- United States

- /

- Specialty Stores

- /

- NYSE:HD

What Home Depot (HD)'s Cautious Outlook and AI Innovation Mean For Shareholders

Reviewed by Sasha Jovanovic

- Home Depot recently reported its third-quarter 2025 results, noting sales of US$41.35 billion and net income of US$3.60 billion, alongside an updated full-year outlook anticipating 3% sales growth, continuing challenges from weak storm activity, consumer uncertainty, and pressures in the housing market.

- The company also introduced an AI-powered Blueprint Takeoffs tool for professionals and approved amendments to its by-laws, reflecting its ongoing focus on operational improvements and corporate governance.

- We'll examine how Home Depot's cautious guidance and recent innovation in professional services could reshape the company’s investment narrative moving forward.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Home Depot Investment Narrative Recap

To be a shareholder in Home Depot, you need to believe in the resilience of large-scale home improvement demand, the company’s focus on operational efficiency, and its ability to capitalize on long-term trends despite ongoing pressures from consumer uncertainty and a sluggish housing market. Recent updates, including the amended by-laws and cautious forward guidance, do not appear to materially shift the short-term catalyst, which remains an anticipated recovery in discretionary home renovation spending, nor do they mitigate the greatest current risk: persistent softness in big-ticket remodeling projects due to economic headwinds. Among the recent announcements, the launch of the AI-powered Blueprint Takeoffs tool is especially relevant as Home Depot continues to target professional customers and large-scale projects. This move aligns closely with the company’s ongoing efforts to build market share and drive organic revenue growth, particularly as broader industry recovery remains a key near-term catalyst. However, investors should also be aware that unlike operational initiatives, persistent weakness in sales from deferred major remodels remains a significant risk if economic conditions do not improve…

Read the full narrative on Home Depot (it's free!)

Home Depot's narrative projects $182.4 billion in revenue and $17.4 billion in earnings by 2028. This requires 3.4% yearly revenue growth and a $2.8 billion earnings increase from the current $14.6 billion.

Uncover how Home Depot's forecasts yield a $403.36 fair value, a 13% upside to its current price.

Exploring Other Perspectives

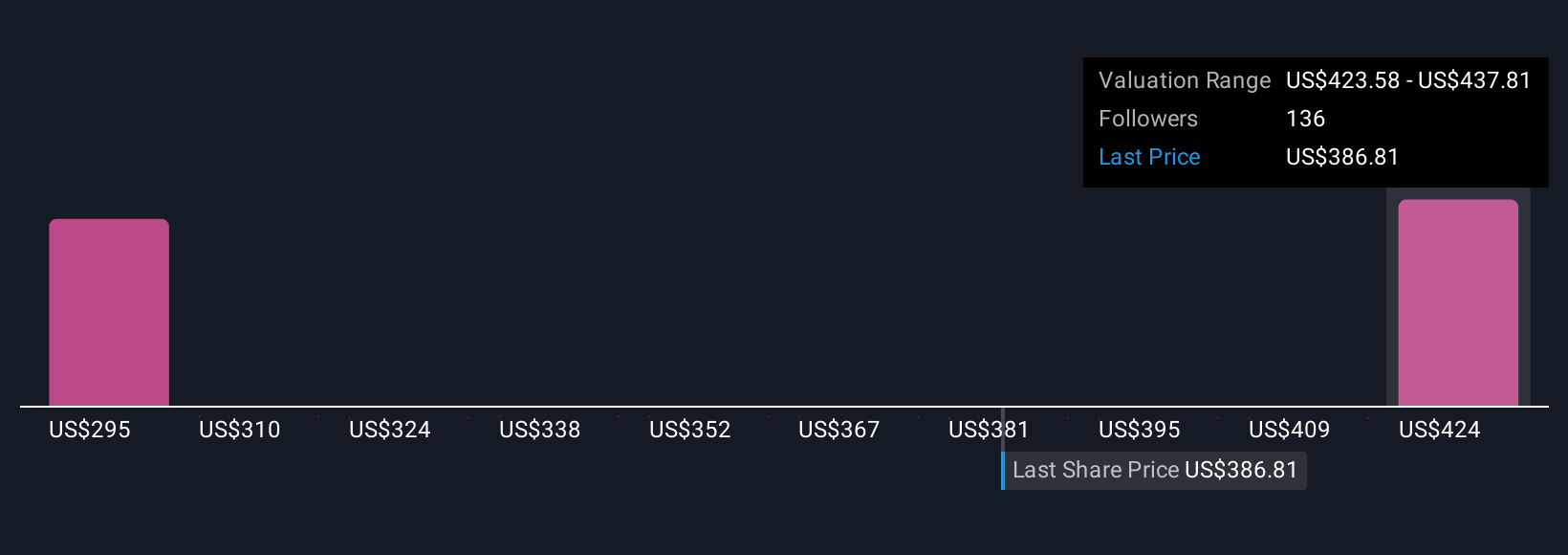

Simply Wall St Community members provided four fair value estimates for Home Depot stock ranging from US$311 to US$403 per share. With earnings and remodeling demand under pressure, your view may differ from the crowd, compare these perspectives to your own outlook for housing market recovery.

Explore 4 other fair value estimates on Home Depot - why the stock might be worth 13% less than the current price!

Build Your Own Home Depot Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Home Depot research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Home Depot research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Home Depot's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Home Depot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HD

Home Depot

Operates as a home improvement retailer in the United States and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.