- United States

- /

- Specialty Stores

- /

- NYSE:GPI

Group 1 Automotive (GPI): Assessing Valuation After Analyst Upgrades and Continued Expansion

Reviewed by Simply Wall St

If you are watching Group 1 Automotive (GPI) right now, there is a fresh set of earnings revisions and a number of business updates to consider. In just the past few weeks, analysts have increased their profit expectations for 2025, reflecting growing confidence in the company’s operational strategy. At the same time, Group 1’s ongoing dealership expansion, including its new Mercedes-Benz of South Austin property, and a steady, higher dividend suggest the business is taking a balanced approach to growth and shareholder returns.

This combination of upwardly revised forecasts and real-world execution has helped Group 1 shares rise 13% over the past month, with year-to-date returns near 13% and a total of 28% over the past year. While momentum appears to be building, these moves come after several quarters of consistent growth, which have included new leadership appointments and strategic investments in both facilities and personnel.

After this strong run, some investors may be asking whether Group 1 Automotive represents an undervalued growth story or if the market has already priced in its next phase of expansion.

Most Popular Narrative: 1.7% Undervalued

According to community narrative, Group 1 Automotive is viewed as modestly undervalued based on analyst consensus, with future earnings and profitability improvements driving a higher fair value estimate.

The sustained growth in the high-margin parts & service (aftersales) segment, driven by an aging vehicle fleet and rising average vehicle age in both the U.S. and U.K., positions Group 1 to capitalize on increasing repair and maintenance needs. This trend is expected to continue to expand recurring revenue and bolster margins.

Want to uncover why analysts see higher profits around the corner? The most surprising driver behind this valuation is hiding in plain sight. Is it steady growth, margin gains, or the impact of new business strategies? Find out what analysts are really banking on and see what could set Group 1 apart from its peers.

Result: Fair Value of $478.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising competition from digital auto retailers and the risk of integration missteps from acquisitions could present challenges to Group 1's growth strategy in the future.

Find out about the key risks to this Group 1 Automotive narrative.Another View: Our DCF Model Results

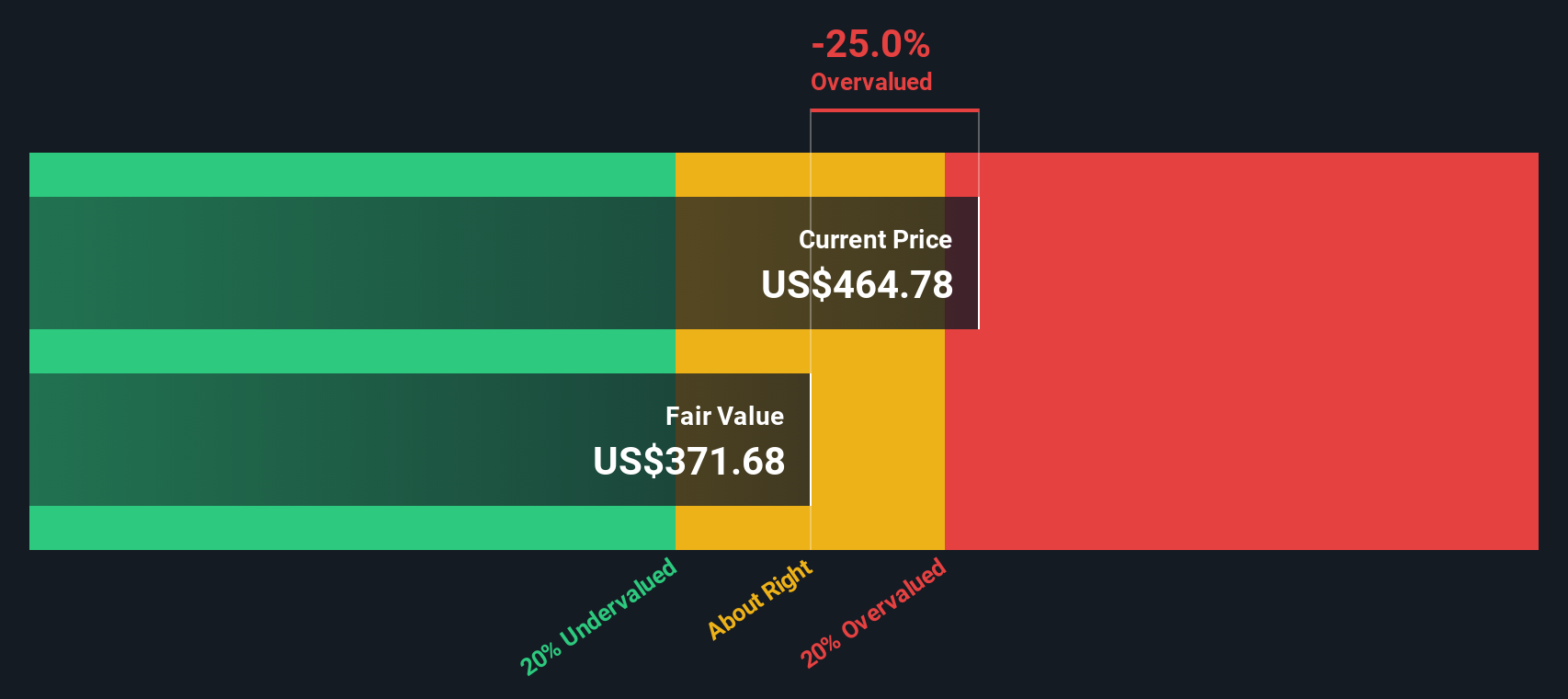

Looking at Group 1 Automotive through the lens of our DCF model tells a different story. The shares appear overvalued according to this cash flow-based approach. Why does this model diverge from the analyst consensus? Which approach provides a closer reflection of reality?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Group 1 Automotive Narrative

If the current analysis does not match your perspective or you like to take a hands-on approach, you have the option to craft your own narrative in just a few minutes. do it your way.

A great starting point for your Group 1 Automotive research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let your next big opportunity pass you by. There is a whole universe of standout stocks beyond Group 1 Automotive just waiting to help you reach your financial goals. Whether you are seeking reliable income or exposure to high-growth sectors, these smart strategies put you in control of your investing journey:

- Boost your income by checking out dividend stocks with yields > 3%, which features companies with consistently high yields and compelling payout histories.

- Stay ahead of tomorrow’s trends by browsing quantum computing stocks and gain early insight into firms powering breakthroughs in quantum technology.

- Supercharge your portfolio’s quality by spotting undervalued stocks based on cash flows, which highlights strong fundamentals and attractive price points based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GPI

Group 1 Automotive

Through its subsidiaries, operates in the automotive retail industry in the United States and the United Kingdom.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives