- United States

- /

- Specialty Stores

- /

- NYSE:CAL

Earnings Working Against Caleres, Inc.'s (NYSE:CAL) Share Price Following 25% Dive

The Caleres, Inc. (NYSE:CAL) share price has fared very poorly over the last month, falling by a substantial 25%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 23% in that time.

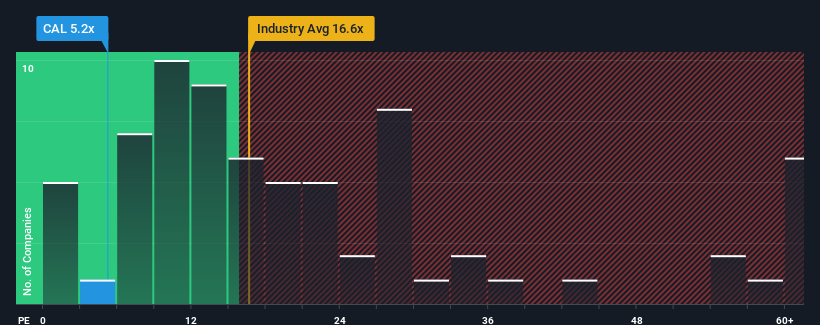

Even after such a large drop in price, Caleres' price-to-earnings (or "P/E") ratio of 5.2x might still make it look like a strong buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 19x and even P/E's above 34x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent earnings growth for Caleres has been in line with the market. One possibility is that the P/E is low because investors think this modest earnings performance may begin to slide. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

Check out our latest analysis for Caleres

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Caleres' to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. However, a few strong years before that means that it was still able to grow EPS by an impressive 640% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 4.1% per year as estimated by the four analysts watching the company. With the market predicted to deliver 11% growth per annum, that's a disappointing outcome.

With this information, we are not surprised that Caleres is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

Caleres' P/E looks about as weak as its stock price lately. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Caleres' analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Having said that, be aware Caleres is showing 1 warning sign in our investment analysis, you should know about.

If you're unsure about the strength of Caleres' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CAL

Caleres

Engages in the designs, develops, sources, manufactures, and distributes footwear in the United States, Canada, East Asia, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives