- United States

- /

- Specialty Stores

- /

- NYSE:FL

Foot Locker's (NYSE:FL) Dividend and Buyback Authorization Makes it an Interesting Value Prospect

After the stock price ran into the ground in the first quarter of the year, Foot Locker, Inc. (NYSE: FL) is finally showing signals of bottoming out.

While posting a solid earnings result is a good sign, the board has the authorization to purchase up to an astonishing 40% of the current market cap.

First-quarter 2023 results

- EPS: US$1.37 (down from US$1.95 in 1Q 2022).

- Revenue: US$2.18b (up 1.0% from 1Q 2022).

- Net income: US$133.0m (down 34% from 1Q 2022).

- Profit margin: 6.1% (down from 9.4% in 1Q 2022).

Higher expenses drove the decrease in margin. Revenue was in line with analyst estimates. Earnings per share (EPS) missed analyst estimates by 1.6%.

Over the next year, revenue is expected to shrink by 6.0% compared to a 7.9% growth forecast for the industry in the US. Over the last 3 years, on average, earnings per share have increased by 34% annually, but its share price has fallen by 11% per year, which means it is significantly lagging behind earnings.

Although revenue slightly missed the mark, total sales increased by 1%, with gross margins holding up well and losing only 80 basis points.CEO Richard Johnson and CFO Andrew Page reiterated their optimism, with the latter noting that the company should hit the upper end of revenue and earnings guidance for the full year.

Dividend Analysis

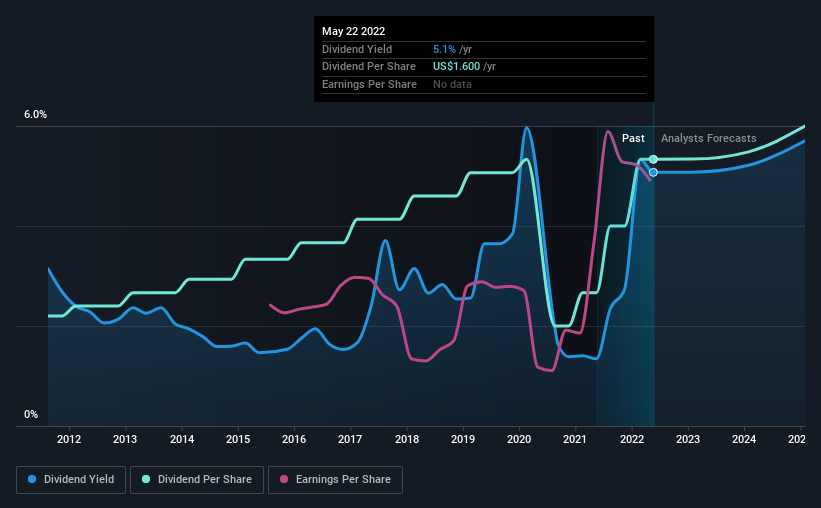

With Foot Locker yielding 5.1% and having paid a dividend for over 10 years, many investors likely find the company quite interesting. It would not be surprising to discover that many investors buy it for dividends. The company also bought back stock during the year, equivalent to approximately 11% of the company's market capitalization at the time.

Explore this interactive chart for our latest analysis on Foot Locker!

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company pays more than it earns, the dividend might have to be cut. So we need to form a view on if a company's dividend is sustainable relative to its net profit after tax. Foot Locker paid out 15% of its profit as dividends over the trailing twelve-month period. This is a low payout ratio, and it looks like earnings comprehensively cover the dividend.

We also measure dividends paid against a company's levered free cash flow to see if enough cash was generated to cover the dividend. Foot Locker's cash payout ratio last year was 22%. Cash flows are typically lumpy, but this is an appropriately conservative payout. It's positive that both profits and cash flow cover Foot Locker's dividend since this is generally a sign that the dividend is sustainable. A lower payout ratio usually suggests a more significant margin of safety before the dividend gets cut.

We update our data on Foot Locker every 24 hours, so you can always get our latest analysis of its financial health here.

Dividend Volatility and Growth Potential

For this article, we only look into the last decade of Foot Locker's dividend payments. Its dividend payments have declined on at least one occasion over the past 10 years. During the past 10-year period, the first annual payment was US$0.7 in 2012, compared to US$1.6 last year. Dividends per share have grown at approximately 9.3% per year over this time. Foot Locker's dividend payments have fluctuated, so it hasn't grown 9.3% every year, but the CAGR is a helpful rule of thumb for approximating the historical growth.

It's good to see the dividend growing at a decent rate. While the dividend slumped during the 2020 Pandemic, this was the typical case in the sector. Before that situation, dividend growth was relatively stable. Strong earnings per share (EPS) growth might encourage our interest in the company despite fluctuating dividends, which is why it's great to see Foot Locker has grown its earnings per share at 12% per annum over the past five years. Earnings per share are growing at a solid clip, and the payout ratio is low. We think this is an ideal combination in a dividend stock.

Conclusion

To summarise, shareholders should always check that Foot Locker's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend.

First, we like that the company's dividend payments appear well covered, although the retained capital needs to be effectively reinvested. Next, earnings growth has been good, and while the dividend has been cut once in the past, this was due to extraordinary circumstances in 2020.

With a decent dividend yield, a favorable valuation, and a board that has considerable share buyback authorization, Foot Locker is an interesting prospect for any investor who is not afraid to bet on a retailer in a current market environment.

Market movements attest to how highly valued a consistent dividend policy is compared to a more unpredictable one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Case in point: We've spotted 3 warning signs for Foot Locker you should know about.

We have also put together a list of global stocks with a market capitalization above $1bn and yielding more than 3%.

If you're looking to trade Foot Locker, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:FL

Foot Locker

Through its subsidiaries, operates as a footwear and apparel retailer in North America, Europe, the Middle East, Africa, Asia Pacific, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives