- United States

- /

- Specialty Stores

- /

- NYSE:CWH

Camping World Holdings (CWH): Exploring Valuation as Investors Weigh Fundamentals and Recent Price Trends

Reviewed by Kshitija Bhandaru

See our latest analysis for Camping World Holdings.

After a period of downward momentum, Camping World Holdings' share price has settled around $16.20, while its one-year total shareholder return remains negative. The recent moves reflect a broader cooling of enthusiasm as investors weigh long-term fundamentals against emerging headwinds.

If you’re curious which stocks are catching steady interest this season, now is a good moment to expand your search and discover fast growing stocks with high insider ownership

With the share price lagging its longer-term potential and trading below analyst targets, the key question now is whether Camping World is trading at an undervalued level or if the market is already anticipating future growth.

Most Popular Narrative: 20.7% Undervalued

Camping World Holdings’ most widely-followed narrative points to meaningful upside from its recent closing price, with a fair value calculation that notably tops current market levels. The gap between what the narrative suggests as fair value and where shares currently trade invites a deeper look at the growth story playing out beneath the surface.

Camping World's focus on offering affordable entry-level RVs with compelling features is attracting first-time buyers and accelerating the trade-in cycle, enabling more frequent repeat purchases and upselling across higher-margin goods and services. This is expected to support both ongoing revenue growth and margin improvement as customer LTV rises.

Curious how this fair value estimate stacks up? The most popular narrative hints at a surge in long-term earnings power and margin expansion, based on customer shifts and a changing RV market. Find out which bold forecasts drive the undervaluation thesis and why analysts believe a re-rating could be on deck.

Result: Fair Value of $20.42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as weaker demand from younger buyers or excess used inventory could challenge Camping World's growth outlook and potentially undermine bullish forecasts.

Find out about the key risks to this Camping World Holdings narrative.

Another View: What Do Sales Ratios Say?

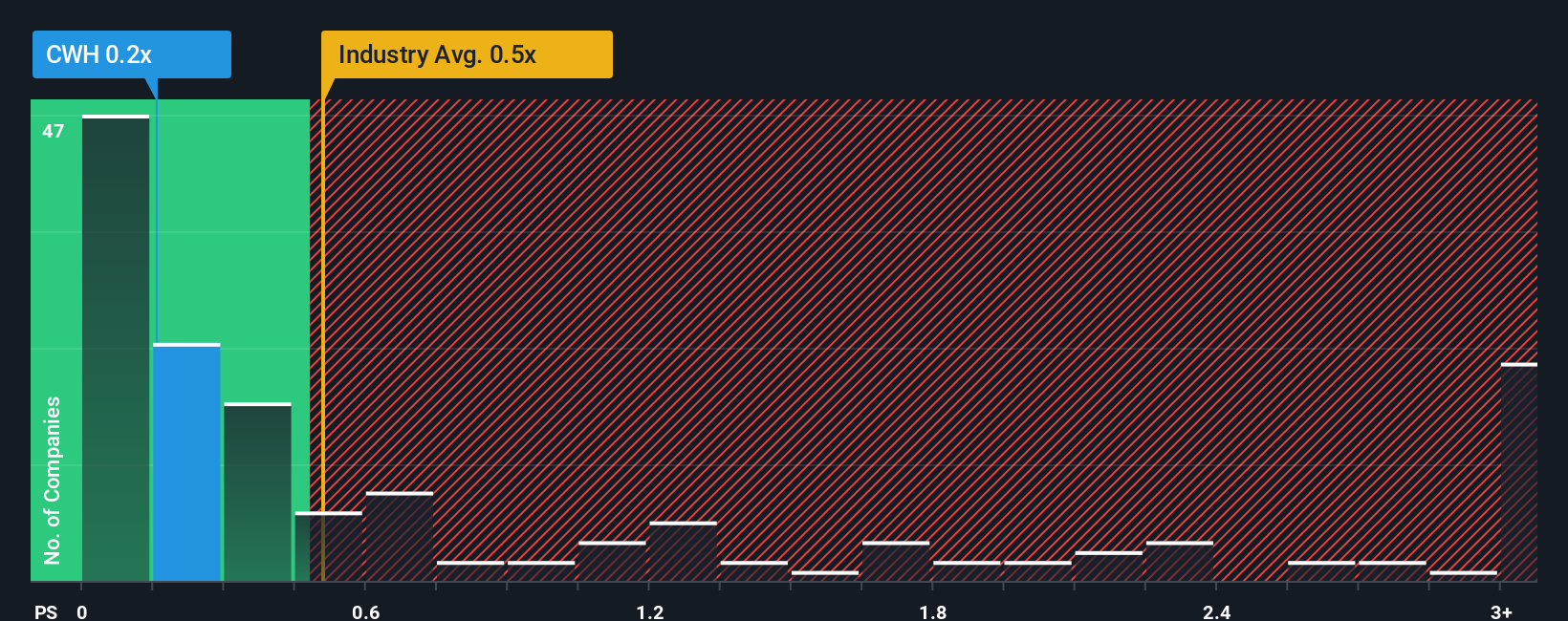

Taking a step back from the analyst-driven fair value, the company’s price-to-sales ratio is just 0.2x, far lower than both its peers (0.8x) and the broader US Specialty Retail industry (0.5x). The fair ratio for Camping World is estimated at 0.4x. This suggests the market currently values its sales very cheaply. Is this a signal of opportunity or a warning about possible challenges ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Camping World Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Camping World Holdings Narrative

If you think the story could be different or you want a firsthand look at the numbers, crafting your own narrative takes just a few minutes: Do it your way

A great starting point for your Camping World Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Limited opportunities can slip past if you don’t look beyond the obvious. Open new possibilities and get ahead by screening the markets for standout stocks right now.

- Unlock powerful passive income streams by reviewing these 19 dividend stocks with yields > 3% offering yields above 3%, which can help boost your portfolio’s stability and returns.

- Catch the momentum in the digital economy and scan through these 23 AI penny stocks that are making waves in artificial intelligence and transforming entire industries with their innovations.

- Tap into value by seeking out these 914 undervalued stocks based on cash flows that are trading below their intrinsic worth, providing you with an edge as the market catches up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CWH

Camping World Holdings

Together its subsidiaries, retails recreational vehicles (RVs), and related products and services in the United States.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives