- United States

- /

- Specialty Stores

- /

- NYSE:GAP

Is Gap’s Recent Stock Slide an Opportunity After Strong Cash Flow Forecasts for 2025?

Reviewed by Bailey Pemberton

If you have been eyeing Gap stock but are unsure whether now is the right moment to jump in or cash out, you are definitely not alone. Over the past year, Gap's share price has delivered a 7.0% return. If you zoom out to the last three years, shareholders have enjoyed a massive 147.5% gain. Those longer-term returns are enough to make anyone take a closer look. However, a glance at its more recent performance shows the stock has pulled back slightly, dipping -2.0% in the past week and -3.9% over the past month. Year to date, shares are down -7.9%, which feels like a reset in enthusiasm as the broader retail sector navigates ongoing market shifts.

So, what is really driving that mix of excitement and hesitation around Gap right now? Part of the story comes down to big market developments influencing how investors perceive the stock's risk and growth potential. Challenges in consumer spending and changing retail habits are reshaping the landscape. However, with such strong multiyear growth, it is clear that Gap still has quite a few fans among investors.

When looking at value specifically, Gap scores a 5 out of 6 on a common valuation checklist. This means it is undervalued in five of the six key metrics that analysts typically watch. That is an eye-catching figure for anyone searching for value plays in the current market.

Next, let’s dig into these valuation approaches to see exactly where Gap measures up. There is an even smarter way to judge value that we will cover by the end of this article.

Why Gap is lagging behind its peers

Approach 1: Gap Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model projects a company’s future cash flows and then calculates what those are worth in today’s dollars. This provides investors with an estimate of the business’s intrinsic value. This approach offers a grounded way to assess whether a stock might be undervalued or overvalued based on its financial fundamentals, rather than market hype.

For Gap, the latest reported Free Cash Flow (FCF) stands at $773 million. Analysts expect Gap’s FCF to steadily climb, with estimates reaching $837 million by 2030. The first five years of these projections come from analysts, while further projections are extrapolated based on industry trends and Gap’s historical growth rates.

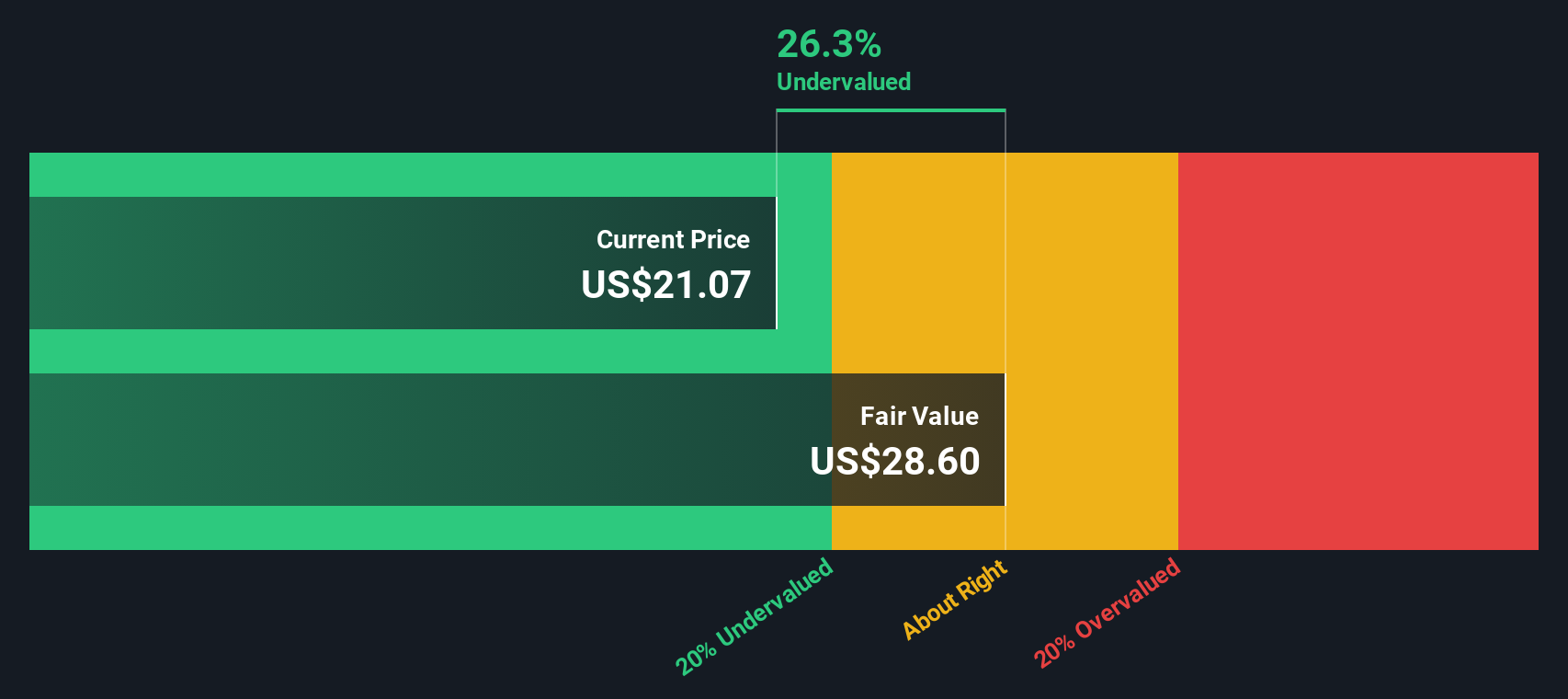

Using these forecasts, the DCF model estimates Gap’s fair value at $28.44 per share. This is nearly 24% higher than where the stock currently trades. This intrinsic discount suggests that Gap stock is 23.6% undervalued right now according to cash flow fundamentals.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Gap is undervalued by 23.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Gap Price vs Earnings

For established, profitable companies like Gap, the price-to-earnings (PE) ratio is often a go-to valuation tool. It gives investors a quick way to see how much they're paying for each dollar of a company's earnings. Growth expectations and risk play a big part here, as stocks with higher growth prospects or lower risk profiles typically command a higher “normal” PE ratio, while riskier or slower-growth companies tend to trade at lower multiples.

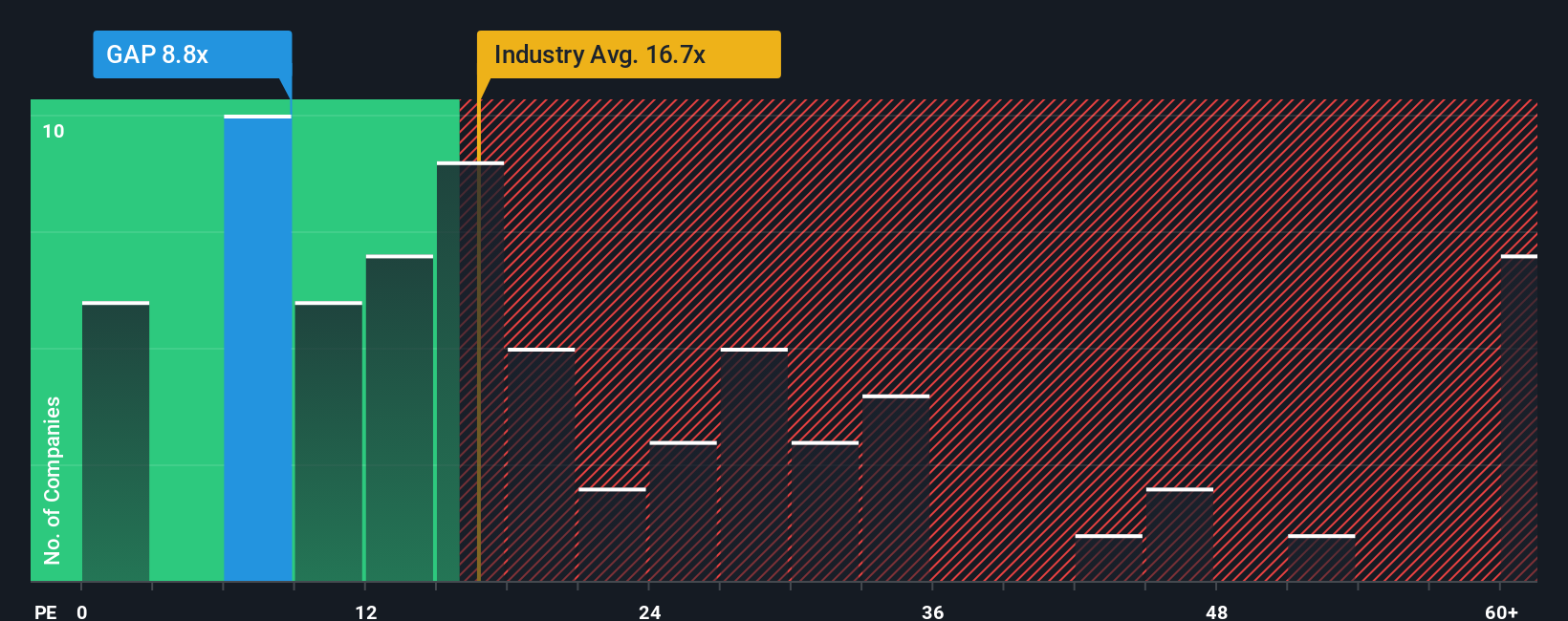

Gap currently trades on a PE ratio of 9.1x, which stands out compared to the Specialty Retail industry average of 17.2x and the peer average of 19.2x. This conservative multiple suggests the market is pricing in relatively modest growth or perceiving higher risk for Gap versus its competitors. However, context matters, and simple peer comparisons can miss the bigger picture.

This is where the Simply Wall St “Fair Ratio” comes in. Unlike basic benchmarks, the Fair Ratio is a proprietary estimate that projects what Gap’s PE should be right now by balancing its growth outlook, profit margins, size, and sector risk. It offers a more holistic, apples-to-apples measure than just lining up the company with industry or peers.

Gap’s Fair Ratio is calculated to be 16.7x. Since its actual PE is 9.1x, the stock is trading below what the fundamentals and context would warrant. This points toward the shares being undervalued based on earnings power and company-specific factors.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Gap Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personal story or perspective behind the numbers, allowing you to connect what you believe about a company’s future, such as expected revenue, profit margins, or growth catalysts, with a corresponding financial forecast and calculated fair value.

Narratives make investing approachable by letting you factor in both data and your individual view, going beyond simple ratios or analyst targets. On Simply Wall St’s Community page, millions of investors can create and share their own Narratives, making it easy to see how others are weighing Gap’s potential and to quickly update your own thesis as fresh information emerges.

Instead of relying only on analyst price targets or market consensus, Narratives let you decide whether a stock is a buy or sell by comparing your Fair Value to the current Price. This approach puts your belief and conviction at the center of your decision process.

Narratives dynamically update when news drops or results are released, ensuring your analysis is always timely. For example, some investors using Narratives have projected a fair value for Gap as high as $32, while others, taking a more cautious view on growth and margins, have set their fair value as low as $19.

Do you think there's more to the story for Gap? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GAP

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives