Are Short-Term Gains in Dillard's (DDS) Reflecting a Lasting Shift in Consumer Behavior?

Reviewed by Simply Wall St

- Shares of Dillard’s moved higher after an analyst highlighted stronger consumer activity at the end of the previous quarter.

- This suggests that investors are increasingly focused on short-term retail performance signals, even as some analysts remain cautious about longer-term prospects.

- We'll examine how the recent increase in consumer activity is shaping Dillard’s investment narrative going forward.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Dillard's Investment Narrative?

To be a confident Dillard’s shareholder right now, you’d need to believe that recent signs of stronger consumer activity will last long enough to outweigh a streak of softer sales and declining profits. The recent analyst price target hike and big jump in shares have put a spotlight on near-term retail spending signals, seemingly giving investors a reason to look past longer-term risks like falling revenue, shrinking earnings, and the company’s high price-to-earnings ratio compared to its own fair value. While new product launches and buybacks show efforts to drive interest, and the dividend remains attractive, analysts had warned of declining growth for both sales and profits even before this news. The latest surge in consumer activity could influence short-term results and sentiment, but unless this trend continues, it may not be enough to shift the bigger picture on risk.

However, declining earnings forecasts remain a key issue investors should keep an eye on.

Exploring Other Perspectives

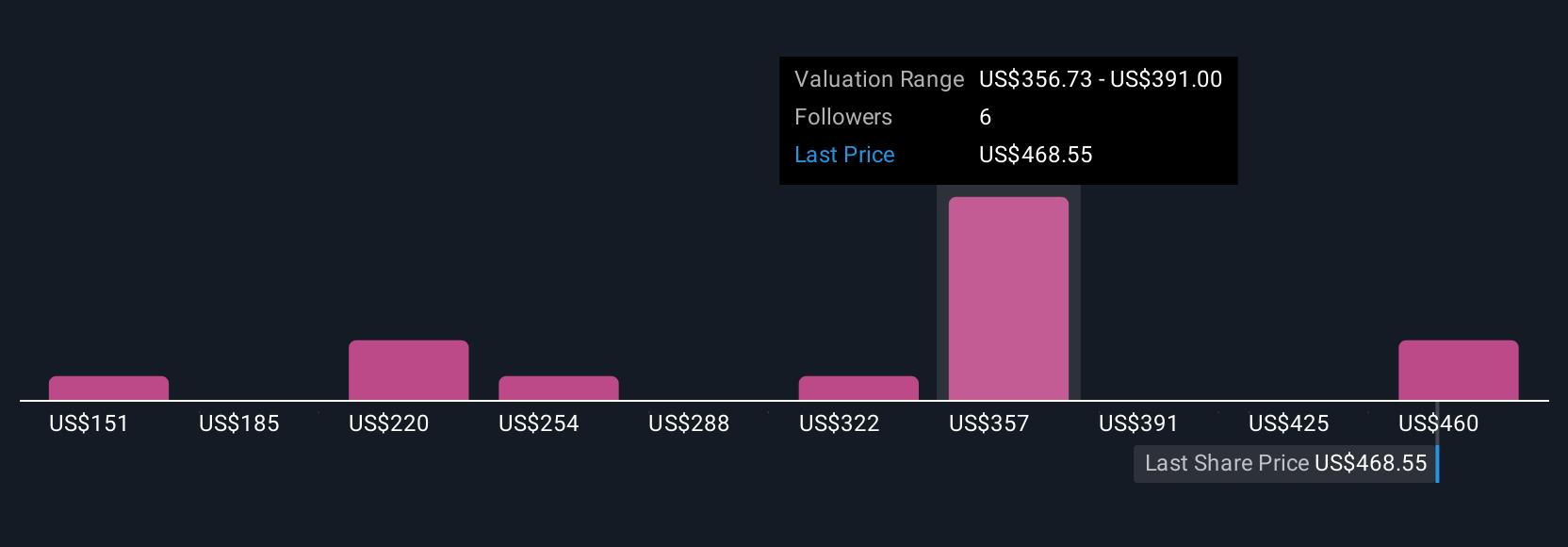

Explore 6 other fair value estimates on Dillard's - why the stock might be worth less than half the current price!

Build Your Own Dillard's Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dillard's research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Dillard's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dillard's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DDS

Dillard's

Operates retail department stores in the southeastern, southwestern, and midwestern areas of the United States.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives