- United States

- /

- Specialty Stores

- /

- NYSE:CVNA

Carvana (CVNA) Is Down 12.7% After Record Q3 Revenue and Unit Sales Surge - What's Changed

Reviewed by Sasha Jovanovic

- Carvana reported record third-quarter results in October 2025, including US$5.65 billion in revenue and 155,941 retail units sold, marking a very large year-over-year increase in both metrics.

- Alongside this operational momentum, Carvana continued expanding its same-day delivery offering and forged new finance partnerships, accelerating its digital-first strategy and market reach.

- We'll explore how Carvana's rapid delivery expansion and strong Q3 results could influence its future investment outlook and growth profile.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Carvana Investment Narrative Recap

To believe in Carvana as a shareholder, you need confidence in its ability to scale online used car sales rapidly and profitably while managing the operational and financial risks tied to growth and expansion. The latest record Q3 results, with US$5.65 billion in revenue and a substantial leap in retail units sold, reinforce optimism around Carvana's near-term growth catalysts, though the market reaction shows margin pressure remains the prominent short-term risk and the news doesn’t meaningfully shift this focus.

Among recent company moves, the expansion of same-day delivery to new metro areas stands out as most relevant to current results, as it directly enhances Carvana’s e-commerce proposition and supports its strategy to increase conversion and market share. With deployments in large cities like San Diego and San Francisco, Carvana is working to turn digital traffic into actual sales, a key driver for its ambitious growth outlook and a central focus after strong quarterly numbers.

Yet, in contrast to the upbeat sales story, investors should remain alert to the risk of margin compression if operational scaling runs into...

Read the full narrative on Carvana (it's free!)

Carvana's narrative projects $33.2 billion revenue and $2.2 billion earnings by 2028. This requires 26.8% yearly revenue growth and a $1.6 billion earnings increase from $563.0 million.

Uncover how Carvana's forecasts yield a $423.90 fair value, a 38% upside to its current price.

Exploring Other Perspectives

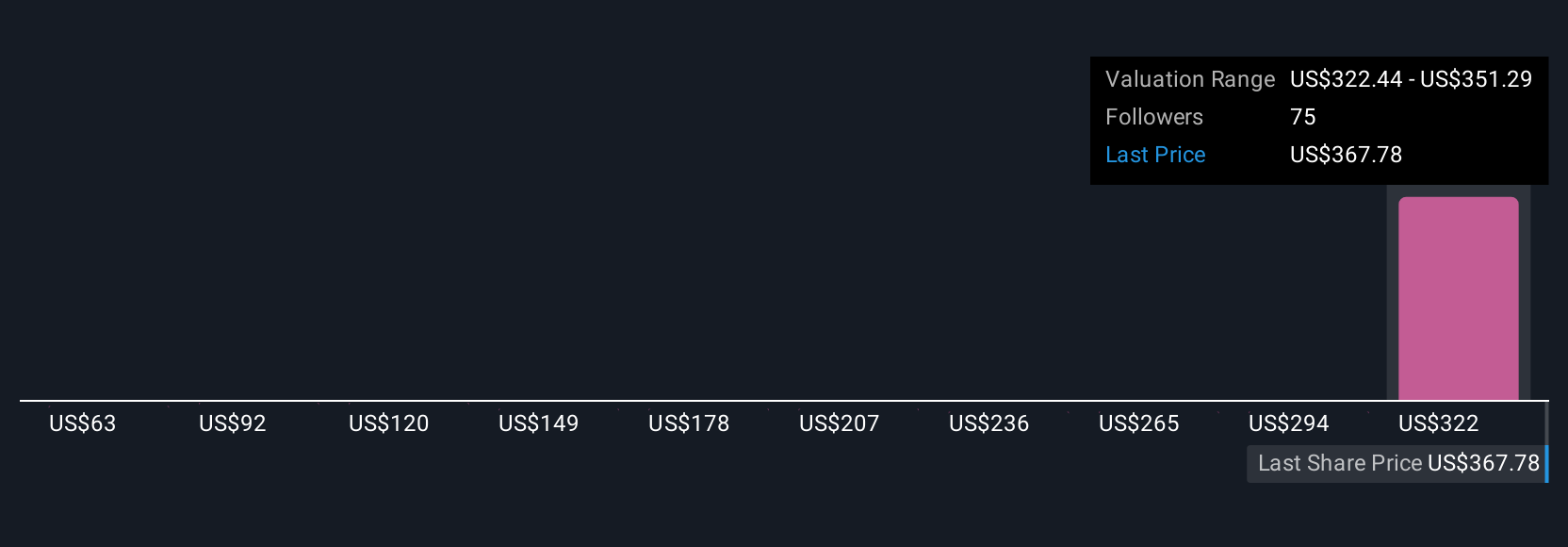

Seventeen recent fair value estimates from the Simply Wall St Community range widely from US$62.76 to US$500 per share. While investors hold very different views, many are watching the critical risk of operational bottlenecks and potential cost overruns as Carvana pursues aggressive unit growth.

Explore 17 other fair value estimates on Carvana - why the stock might be worth as much as 63% more than the current price!

Build Your Own Carvana Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carvana research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Carvana research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carvana's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CVNA

Carvana

Operates an e-commerce platform for buying and selling used cars in the United States.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives