- United States

- /

- Hospitality

- /

- NasdaqGS:DASH

DoorDash, Inc. (NYSE: DASH) Still Lacks the Optimism From Insiders

Despite a few bright moments, DoorDash, Inc. (NYSE: DASH) stock produced lackluster performance in 2021, as the stock traded flat for the year.

Yet, while institutions might be bullish, our data shows that the insiders are not as optimistic.

Check out our latest analysis for DoorDash

Latest Developments

Evercore ISI just upgraded Doordash to Outperform (from In line), as analyst Mark Mahaney set the target price at US$256.

Mr.Mahaney claims that DoorDash is a structural Covid winner, noting that the company's growth continued even through the restaurant reopening in 2021. Furthermore, he notes that the stock is now trading at reasonable multiples – about 6.6 x 2023 estimated sales and 0.8 x 2023 expected gross order values.

Finally, he reflects on the orders beyond food, which account for 12% - nothing the growth potential of this category.

This contrasts with the short-seller Jim Chanos, who listed DoorDash as a short, criticizing the company for not taking full advantage of the quarantines. Interestingly, DASH doesn't have a significant short interest at the moment (5.43%).

Meanwhile, Meta Platforms (Facebook) named DoorDash CEO Tony XU as the newest member of their board. As commerce will undoubtedly play a significant role in the metaverse, it will be interesting to see whether this move will spark a future collaboration between the corporations.

The Last 12 Months Of Insider Transactions At DoorDash

In the last twelve months, the biggest single sale by an insider was when the Chief Financial Officer, Prabir Adarkar, sold US$70m worth of shares at US$154 per share. So we know that an insider sold shares at around the current share price of US$144. While we don't usually like to see insider selling, it's more concerning if the sales occur at a lower price.

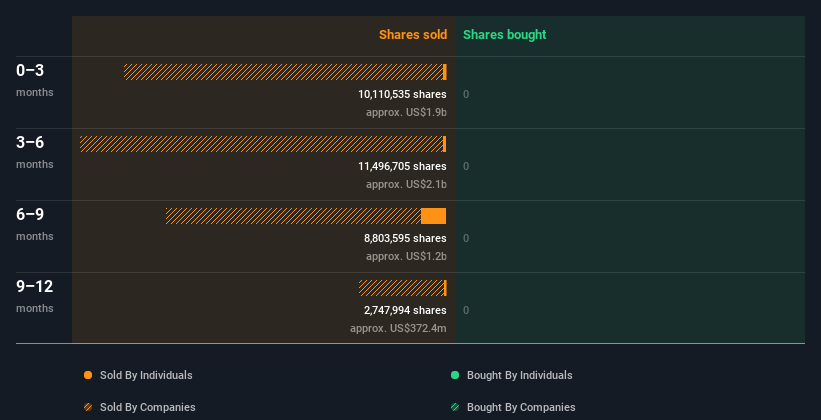

In the last year, DoorDash insiders didn't buy any company stock. You can see a visual depiction of insider transactions (companies and individuals) over the last 12 months below.

If you click on the chart, you can see all the individual transactions, including the share price, individual, and date.

Insider Ownership

We like to look at how many shares insiders own in a company to help inform our view of how aligned they are with insiders. If insiders own a significant number of shares, it is generally a good sign.

DoorDash insiders own 8.6% of the company, currently worth about US$4.2b based on the recent share price. We like to see this level of insider ownership because it increases the chances that management is thinking about the best interests of shareholders.

So What Does This Data Suggest About DoorDash Insiders?

Insiders sold DoorDash shares recently, but, during the last 12 months, they didn't buy any - even at the lows in May. The company boasts high insider ownership, but we're a little hesitant, given the history of share sales. Furthermore, we aren't impressed that the number of the total shares outstanding grew by 8% Y/Y, diluting the shareholders.

While we like knowing what's going on with the insider's ownership and transactions, we should also consider what risks a stock faces before making any investment decision. In terms of investment risks, we've identified 3 warning signs with DoorDash, and understanding them should be part of your investment process.

But note: DoorDash may not be the best stock to buy. So take a peek at this free list of growing companies that insiders are buying.

For this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you're looking to trade DoorDash, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:DASH

DoorDash

Operates a commerce platform that connects merchants, consumers, and independent contractors in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives