- United States

- /

- Specialty Stores

- /

- NYSE:CWH

Does Camping World Holdings (NYSE:CWH) Deserve A Spot On Your Watchlist?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Camping World Holdings (NYSE:CWH). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Camping World Holdings

How Fast Is Camping World Holdings Growing Its Earnings Per Share?

Over the last three years, Camping World Holdings has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. Thus, it makes sense to focus on more recent growth rates, instead. Over twelve months, Camping World Holdings increased its EPS from US$3.11 to US$3.30. That's a modest gain of 6.4%. It also seems the company is in good financial health, since it has boosted EPS by buying back shares.

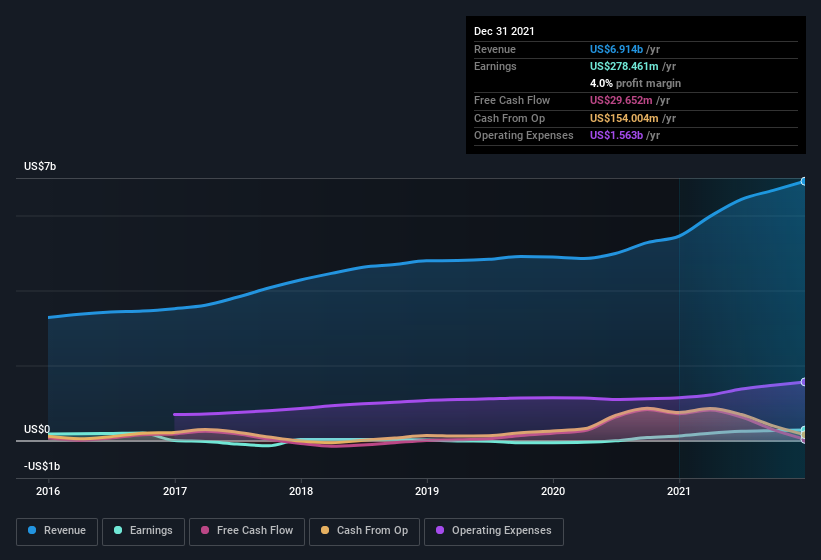

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). I note that Camping World Holdings's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Camping World Holdings shareholders can take confidence from the fact that EBIT margins are up from 9.4% to 12%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future Camping World Holdings EPS 100% free.

Are Camping World Holdings Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

First things first; I didn't see insiders sell Camping World Holdings shares in the last year. But the really good news is that Chairman & CEO Marcus Lemonis spent US$201k buying stock stock, at an average price of around US$39.91. Big buys like that give me a sense of opportunity; actions speak louder than words.

On top of the insider buying, it's good to see that Camping World Holdings insiders have a valuable investment in the business. With a whopping US$61m worth of shares as a group, insiders have plenty riding on the company's success. This should keep them focused on creating long term value for shareholders.

Is Camping World Holdings Worth Keeping An Eye On?

One positive for Camping World Holdings is that it is growing EPS. That's nice to see. On top of that, we've seen insiders buying shares even though they already own plenty. That makes the company a prime candidate for my watchlist - and arguably a research priority. However, before you get too excited we've discovered 3 warning signs for Camping World Holdings (1 can't be ignored!) that you should be aware of.

The good news is that Camping World Holdings is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CWH

Camping World Holdings

Together its subsidiaries, retails recreational vehicles (RVs), and related products and services in the United States.

Good value with reasonable growth potential.