- United States

- /

- Specialty Stores

- /

- NYSE:CWH

Camping World Holdings (NYSE:CWH) Is Reducing Its Dividend To $0.125

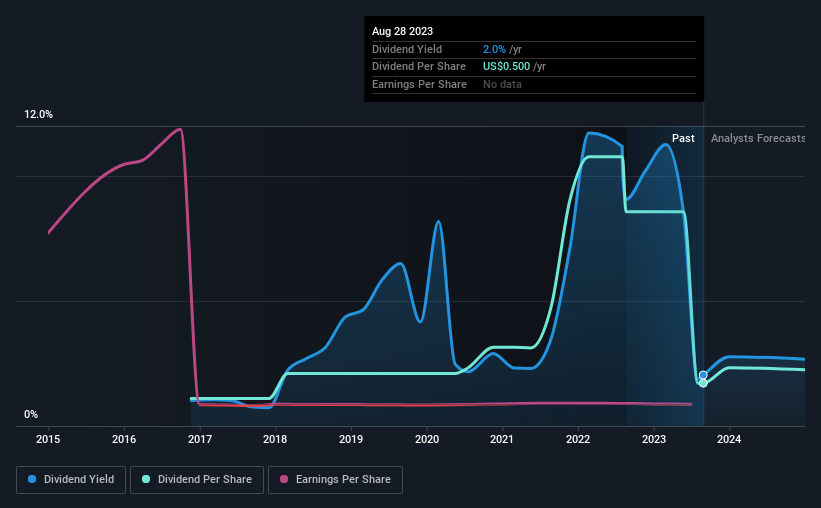

Camping World Holdings, Inc. (NYSE:CWH) is reducing its dividend from last year's comparable payment to $0.125 on the 29th of September. This means that the annual payment will be 2.0% of the current stock price, which is in line with the average for the industry.

See our latest analysis for Camping World Holdings

Camping World Holdings Doesn't Earn Enough To Cover Its Payments

We aren't too impressed by dividend yields unless they can be sustained over time. Prior to this announcement, the company was paying out 272% of what it was earning, however the dividend was quite comfortably covered by free cash flows at a cash payout ratio of only 45%. Given that the dividend is a cash outflow, we think that cash is more important than accounting measures of profit when assessing the dividend, so this is a mitigating factor.

Earnings per share is forecast to rise by 66.7% over the next year. If the dividend continues on its recent course, the payout ratio in 12 months could be 193%, which is a bit high and could start applying pressure to the balance sheet.

Camping World Holdings' Dividend Has Lacked Consistency

Even in its relatively short history, the company has reduced the dividend at least once. If the company cuts once, it definitely isn't argument against the possibility of it cutting in the future. Since 2016, the annual payment back then was $0.32, compared to the most recent full-year payment of $0.50. This works out to be a compound annual growth rate (CAGR) of approximately 6.6% a year over that time. A reasonable rate of dividend growth is good to see, but we're wary that the dividend history is not as solid as we'd like, having been cut at least once.

Dividend Growth May Be Hard To Achieve

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. Unfortunately, Camping World Holdings' earnings per share has been essentially flat over the past five years, which means the dividend may not be increased each year. With anaemic earnings growth, it's not confidence inspiring to see Camping World Holdings paying out more than double what it is earning. Meaning that on balance, the dividend is more likely to fall in the future than to grow.

In Summary

Overall, it's not great to see that the dividend has been cut, but this might be explained by the payments being a bit high previously. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. We would probably look elsewhere for an income investment.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. To that end, Camping World Holdings has 4 warning signs (and 1 which doesn't sit too well with us) we think you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CWH

Camping World Holdings

Together its subsidiaries, retails recreational vehicles (RVs), and related products and services in the United States.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives