- United States

- /

- Specialty Stores

- /

- NYSE:CVNA

Carvana (CVNA): Analyst Praise and Strong Growth Prompt Fresh Look at Valuation

Reviewed by Simply Wall St

Carvana stock saw renewed momentum after several analysts reaffirmed their positive outlook on the company. The latest analyst updates follow a quarter marked by strong growth in retail unit sales and improvement in operational efficiency, including expanded same-day delivery. Investors are now watching closely to see how these factors shape Carvana’s growth trajectory over the coming months.

See our latest analysis for Carvana.

Carvana's share price has shown tremendous strength this year, surging 56.97% year-to-date. However, short-term volatility has caused the last month’s share price return to dip by 11.98%. Those swings have not stopped the company from posting an impressive 26.12% total shareholder return over the past year. Momentum has broadly built on operational improvements and robust sales growth.

If Carvana’s run has you thinking about where the next breakout could come from, it is a great moment to broaden your search and discover fast growing stocks with high insider ownership

With so many analysts remaining bullish and operational gains continuing, investors now face a pivotal question: Is Carvana’s rapid climb still leaving room for upside, or has the market already priced in the company’s future growth potential?

Most Popular Narrative: 25.4% Undervalued

Carvana’s last close at $313.25 sits well below the fair value estimated by the most widely followed narrative, suggesting significant headroom still exists. This setup comes as analysts cluster around robust future growth and expanding profitability expectations.

Ongoing advancements in Carvana's data-driven technology, including integration of AI for operational efficiency and customer-facing processes, enable continual process improvement, reducing per-unit costs and fueling net margin expansion.

Want to peek behind the scenes of this valuation? The entire premise rests on bold, back-tested assumptions around margins, growth pace, and future profitability. There is a key financial leap at the core that could surprise even the most optimistic bulls. Uncover the specific numbers that drive this eye-catching price target.

Result: Fair Value of $419.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering risks remain, particularly around operational growing pains and the unpredictability of used vehicle pricing. These factors could pressure margins and temper optimism.

Find out about the key risks to this Carvana narrative.

Another View: Caution from Market Valuation Ratios

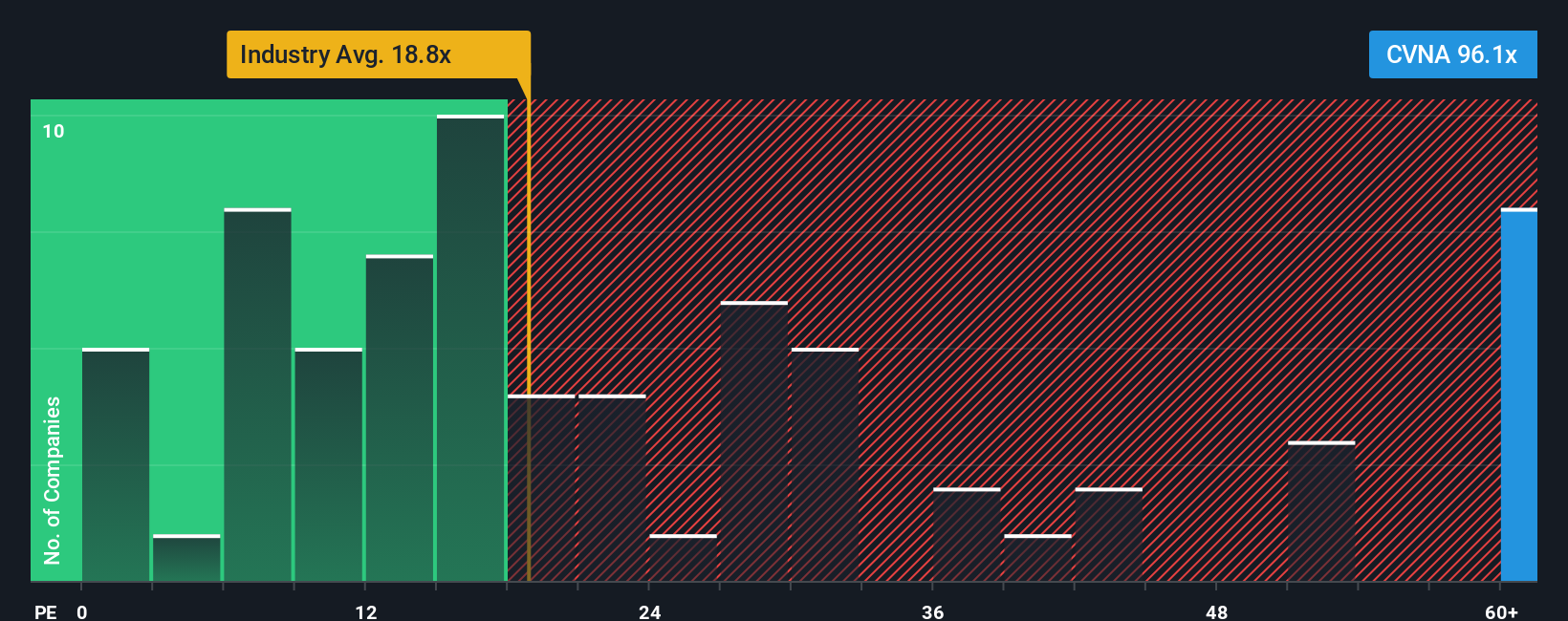

While the widely followed narrative sees significant upside, market valuation ratios tell a more guarded story. Carvana trades at a price-to-earnings ratio of 70.4 times, far above the US Specialty Retail industry’s 17.5 times and well above the fair ratio of 38. For investors, this wide gap means the market is assuming much faster future growth than its peers. This leaves little room for disappointment if growth momentum slows.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Carvana Narrative

If you see things differently or want to dig into the numbers on your own terms, the data is all there. Creating your own take is quick and easy. Do it your way

A great starting point for your Carvana research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Put your money to work by getting ahead of the next big trend. The right tools help you zero in on opportunities others might overlook, so don’t let them pass you by.

- Unlock higher income with reliable picks by checking out these 16 dividend stocks with yields > 3%, which features stocks that consistently deliver strong yields above 3%.

- Stay at the forefront of innovation in healthcare and tech advancements with these 30 healthcare AI stocks, where you'll find leaders transforming patient care using artificial intelligence.

- Position yourself for explosive growth by targeting these 3612 penny stocks with strong financials, which boasts solid fundamentals and the potential for outsized returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CVNA

Carvana

Operates an e-commerce platform for buying and selling used cars in the United States.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives