- United States

- /

- Specialty Stores

- /

- NYSE:CHWY

Chewy (CHWY): Assessing Valuation After Recent Share Price Volatility

Reviewed by Simply Wall St

See our latest analysis for Chewy.

Chewy’s share price has seen some short-term turbulence, slipping by 4.9% over the past week and down 5.3% for the last month. Curiosity from investors is rising thanks to its solid annual revenue growth and a robust 1-year total shareholder return of 33.7%. Even though the 3- and 5-year total returns remain in the red, recent momentum suggests sentiment could be shifting as the latest results get digested.

If renewed optimism in Chewy’s story has you scanning for other opportunities, now is a great time to broaden your search and discover fast growing stocks with high insider ownership.

But with Chewy trading at a nearly 40% discount to its estimated intrinsic value and still below analyst price targets, investors may wonder if there is a genuine buying opportunity here or if the market has already priced in the company’s future growth.

Most Popular Narrative: 20.3% Undervalued

Chewy’s most widely-followed narrative estimates the shares are trading well below fair value, with the last close of $36.23 versus a fair value of $45.45. This gap is attracting attention as investors look for the factors supporting this bullish outlook.

Chewy's strategic expansions, such as opening new Chewy Vet Care Clinics, are expected to further penetrate the $25 billion vet services market. This is likely to increase revenue and active customer engagement in 2025 and beyond. The migration to a 1P ad platform allows for enhanced advertising capabilities, including off-site ads and new content formats like video, which could grow the sponsored ads business up to 3% of total enterprise net sales. This may positively impact gross margins.

Curious how this narrative arrives at its bullish stance? The pivotal assumptions driving this fair value involve ambitious revenue growth forecasts and a future profit multiple that commands a premium in the retail sector. Want the specifics fueling these bold projections? Delve into the details to uncover what justifies such optimism.

Result: Fair Value of $45.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing dependence on Autoship subscriptions and modest customer growth could threaten Chewy's revenue stability, which may challenge expectations for long-term expansion.

Find out about the key risks to this Chewy narrative.

Another View: Is Chewy Actually Expensive?

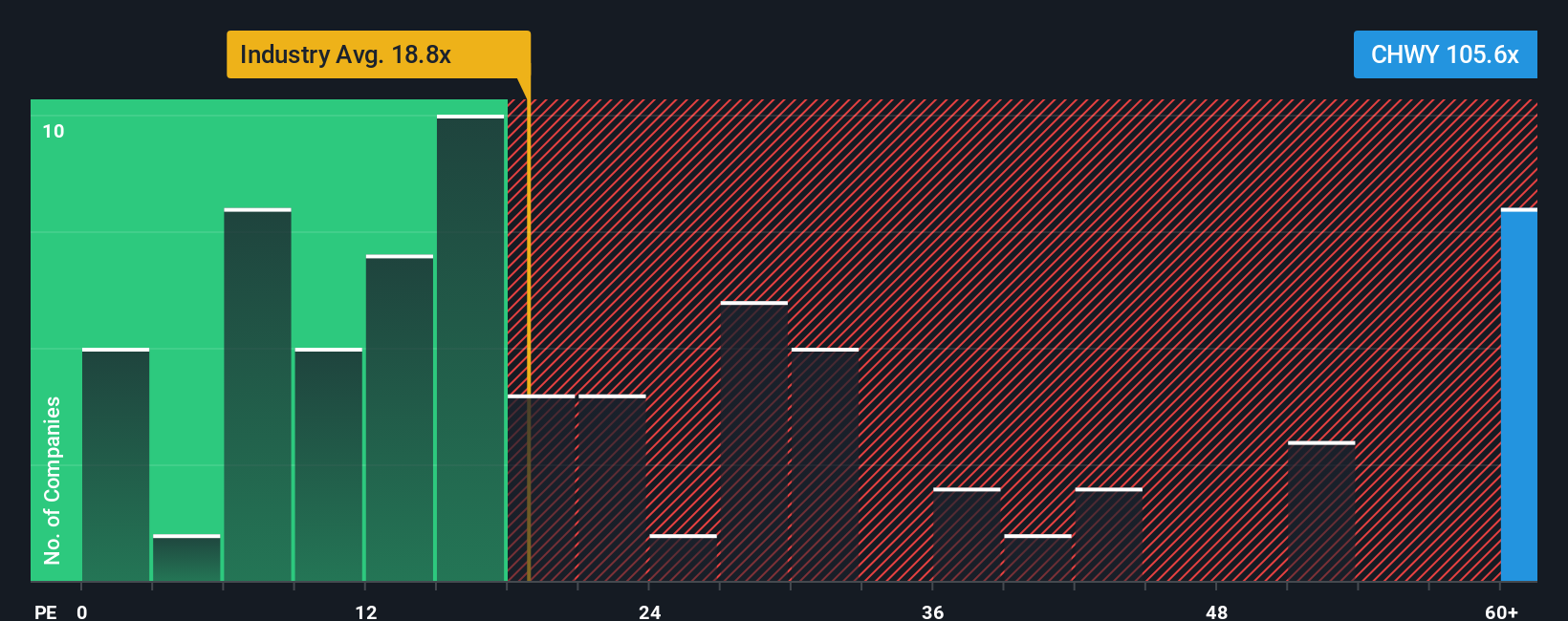

While the fair value narrative points to Chewy’s shares being undervalued, a look at the widely used price-to-earnings ratio paints a strikingly different picture. Chewy trades at 99.4 times earnings, far higher than the US Specialty Retail industry average of 16.5 and its peer group’s 23.6. Even compared to the market’s fair ratio of 29, Chewy’s multiple stands out.

This kind of premium suggests investors are baking in high expectations for future growth, but it also increases the risk if Chewy does not deliver. Does the market’s optimism have substance, or is caution the wiser stance?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Chewy Narrative

If you want to dig deeper or have your own take on Chewy’s outlook, you can build your own view using the same data and insights in just a few minutes. Do it your way.

A great starting point for your Chewy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Unlock even more opportunities and don’t let your portfolio miss out on stocks tapping into breakout industries and under-the-radar winners with strong fundamentals. Use the Simply Wall Street Screener to give yourself an investing edge.

- Capture potential with these 875 undervalued stocks based on cash flows, revealing which companies are currently trading below their intrinsic value.

- Secure steady income by checking out these 17 dividend stocks with yields > 3%, offering yields above 3% and robust financial health.

- Lead the way in technology with these 27 AI penny stocks, highlighting businesses using artificial intelligence to fuel long-term growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CHWY

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives