- United States

- /

- Specialty Stores

- /

- NYSE:HD

Can Home Depot's (HD) Supply Chain Moves Redefine Its Edge With DIY and Pro Customers?

Reviewed by Sasha Jovanovic

- On October 6, 2025, The Home Depot, Inc. presented at the CSCMP EDGE 2025 Conference, where Troy Campbell, Director of Reverse Logistics, discussed the company’s latest logistics strategies.

- This event highlights Home Depot’s commitment to supply chain innovation as it seeks to strengthen its leadership among professional and do-it-yourself customers.

- We'll explore how Home Depot’s investment in supply chain and digital initiatives could influence its long-term investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Home Depot Investment Narrative Recap

To be a Home Depot shareholder, you need to believe in the lasting value of its industry-leading store network, ongoing investment in supply chain and digital tools, and its strong relationships with professional customers. The recent CSCMP EDGE 2025 presentation reinforces the company’s commitment to supply chain innovation, but does not fundamentally alter the most important short-term catalyst, recovery in large-scale home renovation demand, or the main risk of continued deferral of big-ticket projects due to economic uncertainty, so its impact is not material.

One relevant recent announcement is Home Depot’s reaffirmed 2025 earnings guidance, which includes a 2.8% total sales growth target alongside a 3% decline in diluted EPS from 2024. This outlook underscores that while operational improvements are ongoing, cost pressures and margin risk remain front and center for investors watching both top-line progress and profitability.

But against ongoing investments and stable fundamentals, investors should also be aware that the risk of prolonged customer deferment in larger discretionary remodeling projects still looms...

Read the full narrative on Home Depot (it's free!)

Home Depot's outlook anticipates revenues reaching $182.4 billion and earnings of $17.4 billion by 2028. This projection implies annual revenue growth of 3.4% and an earnings increase of $2.8 billion from current earnings of $14.6 billion.

Uncover how Home Depot's forecasts yield a $437.81 fair value, a 13% upside to its current price.

Exploring Other Perspectives

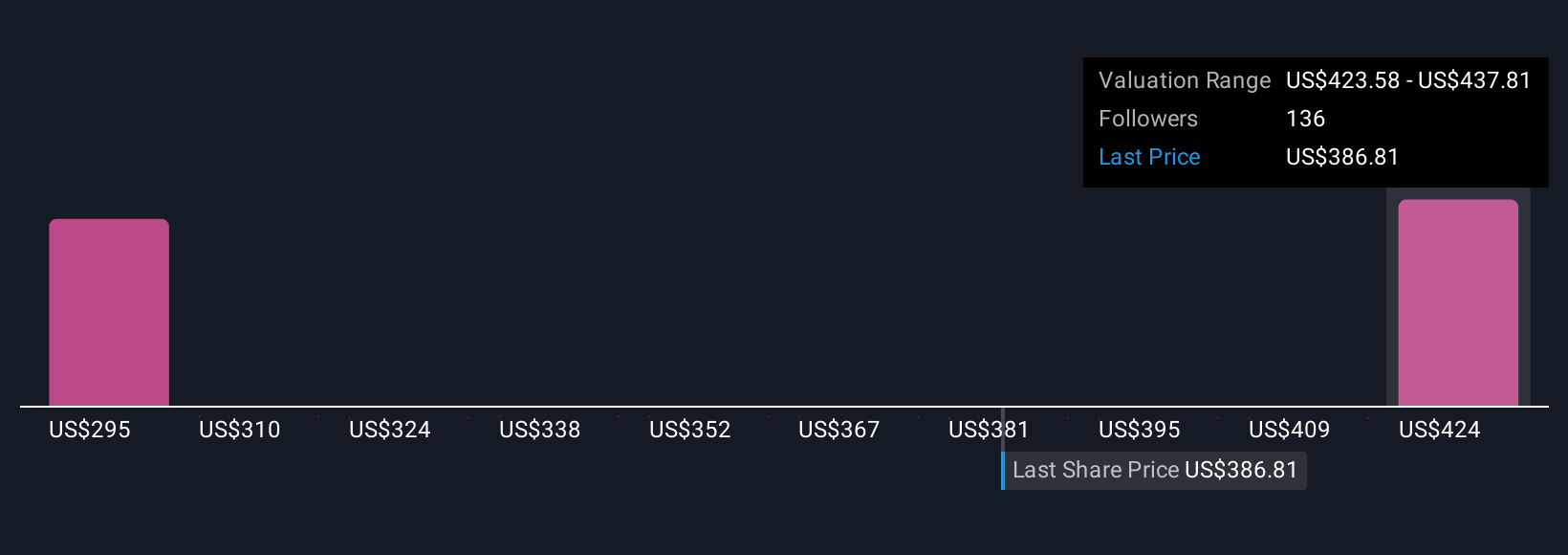

Nine individual members of the Simply Wall St Community estimate Home Depot’s fair value between US$295.47 and US$437.81. Many point to large project deferrals and margin pressure as key issues shaping expectations for future company performance, highlighting why your view on the near-term housing market really matters.

Explore 9 other fair value estimates on Home Depot - why the stock might be worth 24% less than the current price!

Build Your Own Home Depot Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Home Depot research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Home Depot research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Home Depot's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Home Depot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HD

Home Depot

Operates as a home improvement retailer in the United States and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives