Why Jumia Technologies (JMIA) Is Up 21.8% After Strong Q3 Growth and Breakeven Guidance

Reviewed by Sasha Jovanovic

- Jumia Technologies recently reported strong Q3 2025 results, including a 25% year-over-year rise in revenue and 21% growth in Gross Merchandise Volume, while narrowing operating losses and reiterating its target to reach breakeven by Q4 2026.

- Notably, institutional interest has grown alongside Jumia’s expanding e-commerce platform, with stakeholders such as Blair William & Co. IL and Mitsubishi UFJ Asset Management Co. Ltd. increasing their participation in the company’s growth story across Africa and select international markets.

- With Jumia’s solid revenue growth and progress towards breakeven, we’ll explore how these achievements could reshape analyst opinions on its long-term potential.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Jumia Technologies Investment Narrative Recap

To be a shareholder in Jumia Technologies, investors need to believe in the continued growth of Africa’s e-commerce sector, the viability of Jumia’s multi-layer logistics and payment platform, and management’s ability to control costs until profitability is reached. The latest Q3 2025 results, while positive, do not materially change the biggest near-term catalyst, expanding into underserved markets, nor do they reduce the most pressing risk, which remains Jumia’s ability to scale customer acquisition profitably amid infrastructure and competitive challenges.

Among recent announcements, the opening of new large-scale warehouses in Nigeria, Morocco, Egypt, and Ivory Coast stands out as directly relevant to Jumia’s growth ambitions highlighted in the recent news. These expansions are core to unlocking secondary cities and rural regions, which is central to the near-term revenue catalyst yet also subject to considerable risk if logistics costs rise or infrastructure bottlenecks persist.

However, investors should be aware that mounting competitive pressure and infrastructural gaps could limit the pace and profitability of new market entries...

Read the full narrative on Jumia Technologies (it's free!)

Jumia Technologies' narrative projects $236.6 million in revenue and $20.6 million in earnings by 2028. This requires 13.0% yearly revenue growth and an $90.3 million increase in earnings from the current level of -$69.7 million.

Uncover how Jumia Technologies' forecasts yield a $6.99 fair value, a 45% downside to its current price.

Exploring Other Perspectives

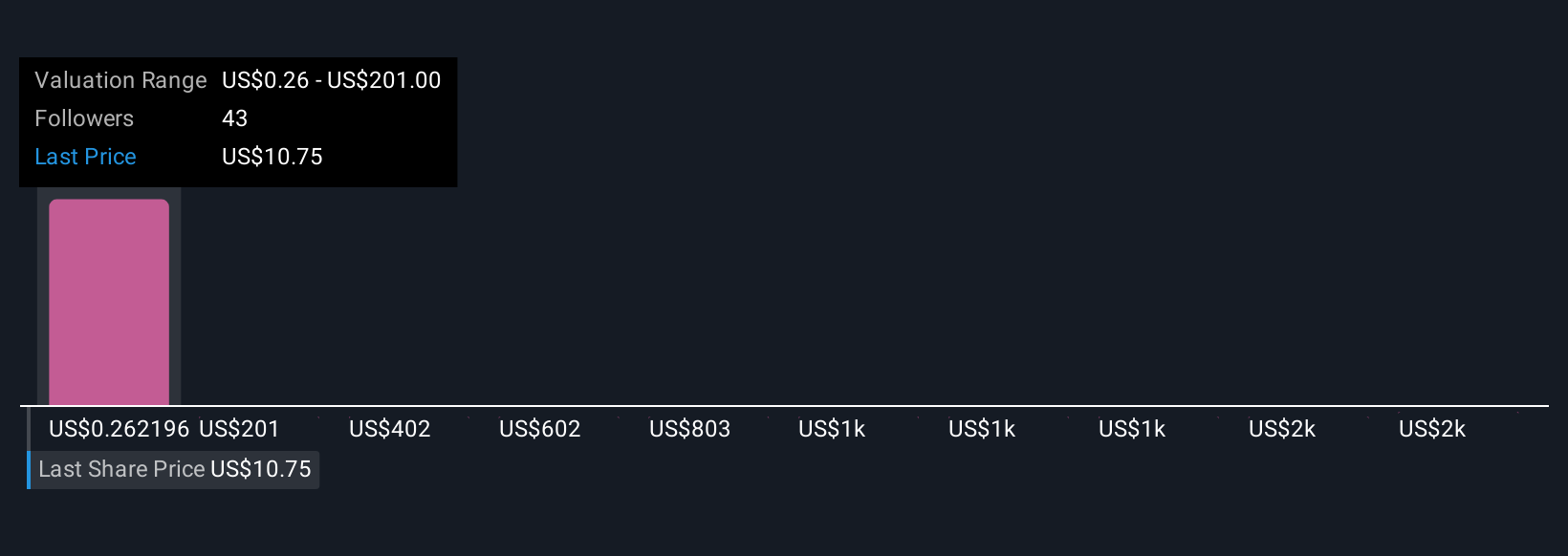

Seven fair value estimates from the Simply Wall St Community span from just US$0.19 up to US$46.28 per share. While views are varied, risk remains if market expansion costs rise faster than anticipated, reminding you to consider multiple viewpoints as you assess Jumia’s outlook.

Explore 7 other fair value estimates on Jumia Technologies - why the stock might be worth over 3x more than the current price!

Build Your Own Jumia Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Jumia Technologies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Jumia Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Jumia Technologies' overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JMIA

Jumia Technologies

Operates an e-commerce platform in West Africa, North Africa, East and South Africa, Europe, the United Arab Emirates, and internationally.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026