Does Coupang's International Expansion Signal a Buying Opportunity in 2025?

Reviewed by Bailey Pemberton

- Thinking about whether Coupang is a bargain or just another high-flying growth stock? Let’s dig in and see what the numbers really say about its value.

- The stock has had its moments. After surging 43.5% year-to-date and climbing 24.4% over the last year, recent weeks saw more muted movement, with a slight 0.8% bump this past week and a -1.2% dip over the last month.

- Much of this action comes in the wake of headlines about Coupang’s continued international expansion and innovative logistics partnerships, which have captured investor attention. Excitement has been building as the company secures new market entrances and signs deals that strengthen its competitive edge.

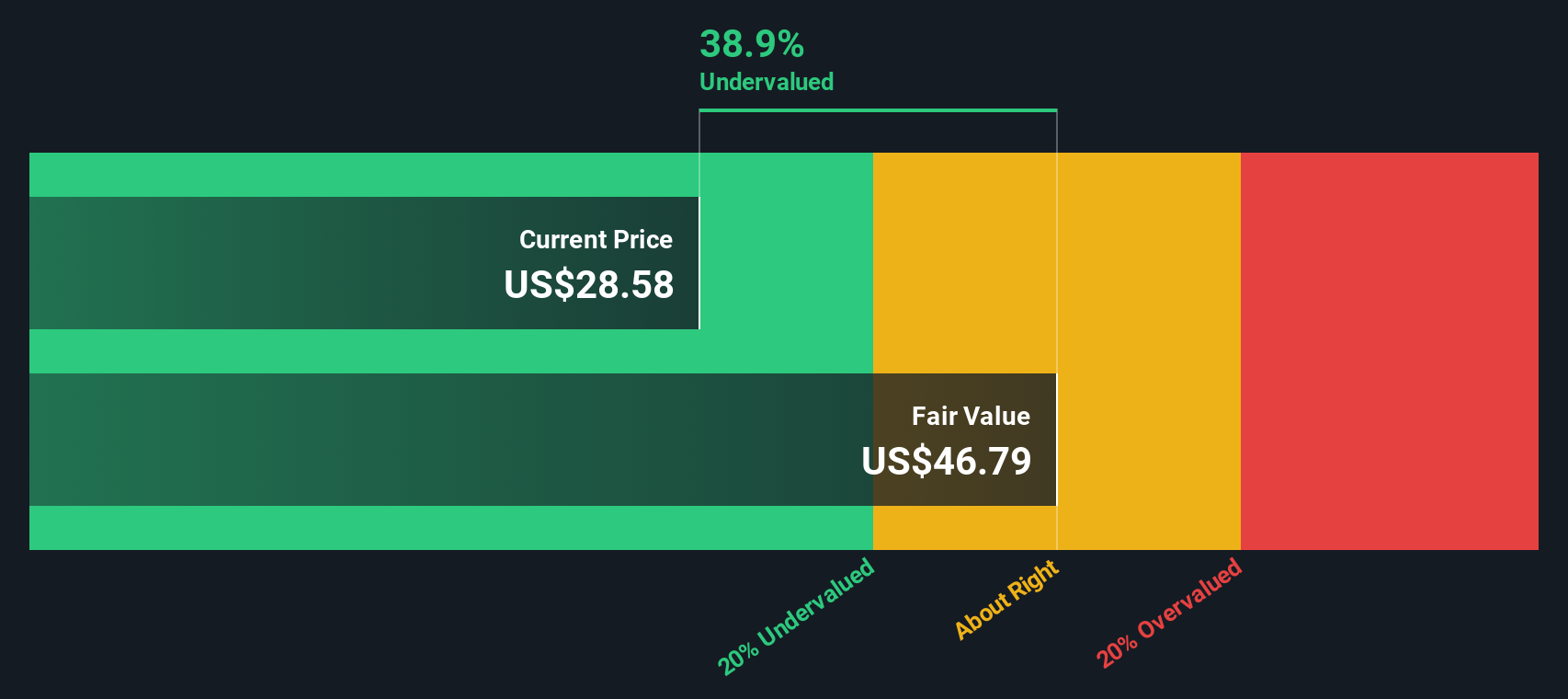

- By our count, Coupang is considered undervalued in 4 out of 6 valuation checks. See its valuation score for the full breakdown. Soon, I’ll walk you through how analysts approach valuation, but stick around for a smarter way to size up whether the stock truly offers value now.

Find out why Coupang's 24.4% return over the last year is lagging behind its peers.

Approach 1: Coupang Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a popular valuation approach that estimates a company’s worth by projecting its future cash flows and discounting them to their present value. This helps investors judge what the business is worth today based on expected future performance.

Coupang’s current Free Cash Flow sits at $833.5 Million, and analysts expect this figure to grow rapidly over the coming years. By 2027, projections indicate Free Cash Flow could reach $2.8 Billion. Long-term estimates, which extend out to 2035, are based on a blend of analyst consensus and further extrapolations. These illustrate strong upward momentum for cash generation.

Using these two stages of forecasted and extrapolated cash flows, the DCF model calculates Coupang’s estimated intrinsic value at $47.55 per share. When compared to the current market price, this implies the stock is trading about 32.7% below what the cash flow fundamentals suggest it is worth.

In short, this model flags Coupang as meaningfully undervalued based on robust cash flow growth and attractive future prospects.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Coupang is undervalued by 32.7%. Track this in your watchlist or portfolio, or discover 843 more undervalued stocks based on cash flows.

Approach 2: Coupang Price vs Sales

For companies like Coupang, which are growing quickly but may not yet deliver consistent profits, the Price-to-Sales (P/S) ratio is often the preferred valuation multiple. This metric gives investors a straightforward way to evaluate how much they are paying for every dollar of the company’s revenue. Since early-stage or rapidly expanding businesses can reinvest earnings to fuel growth, focusing on sales provides a more level playing field for comparison.

The “right” P/S ratio depends in part on how much investors expect a company’s sales to grow, how risky it is compared to others, and how healthy the overall industry is. Fast growers or companies with sturdy margins can often justify higher P/S multiples, while those with slower growth or higher uncertainty should trade lower.

Coupang currently trades at a P/S ratio of 1.81x. This is slightly above the Multiline Retail industry average of 1.48x, but well below the average for its peer group, which is 3.26x. Now, Simply Wall St’s Fair Ratio for Coupang is 2.03x. This is a custom benchmark that adjusts for factors like Coupang’s projected sales growth, its solid market position, profitability profile and relevant risks.

While many investors still default to comparing with industry or similar peers, the Fair Ratio is more dynamic because it factors in judgment around Coupang’s unique qualities, growth outlook, and specific risks. This approach aims to take the guesswork out of interpretation and deliver a more tailored valuation.

With Coupang’s P/S of 1.81x falling just under the Fair Ratio of 2.03x, the stock appears slightly undervalued based on this model.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Coupang Narrative

Earlier we mentioned there is an even better way to judge valuation, so let’s introduce you to Narratives, the most dynamic way to connect a company’s story with its numbers and investment potential.

A Narrative is more than just a take on the numbers: it’s your informed perspective about a company’s future, where you outline your projected revenue, profit margins, and fair value, all shaped by the underlying business story you believe in. This approach doesn’t just summarize a company’s results; it actively links a living story about Coupang’s growth or risks directly to a financial forecast and a fair value you can track in real time.

Narratives are designed to be easily created and accessed within the Simply Wall St platform’s Community page, making them an approachable tool used by millions to weigh buy or sell decisions. The key is comparing your Narrative’s Fair Value with today’s market price to find opportunity or caution.

Since Narratives update alongside news and earnings, your view stays current. One investor might use a bullish Narrative, projecting $46 billion in 2028 revenue for a $39 price target, while a more cautious view could see just $1.4 billion in earnings and a target of $26.20. Narratives let you invest with conviction by identifying when the story truly supports the valuation.

For Coupang, we'll make it really easy for you with previews of two leading Coupang Narratives:

- 🐂 Coupang Bull Case

Fair Value: $34.52

Currently trading at 7.3% below this narrative's fair value

Revenue Growth Forecast: 14%

- Highlights the impact of technology-led efficiency and AI, which are expected to drive margin expansion and strong long-term earnings growth for Coupang.

- Sees Coupang's expansion into new geographies and verticals, especially Taiwan and services like logistics and streaming, as major drivers to outpace traditional retail and diversify revenue streams.

- Notes key risks, including high operating expenses, persistent scaling inefficiencies in new markets, and continued market concentration in South Korea. These factors could threaten stable profitability and margin growth in the medium term.

- 🐻 Coupang Bear Case

Fair Value: $27.25

Currently trading at 17.4% above this narrative's fair value

Revenue Growth Forecast: 12.05%

- Warns that although Coupang has achieved impressive revenue growth and a dominant position in South Korea, its ongoing struggle for profitability and sensitivity to operational challenges keep it high-risk.

- Points to intensifying competition, especially from Alibaba’s venture with E-Mart and global giants like Amazon, as well as regulatory and reputational risks that could erode market share and compress margins.

- Notes that while long-term growth potential exists through logistics innovation and international expansion, persistent losses and risks from expansion, competition, and legal challenges make continued volatility likely.

Do you think there's more to the story for Coupang? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPNG

Coupang

Owns and operates retail business through its mobile applications and internet websites in South Korea and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives