- United States

- /

- Specialty Stores

- /

- NYSE:HD

Even After a 25% Decline, The Home Depot (NYSE:HD) is Not Yet on our Watchlist

It is not surprising to see the home improvement sector do well during a broad real estate rally. After all, both sides of the spectrum want to change something. Sellers get better valuations from improvements, while buyers get a touch of personalization upon the purchase.

While The Home Depot, Inc. ( NYSE: HD ) did exceptionally well in those circumstances, now it is again leading the market but on the downside.

Check out our latest analysis for Home Depot

Q4 Earnings Results

- Non-GAAP EPS: US$3.21 (beat by US$0.03)

- Revenue: US$35.73b (beat by US$870m)

- Revenue growth: +10.77 Y/Y

Other highlights

- U.S. same-store sales +10.7% FY 2021

- Dividend increase 15% to US$1.90 per share / US$7.60 per annum

- US$1.2b invested in improving the shopping experience for professional customers

- FY guidance: sales and comparable sales growth to be slightly positive

While the stock fell over 10% on the earnings results, it seems that once again, the culprit is not the earnings but rather modest guidance as the market expected double-digit growth.

Meanwhile, the company is experiencing a transition in leadership as the CEO, Craig Menear, passes the baton to COO Ted Decker. This should be a rather smooth transition as the company has a history of such changes. Mr.Menear himself used to be a COO, and he will continue to serve as chairman of the board.

What's the opportunity in Home Depot?

According to our valuation model , the stock is trading around 5.9% below the intrinsic value, which means if you buy Home Depot today, you'd be paying a fair price for it. And if you believe that the stock is worth $328, then there isn't much room for the share price to grow beyond what it's currently trading.Is there another opportunity to buy low in the future?

Since Home Depot's share price is quite volatile, we could potentially see it sink lower (or rise higher) in the future, giving us another chance to buy. This is based on its high beta, which is a good indicator of how much the stock moves relative to the rest of the market.

Can we expect growth from Home Depot?

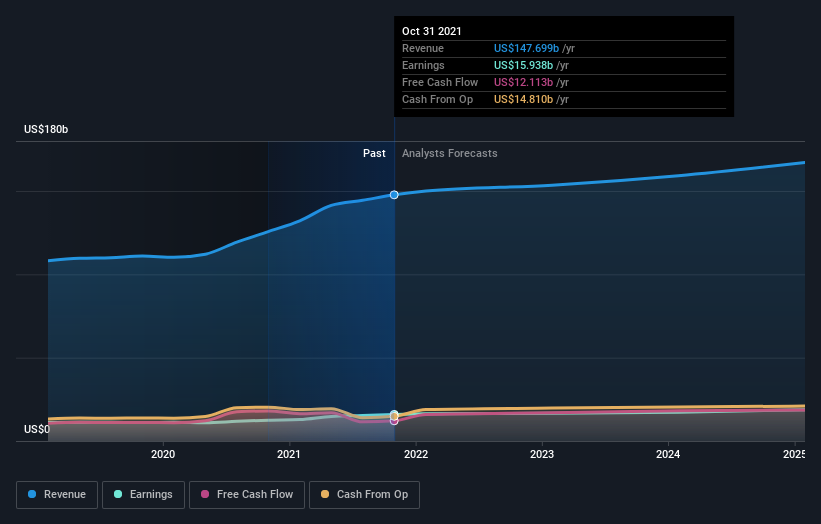

Future outlook is an important aspect when you're buying a stock, especially if you are an investor looking for growth in your portfolio. Although value investors would argue that it's the intrinsic value relative to the price that matters the most, a more compelling investment thesis would be high growth potential at a low price.Home Depot's earnings growth is expected to be in the teens in the upcoming years, indicating a solid future ahead. This should lead to robust cash flows, feeding into a higher share value.

Yet, the near future prospects remain quite modest and that fact seems to be weighing heavily on the price.

What this means for you:

Are you a shareholder? The first reaction, after such a substantial decline, is not to panic but to calmly reassess the situation, and react according to the previously defined risk appetites. Home Depot is almost neutral compared to the average market movement, but at the moment, the broad market is experiencing significant volatility due to the geopolitical news - so keep that in mind. There are also other essential factors that we haven't considered today, such as the company's financial strength . Have these factors changed since the last time you looked at the stock?

Are you a potential investor? If you've been keeping tabs on HD, now may not be the most optimal time to buy, given it isn't trading much below our estimate of fair value . Furthermore, growth forecasts for 2022 are pretty modest and significantly lagging the industry projections.

When it comes to analyzing a stock, it's worth noting the risks involved. For example, we've discovered 2 warning signs that you should run your eye over to get a better picture of Home Depot.

If you are no longer interested in Home Depot, you can use our free platform to see our list of over 50 other stocks with high growth potential.

Valuation is complex, but we're here to simplify it.

Discover if Home Depot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:HD

Home Depot

Operates as a home improvement retailer in the United States and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives