- United States

- /

- Specialty Stores

- /

- NYSE:GAP

Is Gap Still Attractive After Its 109.5% Three Year Surge?

Reviewed by Bailey Pemberton

- If you are wondering whether Gap at around $26.85 is still a bargain or if the easy money has already been made, you are not alone. That is exactly what this breakdown is here to unpack.

- The stock has slipped about 2.5% over the last week, but that comes after a strong 17.7% jump over the past month, a 13.7% gain year to date, and an impressive 109.5% climb over three years that has reshaped how the market views its potential.

- Recent headlines have focused on Gap's ongoing brand refresh, store optimization efforts, and partnerships aimed at revitalizing its core labels. All of these help explain why sentiment has swung more constructive. At the same time, the market is weighing how sustainable these changes are against a still competitive retail landscape and shifting consumer spending.

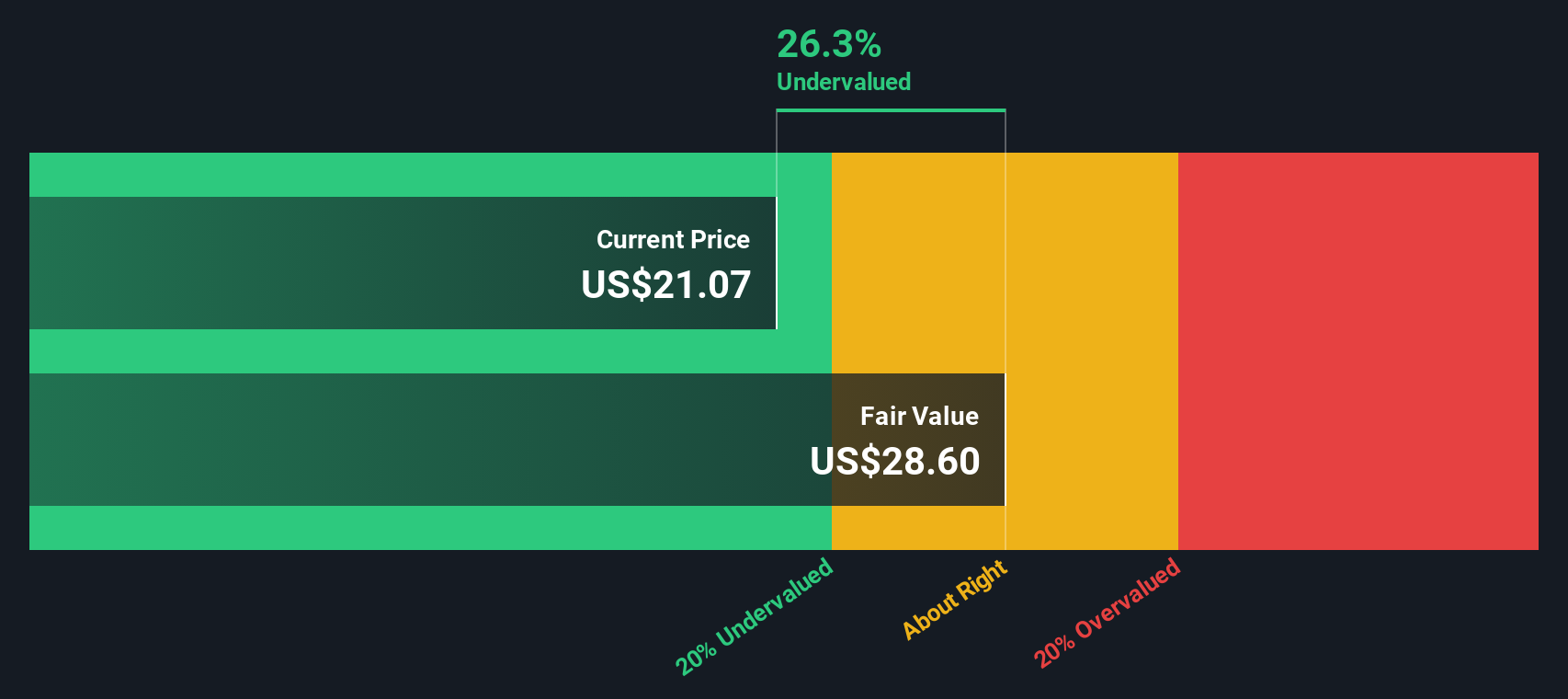

- On our scorecard, Gap earns a 4 out of 6 valuation score, suggesting the market may not be fully pricing in its upside, at least through some lenses. Next we will dig into the main valuation approaches before circling back to a more complete way of thinking about what the stock is really worth.

Approach 1: Gap Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a company is worth by projecting the cash it can generate in the future and then discounting those cash flows back to today. For Gap, the model starts with last twelve month free cash flow of about $784 million and uses analyst forecasts for the next few years, with Simply Wall St extending those trends further out.

Under this 2 Stage Free Cash Flow to Equity approach, Gap's free cash flow is projected to rise to around $932 million by 2035, with interim years gradually stepping up as the business improves margins and efficiency. All of these projected cash flows are discounted back to today using an appropriate required return. This produces an estimated intrinsic value of roughly $29.78 per share.

Compared with a recent share price near $26.85, the DCF implies Gap trades at about a 9.8% discount to its calculated fair value, suggesting the stock is only modestly mispriced rather than deeply cheap.

Result: ABOUT RIGHT

Gap is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

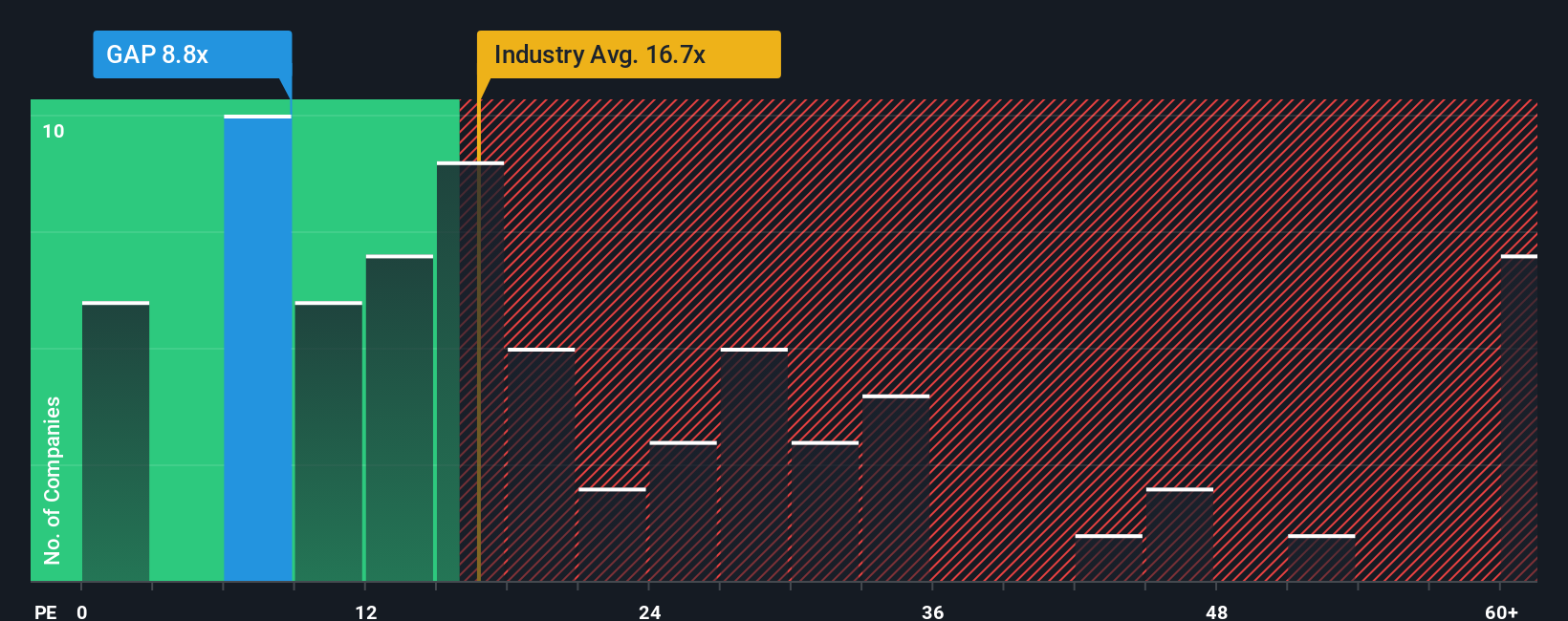

Approach 2: Gap Price vs Earnings

For a profitable retailer like Gap, the price to earnings, or PE, ratio is a useful way to judge value because it links what investors pay directly to the profits the business is generating today. In general, companies with stronger and more reliable growth prospects, and lower perceived risk, tend to justify a higher PE ratio, while slower growth or bumpier earnings usually deserve a lower multiple.

Gap currently trades on a PE of about 11.7x, which sits well below both the Specialty Retail industry average of roughly 18.5x and the broader peer group, around 20.1x. Simply Wall St also calculates a Fair Ratio of 17.3x for Gap, a proprietary estimate of the PE the company should trade on given its earnings growth outlook, profitability, size and specific risk profile. This Fair Ratio is more tailored than a simple peer or industry comparison because it adjusts for Gap’s own fundamentals instead of assuming it should trade in line with averages.

Comparing the current 11.7x PE with the 17.3x Fair Ratio suggests the market is still applying a sizable discount to Gap’s earnings power.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Gap Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple tool on Simply Wall St’s Community page that lets you attach a clear story to your numbers by linking your view of Gap’s brand turnaround, future revenue, earnings and margins to a concrete forecast. You can then turn that into your own fair value estimate and compare it to today’s price to decide whether to buy, hold or sell. The Narrative automatically refreshes when new news or earnings land. For example, one Gap Narrative on the platform might assume stronger digital growth, more pricing power and a higher future PE to support a fair value closer to the bullish 32 US dollars target. Another more cautious Narrative might lean on slower sales, thinner margins and a lower multiple in line with the 19 US dollars bear case. This illustrates how different but clearly defined perspectives can coexist and be tracked over time in a structured, numbers-backed way.

Do you think there's more to the story for Gap? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GAP

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026