- United States

- /

- Specialty Stores

- /

- NYSE:BURL

Burlington Stores (BURL): Evaluating Valuation as Analyst Optimism Rises on Operational Improvements and Growth Strategy

Reviewed by Kshitija Bhandaru

Recent analyst coverage is shining a light on Burlington Stores (BURL) as the company steps up its off-price retail approach. By improving product offerings, modernizing stores, and streamlining operations, Burlington is catching the eye of investors looking for sustained growth.

See our latest analysis for Burlington Stores.

Burlington Stores’ share price has seen some positive moves recently, climbing nearly 8% over the past week amid renewed interest in its off-price strategy and substantial store expansion plans. Although the year-to-date share price return remains slightly negative, investors have been rewarded with a strong 1-year total shareholder return of 6.5% and an exceptional 130% total return over three years. This momentum highlights the progress the company has made as it reshapes its operations for sustained growth and value creation.

If Burlington’s turnaround story piques your interest, this could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With Burlington trading below analyst targets amid its ongoing transformation, investors must now ask whether the recent upside is a sign there is more value ahead, or if the market is already factoring in the company’s next phase of growth.

Most Popular Narrative: 22% Undervalued

Burlington Stores' last close at $274.54 sits well below the narrative's estimated fair value of $351.75. This sets the stage for a deeper look at why analysts believe the company is poised for a re-rating.

Analysts pointed to potential for margin expansion and long-term comp growth, citing strong execution, flexible inventory management, and ongoing strategic investments.

Curious about the bold quantitative leaps powering this valuation? There is a big bet on expanding profitability, sharper merchandising, and ambitious financial projections that could surprise even the savviest investor. Want the details behind the surging fair value? The numbers behind this outlook might change how you see Burlington's next chapter.

Result: Fair Value of $351.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as prolonged tariff pressures and slower consumer traffic could threaten Burlington’s momentum and challenge the bullish case outlined by analysts.

Find out about the key risks to this Burlington Stores narrative.

Another View: Multiples Tell a Different Story

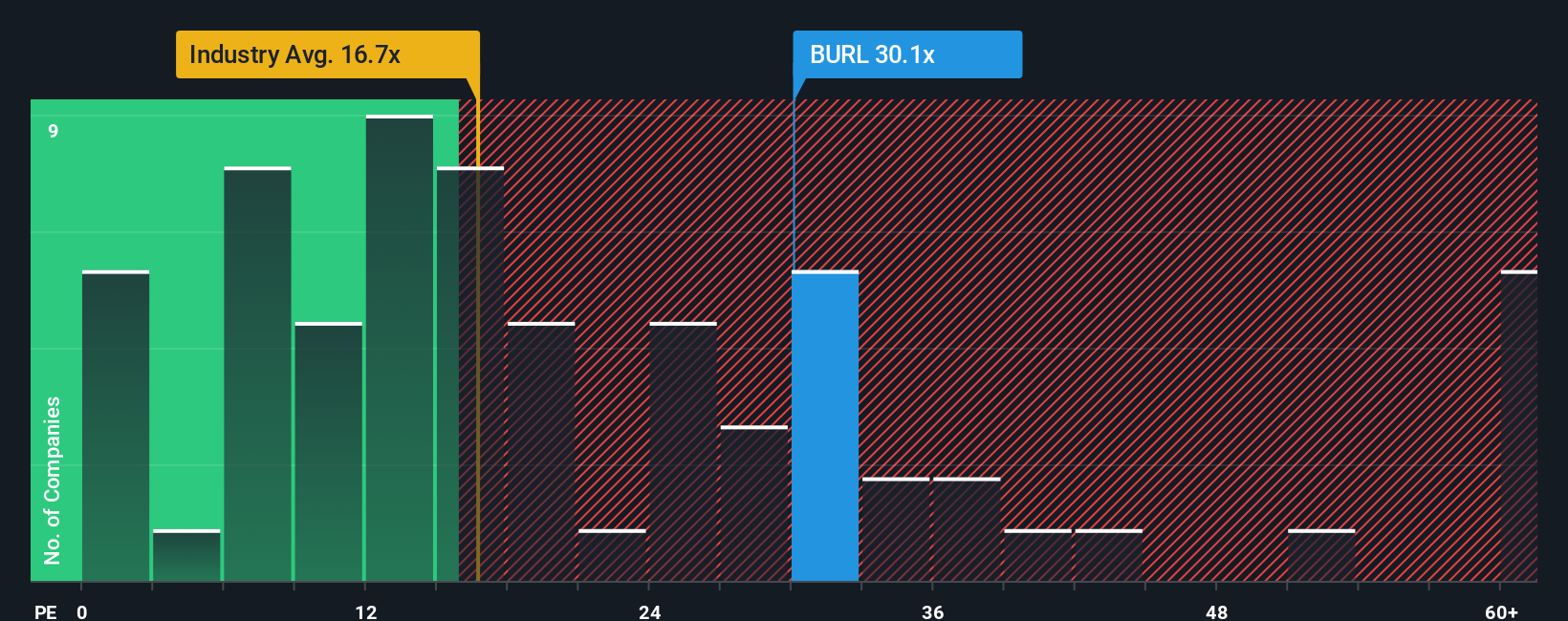

While analysts see upside, Burlington Stores trades at 31.3 times earnings, which is nearly double the industry average of 16.1 times and above the peer average of 18.8 times. Even compared to its fair ratio of just 24 times, this premium raises the bar for future growth and leaves less room for error if results disappoint. Is the market betting too much on a flawless execution?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Burlington Stores Narrative

If you want to dig into Burlington Stores' numbers and craft your own perspective, why not see where your insights lead? After all, building a personalized view takes just a few minutes. Do it your way

A great starting point for your Burlington Stores research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't put your portfolio on hold when new opportunities are just a click away. Upgrade your strategy with proven screens and stay ahead of the market’s next move.

- Start earning more with income-focused picks by checking out these 18 dividend stocks with yields > 3%, which features stocks boasting yields above 3% and reliable fundamentals.

- Capitalize on emerging technology trends by reviewing these 24 AI penny stocks, where you’ll find businesses innovating with artificial intelligence at their core.

- Amplify your investment returns by targeting undervalued opportunities that experts are watching, all included in these 878 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Burlington Stores might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BURL

Burlington Stores

Operates as a retailer of branded merchandise in the United States and Puerto Rico.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives