- United States

- /

- Specialty Stores

- /

- NYSE:CWH

Assessing Camping World Holdings (CWH) Valuation as Shares Lose Momentum in a Challenging Retail Market

Reviewed by Simply Wall St

See our latest analysis for Camping World Holdings.

Over the past year, Camping World Holdings’ share price return has tumbled, with total shareholder return down more than 50% and the stock losing momentum in recent months. Short-term rallies have given way to steeper declines, suggesting investors are growing more cautious amid industry headwinds and shifting consumer demand.

If you’re thinking about broadening your investment approach in a tough retail market, now is the perfect time to check out fast growing stocks with high insider ownership.

With a steep drop in shares but a notable discount to analyst price targets, the question facing investors is whether market pessimism has gone too far or if all future risks are already factored in. Could Camping World be a value buy, or is the market correctly anticipating challenges ahead?

Most Popular Narrative: 35.6% Undervalued

Camping World Holdings' most popular narrative signals significant upside, with the latest fair value estimate ($17.58) notably higher than the current market price of $11.33. This comparison is drawing attention as investors re-examine which trends might spark a turnaround.

The growing trend of remote work and flexible living is expanding the pool of potential RV customers. This is likely to drive ongoing increases in unit volumes, new customer acquisitions, and broader adoption of Camping World's products and membership ecosystem. These factors support top-line revenue growth and recurring earnings through lifetime customer value.

What explains this optimistic valuation? At the core of the narrative is a positive outlook for both sales and margins, with expectations for a notable rebound in future profits. Interested in the factors motivating analysts to look past recent losses and forecast improved profitability? Discover the bold assumptions that underpin this fair value estimate.

Result: Fair Value of $17.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing inventory challenges and shifting consumer trends could undermine Camping World’s recovery story. These factors may make sustained growth harder to achieve.

Find out about the key risks to this Camping World Holdings narrative.

Another View: What Does the SWS DCF Model Say?

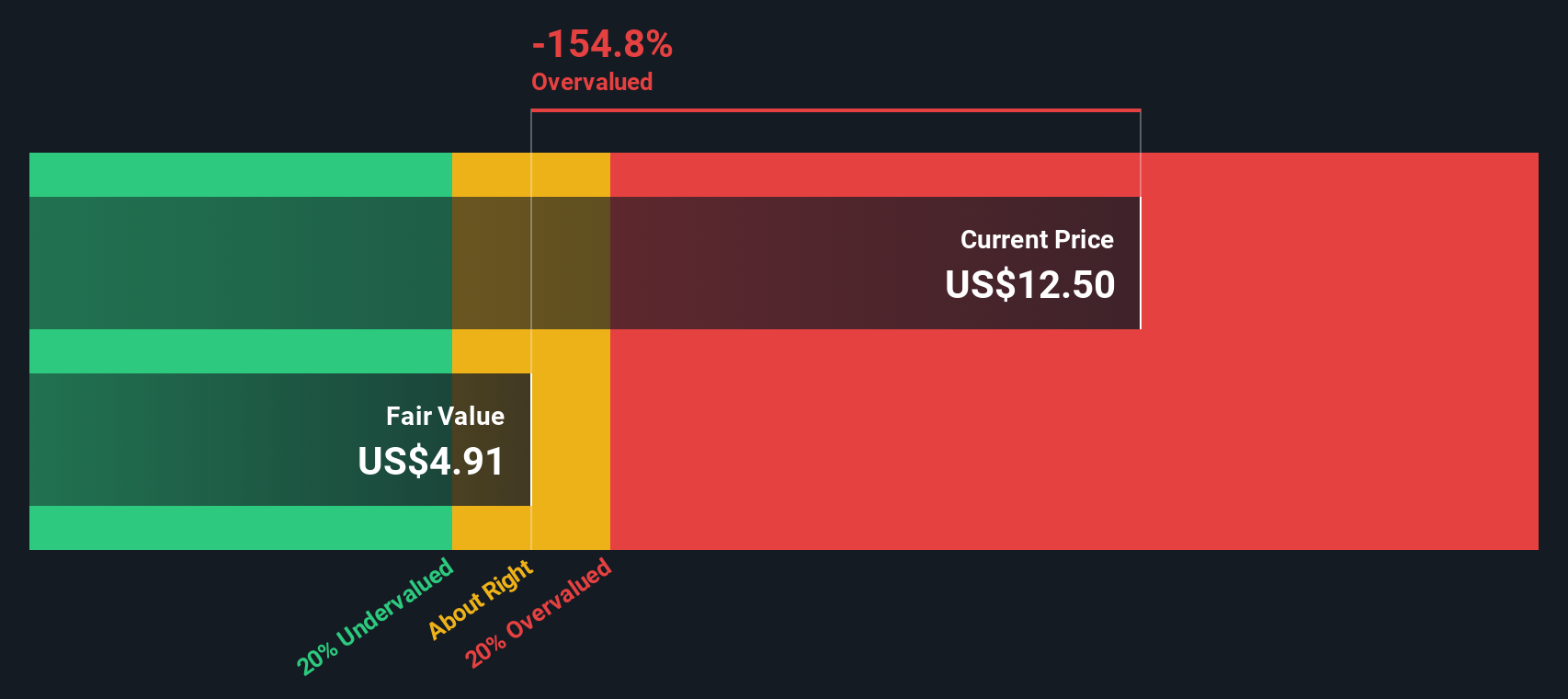

The SWS DCF model tells a different story, calculating a fair value of $3.85 per share for Camping World, which is well below the current market price. This suggests the market might be too optimistic about the company’s turnaround potential. Can analyst optimism hold up under this more conservative lens?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Camping World Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 923 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Camping World Holdings Narrative

If you have a different perspective or want to explore the underlying numbers firsthand, it takes just a few minutes to craft your own view. Do it your way.

A great starting point for your Camping World Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know opportunities do not end with one stock. Get ahead of the curve by tapping into powerful market themes and uncovering fresh growth trends before everyone else.

- Capitalize on tomorrow’s disruptors by zeroing in on these 25 AI penny stocks that are pioneering advancements in artificial intelligence.

- Unlock hidden value by targeting these 923 undervalued stocks based on cash flows primed for a rebound, offering potential upside missed by the crowd.

- Boost your income stream by searching for these 15 dividend stocks with yields > 3% offering attractive yields alongside solid financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CWH

Camping World Holdings

Together its subsidiaries, retails recreational vehicles (RVs), and related products and services in the United States.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.