- United States

- /

- Specialty Stores

- /

- NYSE:GME

GameStop (GME) Net Margin Breakout Tests Bullish Profitability Narratives Heading Into Q3 2026

Reviewed by Simply Wall St

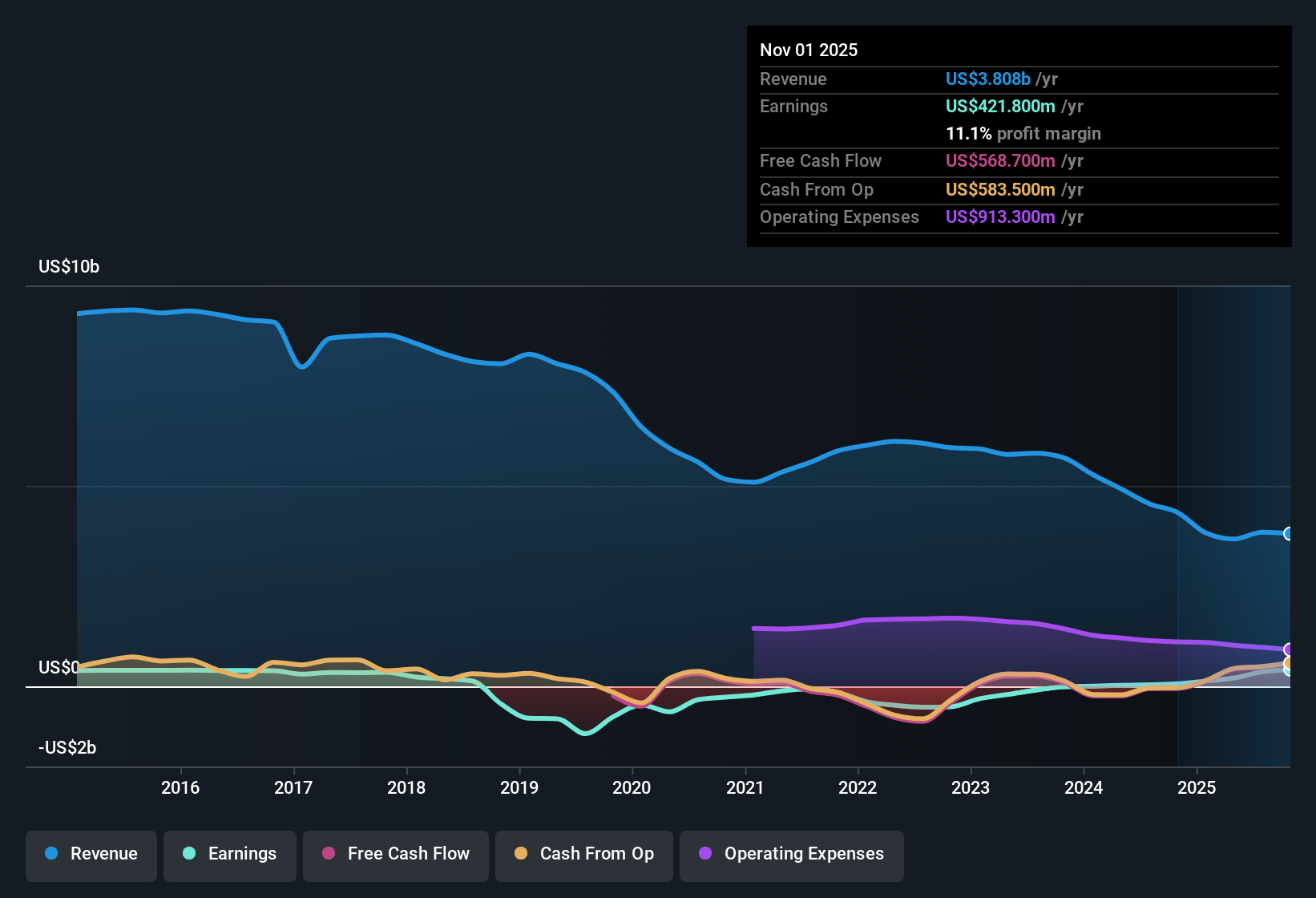

GameStop (GME) opened Q3 2026 with momentum behind it, coming off Q2 revenue of $972 million and basic EPS of $0.38 alongside net income of $168.6 million, with trailing twelve month EPS reaching $0.81 on revenue of about $3.8 billion and net income of $362.2 million. The company has seen quarterly revenue move from $798 million in Q2 2025 to $972 million in Q2 2026, while basic EPS climbed from $0.04 to $0.38 over the same stretch, setting the stage for investors to focus on how these expanding profits translate into healthier margins and a more durable earnings profile.

