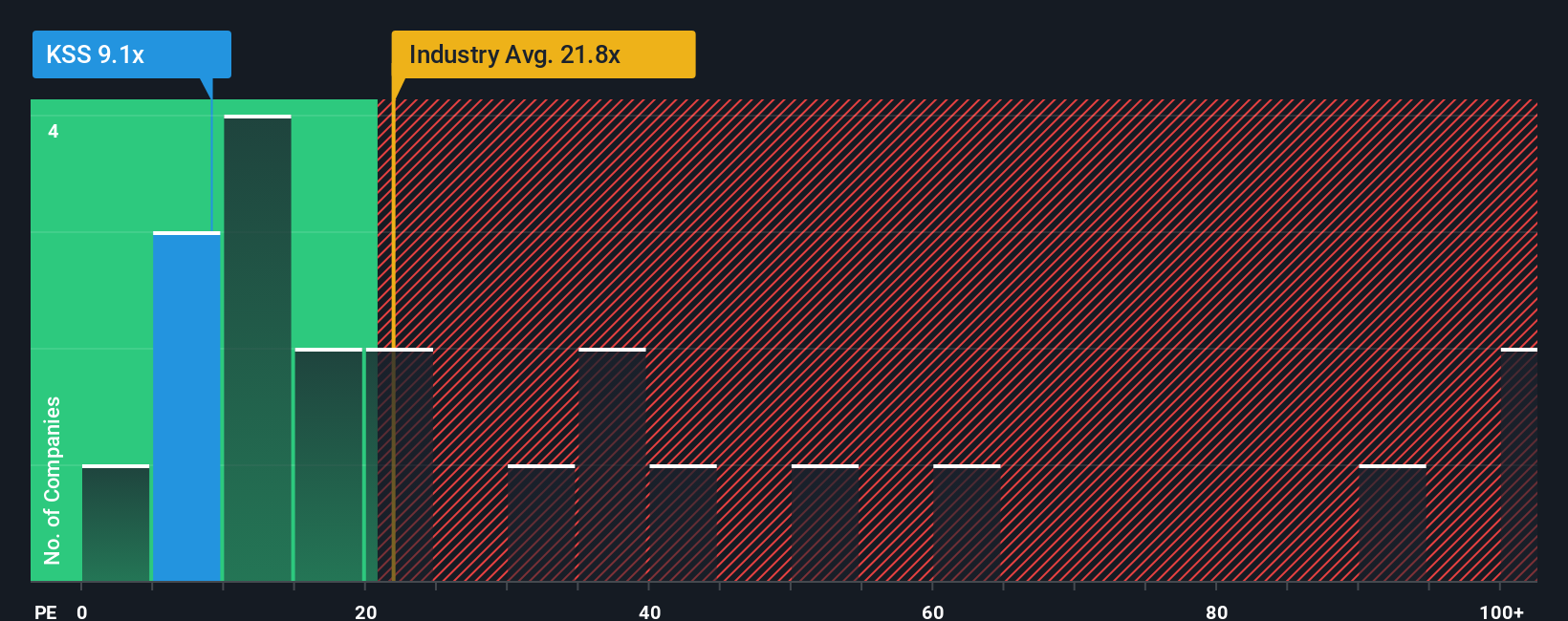

Switching gears to a simple price-to-earnings lens, Kohl's trades at just 8.8 times earnings. That is not only far below the industry average of 21.6x, but even lower than its fair ratio of 22.4x. This could offer a potential opportunity if the market moves closer to peer norms. Could this deep value signal be a chance overlooked by many?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kohl's Narrative

If you see the numbers differently or want to take your own approach, building a personal narrative takes only a few minutes. Do it your way

A great starting point for your Kohl's research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Broaden your strategy and seize new opportunities. Don’t sit on the sidelines while others find stocks with game-changing potential beyond Kohl’s current momentum.

- Capitalize on the search for strong portfolio growth by reviewing these 877 undervalued stocks based on cash flows, highlighting companies whose fundamental value outpaces their current prices.

- Maximize your yield potential by checking out these 17 dividend stocks with yields > 3%, rounding up stocks with consistently robust dividend payouts above 3%.

- Catch the innovation wave as artificial intelligence transforms markets with these 27 AI penny stocks, featuring exciting tech-driven businesses making headlines in the AI revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kohl's might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KSS

Undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives