Etsy (ETSY): Assessing Valuation After Recent 8% Share Price Climb

Reviewed by Kshitija Bhandaru

See our latest analysis for Etsy.

Momentum appears to be building for Etsy, with its 1-month share price return of 8% helping push its year-to-date gain to nearly 33%. This comes despite a recent dip and stands out especially given the platform’s longer-term three- and five-year total shareholder returns remain sharply negative. For investors, the stock’s recent movement hints at renewed optimism about Etsy’s growth prospects in a competitive retail sector.

If you want to expand your radar beyond ecommerce, now’s the perfect chance to explore fast growing stocks with high insider ownership.

But with shares up over 30% so far this year, is Etsy currently undervalued based on its fundamentals? Or is the recent rally a sign that markets have already priced in all the company’s growth potential?

Most Popular Narrative: 6% Overvalued

With Etsy’s latest share price closing above the most followed narrative fair value, optimism continues to run high; however, valuations look stretched relative to underlying assumptions.

Expansion of direct marketing and app-based engagement, with the Etsy app now accounting for nearly 45% of total GMS and providing a higher customer LTV, is an operational pivot expected to increase buyer retention, loyalty, and overall platform stickiness. All of this could support longer-term revenue and margin expansion.

Curious what powers this bold valuation call? The underlying assumptions pack a punch: future earnings are forecast to grow rapidly and margins are expected to improve, while the company must hit a lower profit multiple in years ahead. Wonder which combination of growth and profitability supports this price? Read on for the full breakdown behind the numbers.

Result: Fair Value of $66 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines in gross merchandise sales and rising marketing costs remain real threats that could quickly challenge Etsy's optimistic growth outlook.

Find out about the key risks to this Etsy narrative.

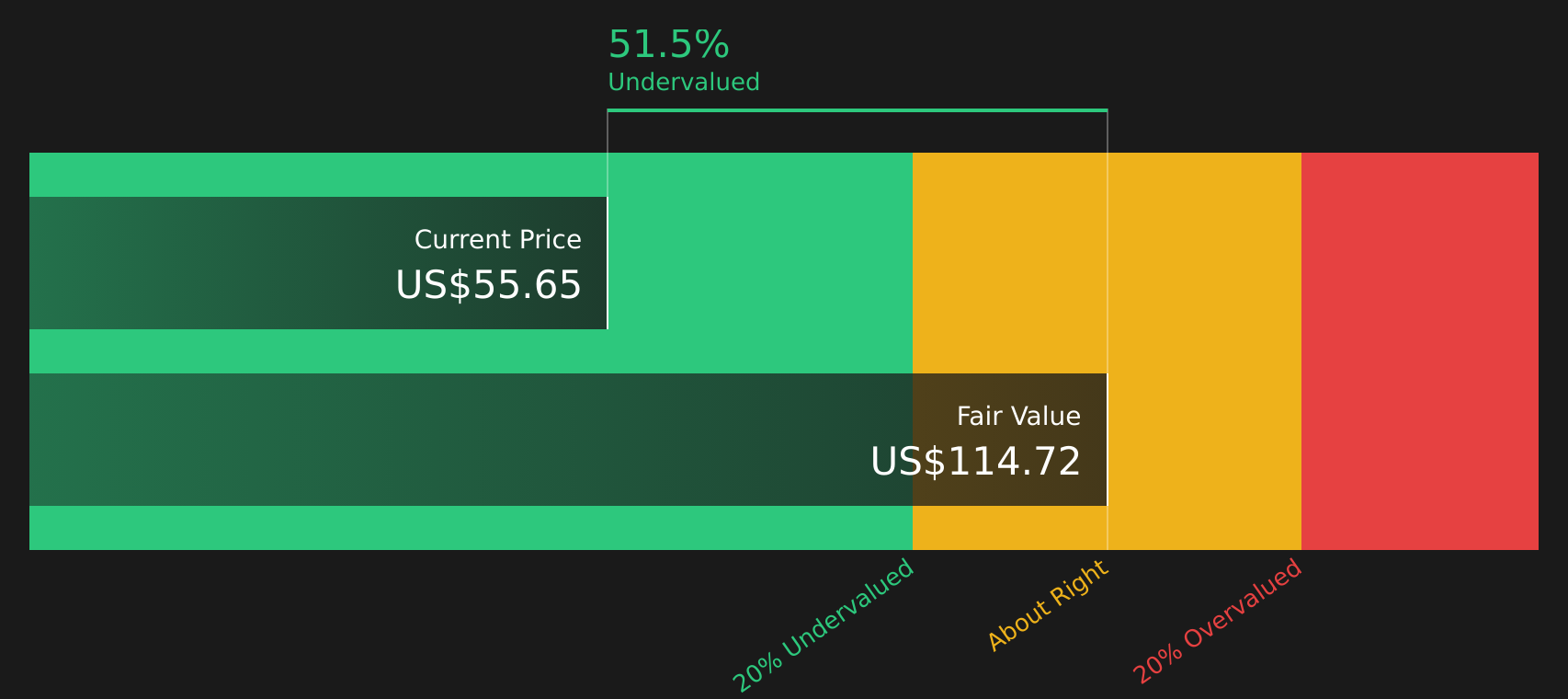

Another View: DCF Tells a Different Story

While valuation using traditional earnings multiples suggests Etsy may be expensive, our DCF model offers a more optimistic view. According to the SWS DCF model, Etsy is actually trading below its estimated fair value. This hints at a potential undervaluation relative to its cash flow generation.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Etsy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Etsy Narrative

If you see the numbers differently or want to explore Etsy’s story in your own way, don’t forget you can build your own narrative in just a few minutes. Do it your way.

A great starting point for your Etsy research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Take action now to get ahead of market trends by uncovering a selection of standout picks tailored to your goals. There is no reason to miss out on the next potential winner.

- Boost your portfolio’s income by reviewing companies offering reliable yields above 3% through these 18 dividend stocks with yields > 3%.

- Tap into the immense potential of breakthrough artificial intelligence by checking out these 24 AI penny stocks shaping tomorrow’s tech landscape.

- Capitalize on strong fundamentals with smart picks that trade below intrinsic value via these 868 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Etsy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ETSY

Etsy

Operates two-sided online marketplaces that connect buyers and sellers worldwide.

Moderate risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives