- United States

- /

- Specialty Stores

- /

- NYSE:GAP

Gap (GPS): Reassessing Valuation After Upgraded Full-Year Outlook and Q3 Earnings Momentum

Reviewed by Simply Wall St

Gap (GAP) just followed up its third quarter earnings with a bump to full year guidance, signaling that management thinks the recent sales momentum and improving income trends can carry into the coming quarters.

See our latest analysis for Gap.

The upbeat guidance drop comes after a strong run, with Gap posting an 18.9% 90 day share price return and a hefty 107.0% three year total shareholder return, suggesting investors see the turnaround gaining traction rather than fading.

If Gap’s rebound has you curious about what else might be changing gears in retail, it could be worth exploring fast growing stocks with high insider ownership for other potential standouts.

Yet with shares hovering just below analyst targets and only a modest intrinsic discount, the real question is whether Gap is still trading at a bargain or if the market is already pricing in the next leg of growth.

Most Popular Narrative Narrative: 3.2% Overvalued

With Gap last closing at $26.86 against a narrative fair value of $26.03, the most followed view frames shares as slightly ahead of fundamentals.

Brand reinvigoration strategies (especially at Old Navy, Gap, and Banana Republic), including product innovation, viral marketing campaigns, and strategic collaborations, are producing stronger customer engagement, increased traffic, higher average unit retails (AUR), and improved brand equity, laying a foundation for sustained revenue and earnings growth.

To understand how modest growth, small margin gains, and a future earnings multiple below the sector average still point to this price tag instead of a large discount, explore the full narrative for the detailed reasoning behind that view.

Result: Fair Value of $26.03 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tariff exposure and Athleta’s underperformance could quickly dent margins and stall the broader multi brand turnaround story.

Find out about the key risks to this Gap narrative.

Another Angle on Value

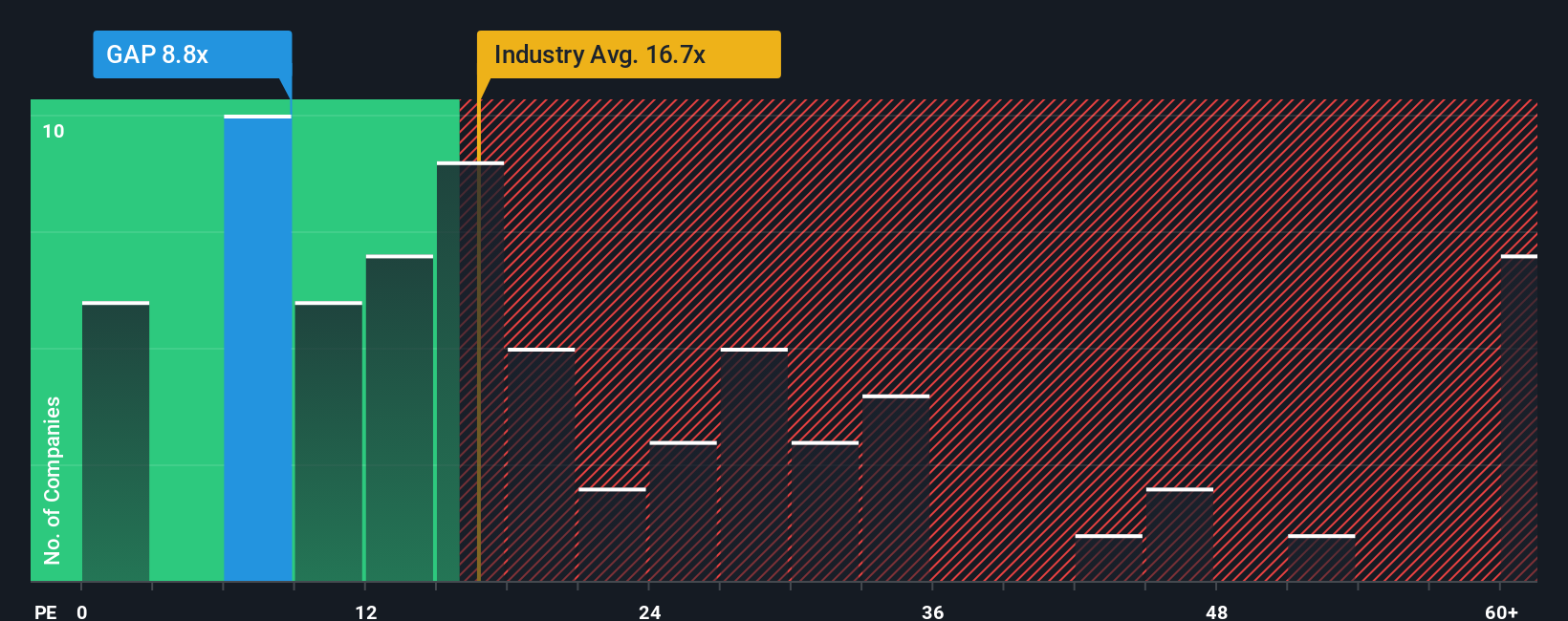

Our valuation view based on earnings multiples is more generous than the community fair value, with Gap trading at a price to earnings ratio of 11.7 times versus a fair ratio of 17.4 times and an industry average of 18.1 times. This hints at potential upside if sentiment keeps improving. Which signal matters more for you, narrative or numbers?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Gap Narrative

If you see the story differently or would rather rely on your own analysis, you can build a fresh view in just minutes, Do it your way.

A great starting point for your Gap research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more high conviction ideas?

Before you move on, lock in a few new watchlist candidates by using the Simply Wall Street Screener to surface fresh, data driven opportunities beyond Gap.

- Capture potential mispricings by targeting quality companies trading below their estimated cash flow value through these 925 undervalued stocks based on cash flows.

- Ride structural trends in automation and machine learning by scanning for future focused innovators using these 24 AI penny stocks.

- Strengthen your income stream by zeroing in on reliable payers with attractive yields via these 14 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GAP

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026