- United States

- /

- Specialty Stores

- /

- NYSE:HD

A Fresh Look at Home Depot (HD) Valuation Following Recent Share Price Dip

Reviewed by Kshitija Bhandaru

See our latest analysis for Home Depot.

Zooming out, Home Depot's share price momentum has cooled since earlier this year. The 1-year total shareholder return has slipped slightly negative even as the stock saw modest gains over the past three months. Growth potential remains a talking point, but recent shifts in risk sentiment are keeping investors on their toes as the company's longer-term performance stays solid.

If you’re weighing your next move in retail, it’s a great time to expand your scope and discover fast growing stocks with high insider ownership

With Home Depot’s shares trading below analyst targets and recent gains beginning to slow, investors face a familiar question: is there hidden value left to unlock, or has the market already accounted for its future prospects?

Most Popular Narrative: 9.8% Undervalued

Home Depot’s consensus valuation signals a meaningful gap between the latest close and the price target favored by most analysts. The calculation weighs in catalysts from tech upgrades to strategic acquisitions, making this price target worth a closer look.

Home Depot's sizable investments in advanced supply chain technologies, machine learning-based delivery optimization, and in-store digital enhancements are yielding faster delivery, higher customer satisfaction, and improved operational productivity. These trends are expected to boost net margins and drive long-term earnings growth.

Curious how bold growth bets, margin upgrades, and a premium future earnings multiple combine to set that higher price target? Find out which critical assumptions analysts rely on, and see for yourself if their outlook justifies the optimism or if there is a twist hidden in the numbers.

Result: Fair Value of $437.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent delays in large renovation projects and elevated costs could easily derail forecasts and challenge the optimism behind current price targets.

Find out about the key risks to this Home Depot narrative.

Another View: Multiples Tell a Different Story

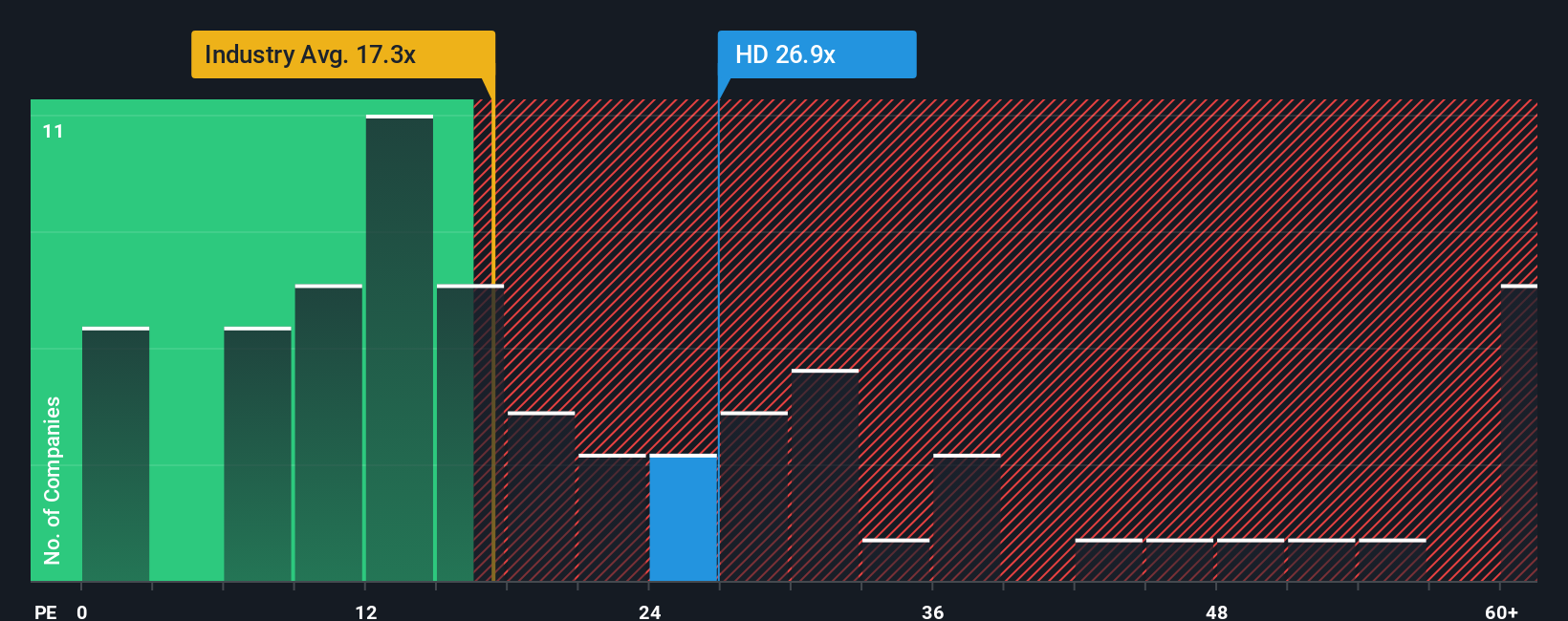

While the analyst consensus points to hidden value, a glance at price-to-earnings ratios tells investors to be careful. Home Depot's P/E stands at 26.9x, making it considerably pricier than the US Specialty Retail industry average of 17.2x and also costlier than its estimated fair ratio of 23.7x. Does this gap signal increased valuation risk, or could continued premium performance keep shares elevated?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Home Depot Narrative

If you want to see how the data supports your own perspective, you can dig in yourself and create a personal view in just a few minutes with Do it your way.

A great starting point for your Home Depot research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock your next market win with smart, targeted strategies. This is your chance to get ahead and avoid missing opportunity by exploring these standout investment ideas.

- Spot stocks with powerful long-term cash flow potential by checking out these 900 undervalued stocks based on cash flows offering attractive price opportunities in today's market.

- Boost your income by selecting businesses rewarding shareholders with yields above 3 percent, thanks to these 19 dividend stocks with yields > 3%.

- Join the frontier of AI-powered healthcare by tapping into these 31 healthcare AI stocks filled with innovators revolutionizing medical treatment and diagnostics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Home Depot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HD

Home Depot

Operates as a home improvement retailer in the United States and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives