- United States

- /

- Specialty Stores

- /

- NYSE:KMX

CarMax (KMX): Valuation in Focus After Earnings Drop and Legal Scrutiny

Reviewed by Simply Wall St

CarMax (KMX) shares fell sharply after the company reported its latest quarterly results, revealing declines in both revenue and profit. The report also showed a jump in expected loan losses, which added to investor anxiety.

See our latest analysis for CarMax.

CarMax’s share price has been hammered in recent months, with a one-day loss of nearly 20% following its tough quarterly results and fresh scrutiny from legal investigations. Even before this, momentum had been fading. The 90-day share price return is down 26.6%, and the total shareholder return for the past year is negative 38.5%, highlighting persistent challenges for long-term investors.

If recent volatility in auto retailers has you rethinking your next move, it could be the perfect opportunity to discover See the full list for free.

With the share price sharply lower and news of legal investigations rattling investors, the key question now is whether CarMax is offering genuine value at current levels, or if the market has already adjusted for tougher times ahead.

Most Popular Narrative: 20% Undervalued

With the current share price sitting well below the narrative’s fair value estimate, the stage is set for debate on whether CarMax is truly discounted or if challenges justify the gap.

The ongoing enhancements to their digital tools are expected to further integrate online and in-store sales. Expansion in the company's vehicle sourcing capabilities, particularly through dealer channels and improved consumer experience, is intended to support unit volume growth and improve gross profit margins by lowering vehicle acquisition costs.

Want to know what’s fueling this optimism? There is a bold call on future earnings and profit margins hidden in the narrative’s assumptions. The details behind the trajectory might surprise you. See what makes this fair value calculation stand out.

Result: Fair Value of $55.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing declines in wholesale profit and competitive pressure on inventory sourcing could easily unsettle this optimistic outlook and change the story ahead.

Find out about the key risks to this CarMax narrative.

Another View: Looking at Value Through the Market’s Lens

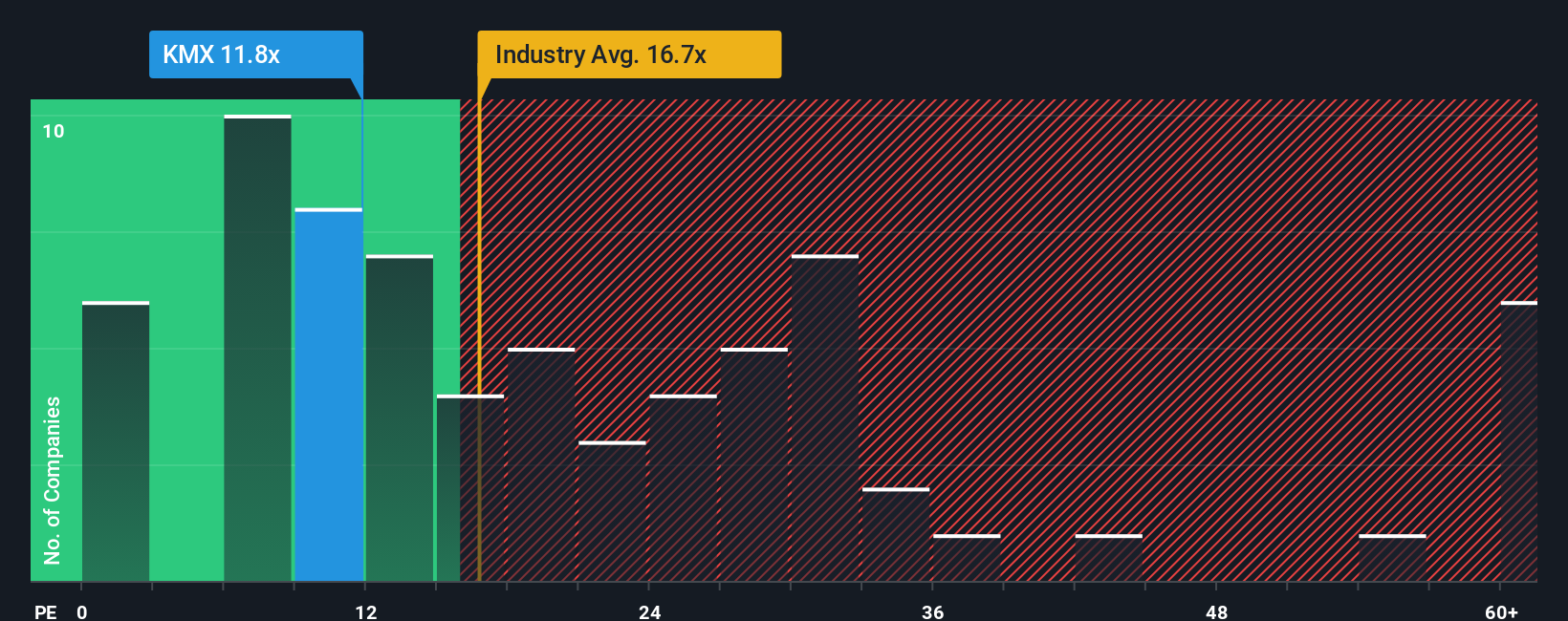

While the fair value calculation points to CarMax being undervalued, the price-to-earnings ratio tells a more nuanced story. At 12.5x, CarMax trades below the US specialty retail average (16.9x), yet it is slightly above its immediate peers (11.1x). The fair ratio comes in even higher at 18.8x, suggesting there may still be room for the market to reassess CarMax’s pricing. Does this gap signal an opportunity, or could it mean the risks are not fully priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CarMax Narrative

If you have your own perspective or want to dig into the numbers yourself, it takes just a few minutes to create your own take on CarMax. Do it your way

A great starting point for your CarMax research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t miss out on the next breakout stock or unique opportunity just because you stopped at CarMax. Give your portfolio an edge by investigating other compelling investments, thoughtfully curated for different strategies and trends.

- Seize the chance to tap into future tech with these 27 AI penny stocks, uncovering companies at the forefront of artificial intelligence innovation.

- Unlock long-term growth potential by evaluating these 876 undervalued stocks based on cash flows, where genuine bargains backed by strong fundamentals might be hiding.

- Secure reliable returns by checking out these 17 dividend stocks with yields > 3% to find stocks offering attractive yields alongside solid financial health.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KMX

CarMax

Through its subsidiaries, operates as a retailer of used vehicles and related products in the United States.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives