- United States

- /

- Specialty Stores

- /

- NYSE:FND

Will Floor & Decor’s (FND) Expansion in Scottsdale Reveal More About Its Long-Term Growth Strategy?

Reviewed by Sasha Jovanovic

- Floor & Decor Holdings recently celebrated the grand opening of its newest warehouse and design center in North Scottsdale, Arizona, expanding its national footprint to over 250 warehouse-format stores across 38 states.

- This latest store launch supports the company's ongoing push to solidify its presence in key growth markets and reflects its commitment to increasing in-stock product availability for both retail and professional customers.

- We’ll explore how this latest expansion into North Scottsdale aligns with Floor & Decor’s growth strategy and its future investment outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Floor & Decor Holdings Investment Narrative Recap

The core belief for Floor & Decor shareholders is that disciplined national expansion, particularly in fast-growing regions, will drive long-term revenue and market share gains as housing trends normalize. The recent North Scottsdale grand opening fits this narrative, incrementally supporting in-stock availability and growth, but does not materially alter the near-term catalyst, which remains a potential recovery in housing turnover, nor does it mitigate the biggest current risk: expense deleverage from aggressive store openings in a still-cautious housing market.

This news follows the September opening of the Gastonia, North Carolina warehouse, which also expanded staffing and retail capacity, highlighting the company’s continued focus on broadening its physical network, an ongoing catalyst tied closely to future demand for home renovation projects and market breadth.

But despite the company’s growth story, investors should be aware that if new stores do not ramp as expected…

Read the full narrative on Floor & Decor Holdings (it's free!)

Floor & Decor Holdings' narrative projects $6.0 billion revenue and $296.9 million earnings by 2028. This requires 9.0% yearly revenue growth and a $85.7 million earnings increase from $211.2 million currently.

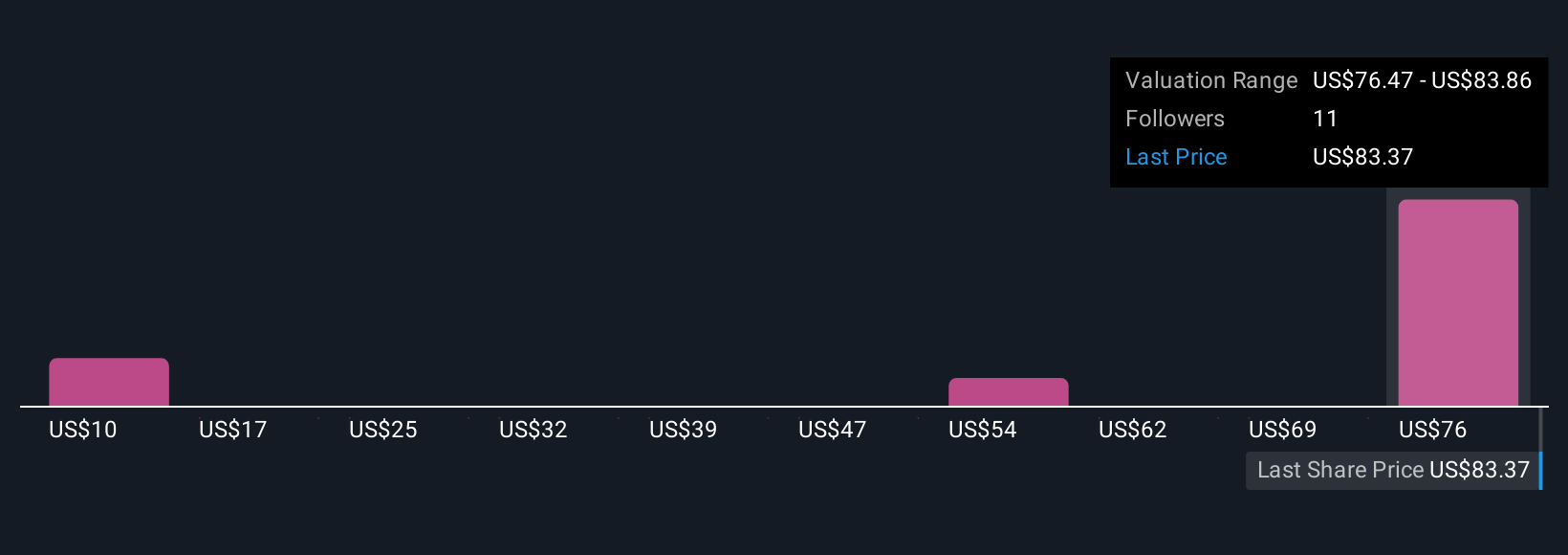

Uncover how Floor & Decor Holdings' forecasts yield a $83.86 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members place Floor & Decor's fair value anywhere from US$9.70 to US$83.86 across five analyses, reflecting sharply different outlooks. This diversity stands out as expense deleverage risk remains top of mind for many when evaluating near-term earnings potential; consider these perspectives as you weigh possible scenarios for the business.

Explore 5 other fair value estimates on Floor & Decor Holdings - why the stock might be worth as much as 14% more than the current price!

Build Your Own Floor & Decor Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Floor & Decor Holdings research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Floor & Decor Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Floor & Decor Holdings' overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FND

Floor & Decor Holdings

Operates as a multi-channel specialty retailer of hard surface flooring and related accessories, and commercial surfaces seller in the United States.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives