- United States

- /

- Specialty Stores

- /

- NYSE:HD

Home Depot (HD) Valuation Check After New Instacart Partnership Expands Canadian Same‑Day Delivery

Reviewed by Simply Wall St

Home Depot (HD) just deepened its Canadian footprint through a new Instacart partnership, offering same day delivery from more than 175 Home Depot Canada stores right as the holiday project rush ramps up.

See our latest analysis for Home Depot.

The Instacart deal lands at a tricky moment for sentiment, with Home Depot’s 30 day share price return at minus 8.33 percent and its 90 day share price return at minus 16.18 percent. At the same time, the 5 year total shareholder return of 49.79 percent shows the long term story is still intact and that momentum has recently cooled rather than disappeared.

If this kind of strategic move has you wondering what else might be setting up for a multi year run, it is worth exploring fast growing stocks with high insider ownership for more ideas beyond the big box names.

With shares sliding in 2025 despite steady multi year returns, and trading at a discount to analyst targets even as growth investments continue, the key question now is whether Home Depot is a bargain or if markets already see the rebound coming.

Most Popular Narrative: 12.9% Undervalued

Compared to Home Depot’s last close of $351.17, the most followed narrative sees fair value nearer $403, framing today’s weakness as potential mispricing.

The company's targeted acquisitions (SRS, pending GMS) and continued expansion of its Pro customer ecosystem are positioning Home Depot as the supplier of choice for complex, higher ticket projects. This is set to increase market share, customer lifetime value, and organic revenue growth over time. Home Depot's sizable investments in advanced supply chain technologies, machine learning based delivery optimization, and in store digital enhancements are yielding faster delivery, higher customer satisfaction, and improved operational productivity trends that are expected to boost net margins and drive long term earnings growth.

Want to see how modest growth forecasts, expanding margins, and a richer future earnings multiple combine to justify that higher fair value? The full narrative unpacks the entire math behind it.

Result: Fair Value of $403.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer big ticket remodeling demand and rising cost pressures could delay the expected margin recovery and challenge the case for multiple expansion.

Find out about the key risks to this Home Depot narrative.

Another Angle on Valuation

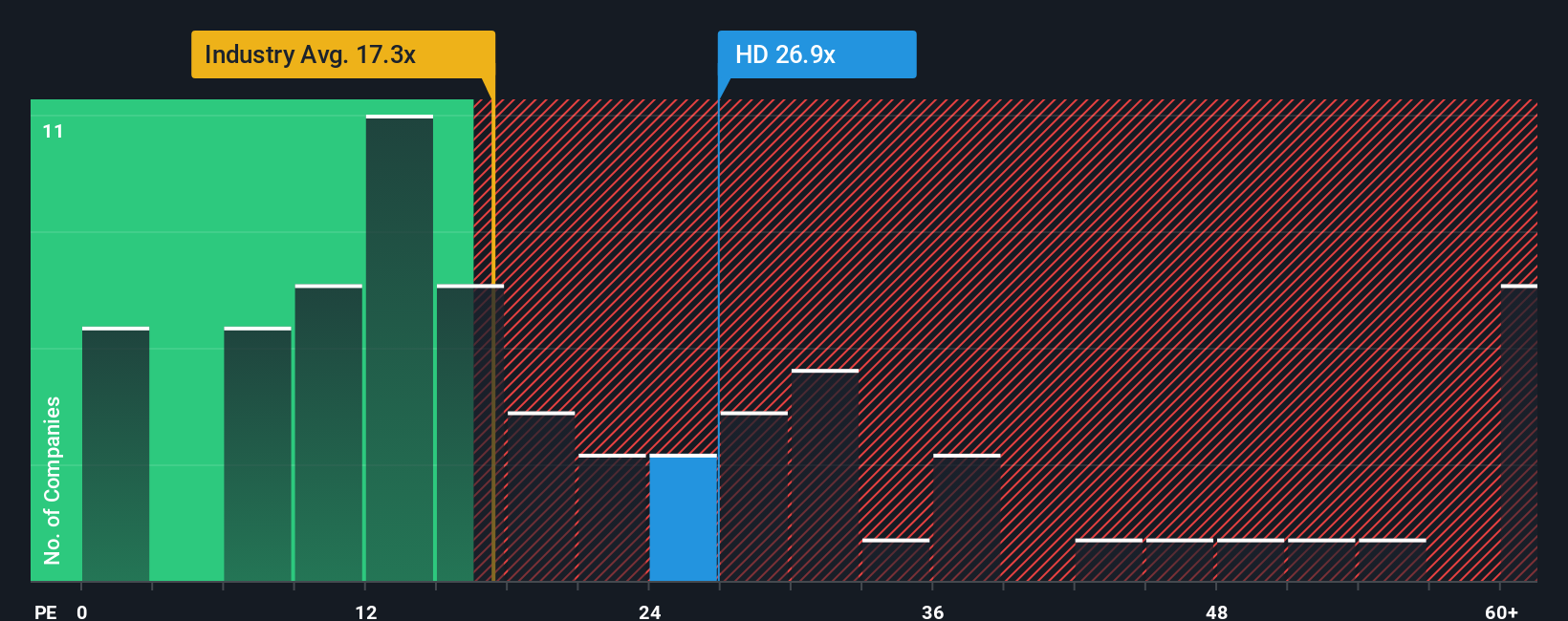

That upbeat 12.9 percent undervaluation story runs into a snag when you look at the price to earnings lens. Home Depot trades around 24 times earnings versus 18.4 times for the US Specialty Retail industry, slightly above its own 23.9 times fair ratio. This tilts the balance toward valuation risk rather than obvious upside. How much premium are you really willing to pay for quality and stability right now?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Home Depot Narrative

If you see things differently or want to dig into the numbers firsthand, you can build a personalized Home Depot thesis in just minutes: Do it your way.

A great starting point for your Home Depot research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider identifying your next set of opportunities with targeted screens that surface high potential stocks you might otherwise overlook.

- Explore early stage momentum by scanning these 3572 penny stocks with strong financials that combine potential with solid financial foundations.

- Gain exposure to the AI transformation with these 30 healthcare AI stocks supporting data driven innovations in medicine and diagnostics.

- Support your income strategy by reviewing these 15 dividend stocks with yields > 3% focused on durable business models and cash distributions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Home Depot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HD

Home Depot

Operates as a home improvement retailer in the United States and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026