See our full analysis for GameStop.With the numbers on the table, the next step is to see how this latest run of results lines up with the dominant narratives around GameStop, and where the data might either reinforce or undercut those storylines.

See what the community is saying about GameStop

Net Margin Jumps to 9.4%

- Over the last twelve months, GameStop generated $362.2 million in net income on $3.8 billion in revenue, translating into a 9.4% net profit margin compared with 0.9% a year earlier.

- Bulls see this margin shift as a sign of a stronger core business, and the trailing data gives them solid support:

- Trailing net income climbed from $42.5 million a year ago to $362.2 million, while revenue moved from $4.6 billion down to $3.8 billion, so most of the improvement is coming from profitability rather than pure top line expansion.

- The five year annualized earnings growth rate of 54.3%, together with that 9.4% margin, suggests recent cost discipline and mix changes are feeding directly into the bottom line, not just producing one off gains.

Bulls argue that this kind of margin turnaround rarely happens by accident, and they want to see how far this profitability reset can run before competition or costs start to bite again. 🐂 GameStop Bull Case

EPS Swing Backs From 2025 Losses

- On a quarterly basis, Basic EPS moved from a loss of $0.11 in Q1 2025 to a profit of $0.04 in Q2 2025 and then up to $0.38 by Q2 2026, with trailing twelve month EPS reaching $0.81.

- Bears question how durable this rebound is, and several figures give them areas to probe:

- Quarterly net income shifted from a loss of $32.3 million in Q1 2025 to profits of $14.8 million in Q2 2025 and $168.6 million by Q2 2026, a sharp swing that skeptics may frame as vulnerable if conditions normalize.

- Revenue has been uneven, ranging from $798 million in Q2 2025 to $1.3 billion in Q4 2025 and back to $972 million in Q2 2026, which bears argue makes it harder to assume a straight line path for future EPS off the current $0.81 trailing base.

Skeptics warn that when a company turns EPS from negative to strongly positive this quickly, even small bumps in demand or costs can create noticeable volatility for shareholders who buy in after the recovery is already visible. 🐻 GameStop Bear Case

Premium Valuation Versus Peers

- At a share price of $22.12, GameStop trades at about 27.4 times trailing earnings, above both the peer average P/E of 20.3 times and the US Specialty Retail industry average of 19.4 times, and also above a DCF fair value of $18.54.

- What stands out for cautious investors is how the valuation stacks up against the recent profit surge:

- Trailing earnings grew 756.1% over the last year, yet the stock already reflects a premium multiple versus peers, so part of that growth is effectively “priced in” rather than being an undiscovered improvement.

- The gap between the $22.12 share price and the $18.54 DCF fair value keeps attention on whether the 9.4% net margin and 54.3% five year earnings growth rate can stay strong enough to justify paying more than both the modelled value and typical sector multiples.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for GameStop on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers through a different lens, shape that view into your own narrative in just a few minutes, then Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding GameStop.

Explore Alternatives

GameStop’s sharp earnings rebound comes with uneven revenue trends and a premium valuation, leaving investors exposed if growth or margins slip from current levels.

If that mix of volatility and rich pricing makes you uneasy, use our these 901 undervalued stocks based on cash flows to quickly refocus on companies where robust fundamentals are not already fully priced in.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GME

GameStop

A specialty retailer, provides games and entertainment products through its stores and e-commerce platforms in the United States, Canada, Australia, and Europe.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Near zero debt, Japan centric focus provides future growth

GE Vernova revenue will grow by 13% with a future PE of 64.7x

A buy recommendation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026