- United States

- /

- Specialty Stores

- /

- NYSE:CVNA

Is Carvana's (CVNA) Push for Same-Day Delivery Shifting Its Tech-Led Efficiency Narrative?

Reviewed by Sasha Jovanovic

- Carvana recently participated in Wells Fargo's 9th Annual TMT Summit, where CEO Ernest Garcia highlighted operational efficiency improvements and the expansion of same-day delivery services driven by technology and staffing advances.

- Analyst updates and third-party observations suggest these productivity enhancements are viewed as key contributors to Carvana's market positioning and future prospects.

- We'll examine how Carvana's expanded same-day delivery capabilities influence its investment narrative focused on technology-led efficiency and growth.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

Carvana Investment Narrative Recap

To be a shareholder in Carvana, you need to believe that its technology-driven approach can deliver continual operational efficiency and scale, outpacing risks around profitability and execution. The recent focus on same-day delivery and operational gains reinforces optimism in technology-led efficiency, but does not fundamentally change the biggest near-term risk: whether management can minimize cost pressures and margin compression as ambitions for rapid growth meet the realities of scaling logistics and reconditioning.

Among recent announcements, the expansion of same-day vehicle delivery in key cities like San Diego and San Francisco stands out. This move is relevant as it highlights Carvana's push to translate technology investments and staffing into tangible improvements for customers, a core catalyst for improving utilization and margin gains if executed effectively.

However, while the company has made visible progress in operational enhancements, investors should not lose sight of the ongoing risk of operational bottlenecks, especially if recent growth outpaces...

Read the full narrative on Carvana (it's free!)

Carvana's narrative projects $33.2 billion in revenue and $2.2 billion in earnings by 2028. This requires a 26.8% annual revenue growth rate and an earnings increase of $1.6 billion from the current earnings of $563.0 million.

Uncover how Carvana's forecasts yield a $419.67 fair value, a 27% upside to its current price.

Exploring Other Perspectives

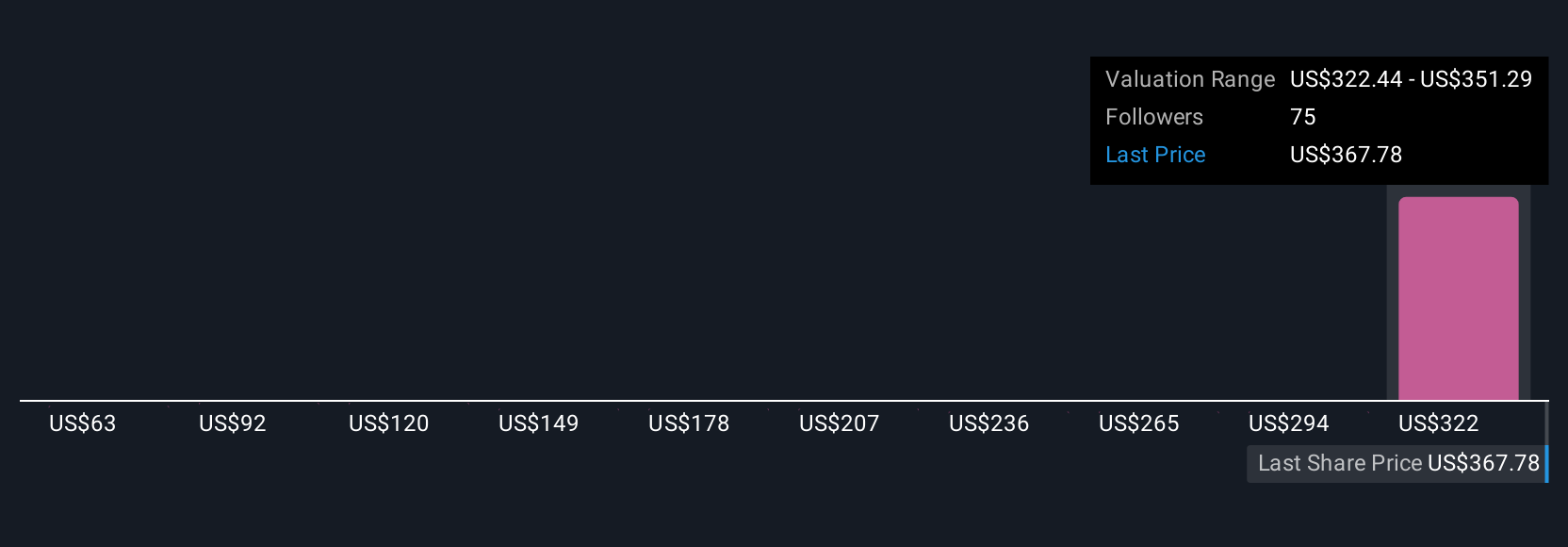

Seventeen community fair value estimates for Carvana span from US$62.76 to US$500, reflecting sharply differing outlooks on the stock’s worth. Even as some expect technology and logistics gains to drive growth, your view on the most significant operational risks may shape your stance, see how varied your peers can be.

Explore 17 other fair value estimates on Carvana - why the stock might be worth as much as 52% more than the current price!

Build Your Own Carvana Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carvana research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Carvana research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carvana's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CVNA

Carvana

Operates an e-commerce platform for buying and selling used cars in the United States.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives