The Bull Case For Dillard's (DDS) Could Change Following Rapid Pandora Shop-in-Shop Expansion

Reviewed by Simply Wall St

- Dillard's, Inc. and Pandora recently celebrated the opening of their 100th Pandora shop-in-shop at the newly constructed Dillard's store in Springfield, Missouri, marking a significant expansion of their partnership which began in 2024.

- This rapid rollout highlights strong customer demand and underscores the growing importance of successful brand collaborations within large-scale retail environments.

- We'll explore how the swift expansion of Pandora offerings at Dillard's could influence the company's broader investment narrative and brand appeal.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Dillard's Investment Narrative?

To believe in Dillard’s as a shareholder today, you’d need confidence in the company’s ability to sustain customer engagement and drive growth, even amid recent declines in sales and earnings. The news of the 100th Pandora shop-in-shop rollout is a positive sign, strengthening Dillard’s position through brand partnerships and hinting at new ways to energize foot traffic and broaden appeal. While the expansion showcases the company’s responsiveness to customer demand, it may not immediately shift the needle on critical metrics like revenue or earnings, especially given the prior trend of modest declines. Catalysts like new product launches and the continued return of capital via dividends and buybacks remain, but the rollout’s fast pace could help offset competitive risks in the short term. However, the overhang of expected multi-year declines in revenue and profit growth hasn’t disappeared, and this remains a chief concern for the investment narrative.

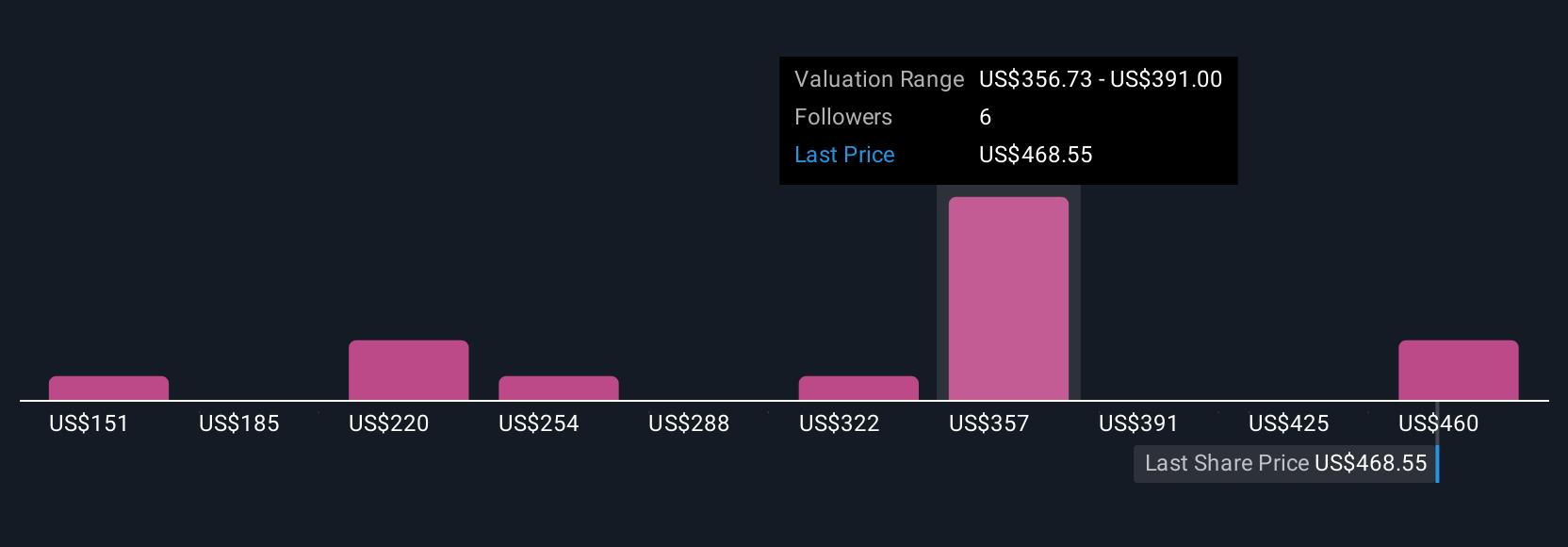

Yet, questions about future earnings momentum linger, especially as growth headwinds persist. Dillard's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 7 other fair value estimates on Dillard's - why the stock might be worth less than half the current price!

Build Your Own Dillard's Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dillard's research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Dillard's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dillard's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 19 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DDS

Dillard's

Operates retail department stores in the southeastern, southwestern, and midwestern areas of the United States.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives