Nordstrom (NYSE:JWN) Has Affirmed Its Dividend Of $0.19

Nordstrom, Inc. (NYSE:JWN) will pay a dividend of $0.19 on the 19th of June. The dividend yield will be 3.5% based on this payment which is still above the industry average.

View our latest analysis for Nordstrom

Nordstrom's Dividend Is Well Covered By Earnings

A big dividend yield for a few years doesn't mean much if it can't be sustained. Before making this announcement, Nordstrom was paying out quite a large proportion of both earnings and cash flow, with the dividend being 239% of cash flows. This is certainly a risk factor, as reduced cash flows could force the company to pay a lower dividend.

Looking forward, earnings per share is forecast to rise exponentially over the next year. If recent patterns in the dividend continue, we could see the payout ratio reaching 19% which is fairly sustainable.

Dividend Volatility

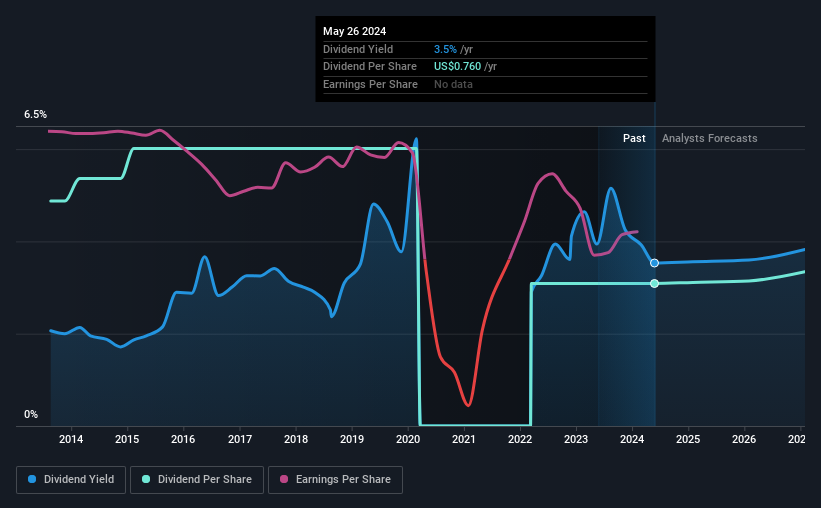

The company has a long dividend track record, but it doesn't look great with cuts in the past. Since 2014, the annual payment back then was $1.20, compared to the most recent full-year payment of $0.76. This works out to be a decline of approximately 4.5% per year over that time. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

Dividend Growth Potential Is Shaky

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. Earnings per share has been sinking by 25% over the last five years. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

Nordstrom's Dividend Doesn't Look Sustainable

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. The track record isn't great, and the payments are a bit high to be considered sustainable. We don't think Nordstrom is a great stock to add to your portfolio if income is your focus.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. For example, we've identified 4 warning signs for Nordstrom (1 is potentially serious!) that you should be aware of before investing. Is Nordstrom not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Nordstrom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:JWN

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026