- United States

- /

- Specialty Stores

- /

- NYSE:HD

Home Depot (HD): Assessing Valuation as Investor Sentiment Shows Signs of Stabilizing

Reviewed by Simply Wall St

Home Depot (HD) stock has moved quietly in recent sessions, with investors weighing its year-to-date performance and recent business trends. Despite recent fluctuations, Home Depot remains a central name in the home improvement sector.

See our latest analysis for Home Depot.

Home Depot’s recent moves have captured investor attention, with the 1-day share price uptick of 1.25% and a 7-day return of 3.54% reflecting some renewed optimism, even as the stock remains down 8.49% year-to-date. Looking further out, Home Depot’s 1-year total shareholder return has lagged at -15.65%. Its 5-year total shareholder return of 51.12% shows long-term holders have still been rewarded. Overall, momentum appears to be stabilizing after a stretch of volatility. This hints at evolving sentiment around the company’s growth outlook and risk profile.

If you’re curious where else value and momentum might be building, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With Home Depot now trading at a notable discount to many analyst targets, but still facing slowdowns in growth, the big question now is whether investors are looking at a genuine value, or if the market has already factored in all future gains.

Most Popular Narrative: 17.9% Undervalued

Home Depot’s most widely followed narrative values the company well above its last close price of $355.47, signaling a potential disconnect between the current market and fair value. This gap sets the stage for deeper debate on what is driving sentiment and price forecasts ahead.

Home Depot's sizable investments in advanced supply chain technologies, machine learning-based delivery optimization, and in-store digital enhancements are yielding faster delivery, higher customer satisfaction, and improved operational productivity. These trends are expected to boost net margins and drive long-term earnings growth.

Want to know what is fueling this lofty valuation? There is a combination of accelerating profit margins, technology upgrades, and category leadership reflected in the numbers. Find out exactly how analysts are considering these growth assumptions, and which changes in future earnings could justify today’s premium.

Result: Fair Value of $433.12 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering economic uncertainty and continued weakness in large remodeling projects could quickly undermine today's bullish outlook for Home Depot's long-term growth.

Find out about the key risks to this Home Depot narrative.

Another View: Testing the Value with Multiples

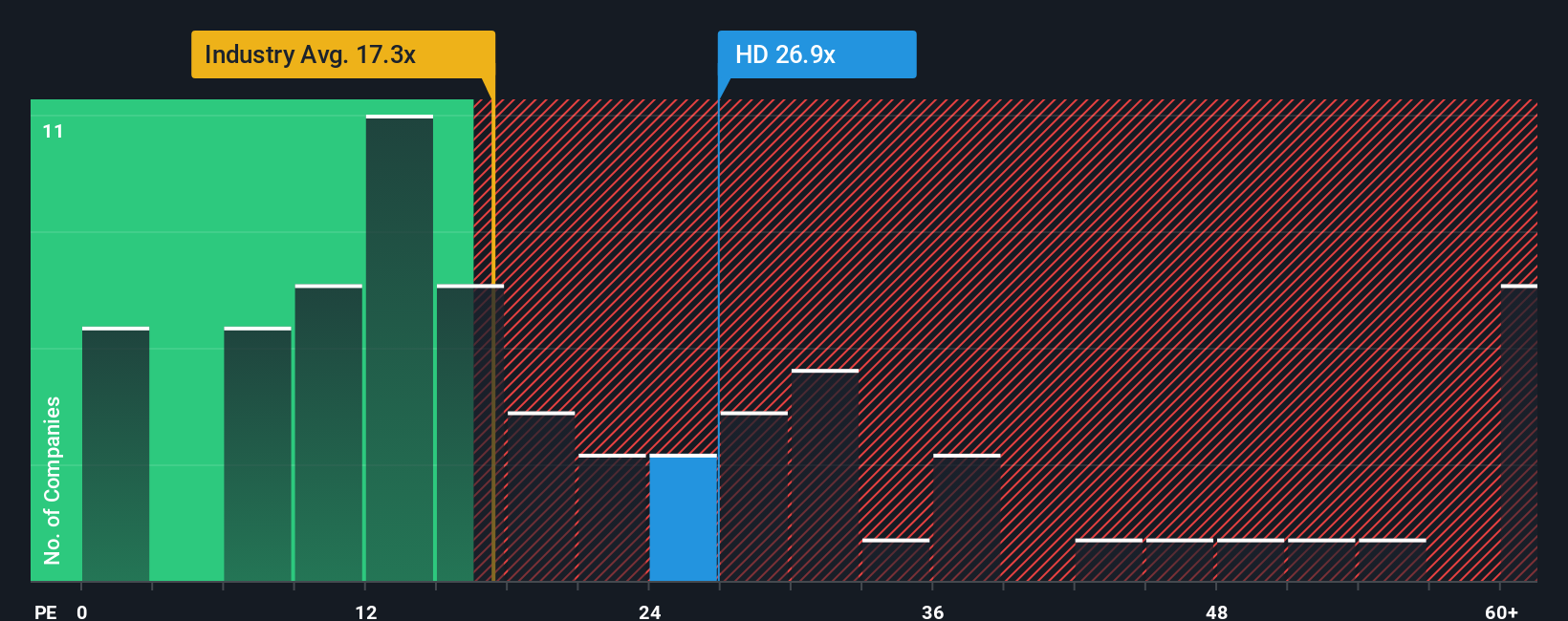

There is another way to judge if Home Depot is a bargain by looking at its price-to-earnings ratio. At 24.3x, Home Depot’s valuation sits well above the US Specialty Retail industry average of 18x and above its own fair ratio of 22.8x. While it is cheaper than peer averages at 26.4x, this premium comes with extra risk if future growth stalls. Multiples like this can quickly compress if investor sentiment changes. Could that be the case for Home Depot, or is its leadership worth the premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Home Depot Narrative

If you see the story differently or want to dig into the numbers on your own terms, you can quickly build your own unique view. Do it your way

A great starting point for your Home Depot research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't limit your strategy to just one stock. Open the door to new opportunities by taking action on these investment themes using our hand-picked screeners.

- Capture growth in healthcare innovation by examining these 30 healthcare AI stocks that are transforming patient care with advanced artificial intelligence.

- Collect consistent returns by targeting income opportunities through these 15 dividend stocks with yields > 3% with yields above 3% and solid fundamentals.

- Ride the wave of digital revolution as you research these 82 cryptocurrency and blockchain stocks that are pioneering breakthroughs in blockchain and cryptocurrency technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Home Depot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HD

Home Depot

Operates as a home improvement retailer in the United States and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.