- United States

- /

- Specialty Stores

- /

- NYSE:BKE

Is It Too Late To Consider Buckle After A 200% Five Year Share Price Surge?

Reviewed by Bailey Pemberton

- If you are wondering whether Buckle is still a smart buy after that long run up, or if you are showing up late to the party, this breakdown will give you a clear, valuation‑first view of where the stock stands today.

- With the share price at $57.41, Buckle has climbed 0.2% over the last week, 4.1% over the last month, 12.3% year to date and 15.7% over the past year, while longer term holders are sitting on gains of 64.2% over 3 years and 203.5% over 5 years.

- Recent market attention on the resilience of US apparel retailers, ongoing debates about discretionary spending in a higher rate environment and Buckle's positioning in casual fashion has helped frame these moves as more than just a short term bounce. Investors are increasingly weighing whether its loyal customer base and disciplined merchandising can keep driving cash flows even if consumer sentiment cools.

- Right now Buckle scores a solid 4 out of 6 on our valuation checks, suggesting the market may still be underpricing parts of its story. Next we walk through the main valuation lenses before exploring an additional way to think about what the stock might be worth over time.

Approach 1: Buckle Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a company is worth by projecting the cash it can generate in the future and discounting those cash flows back to today. For Buckle, the model uses a 2 Stage Free Cash Flow to Equity approach built on cash flow projections.

Buckle currently generates about $214.7 million in free cash flow, and Simply Wall St extrapolates modest growth from there based on analyst inputs and historical trends. Under this framework, free cash flow is expected to rise to roughly $318.0 million by 2035, with intermediate annual increases in the low to mid single digits. These projections are all in $ and cover ten years, with later years increasingly driven by extrapolation rather than direct analyst estimates.

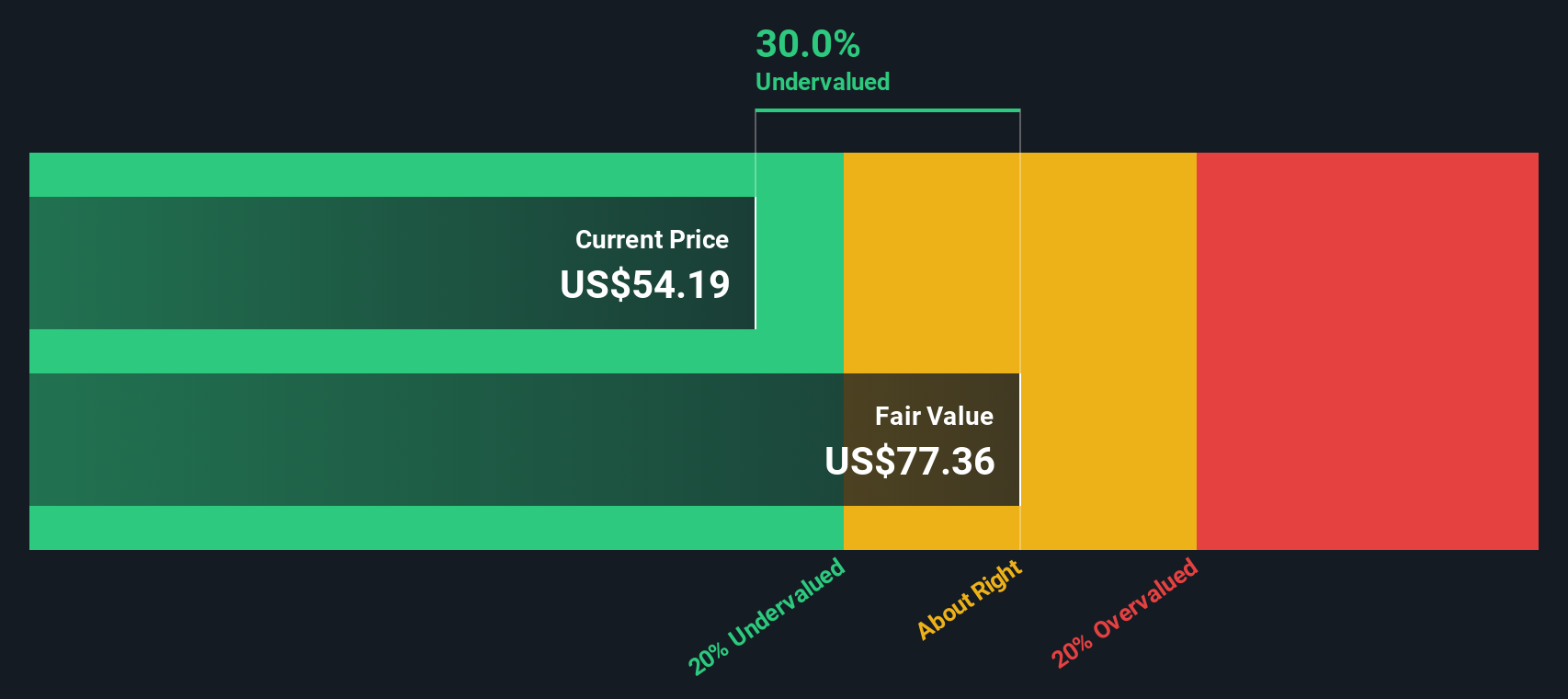

When all projected cash flows are discounted back and combined with a terminal value, the model arrives at an intrinsic value of about $88.00 per share. Compared with the current price near $57.41, Buckle appears roughly 34.8% undervalued on this DCF view, suggesting a meaningful margin of safety for long term investors within the assumptions of the model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Buckle is undervalued by 34.8%. Track this in your watchlist or portfolio, or discover 908 more undervalued stocks based on cash flows.

Approach 2: Buckle Price vs Earnings

For profitable, established companies like Buckle, the price to earnings, or PE, ratio is a straightforward way to gauge how much investors are paying for each dollar of current earnings. In general, businesses with stronger growth prospects and lower perceived risk tend to justify a higher PE, while slower growth or higher uncertainty usually call for a lower, more conservative multiple.

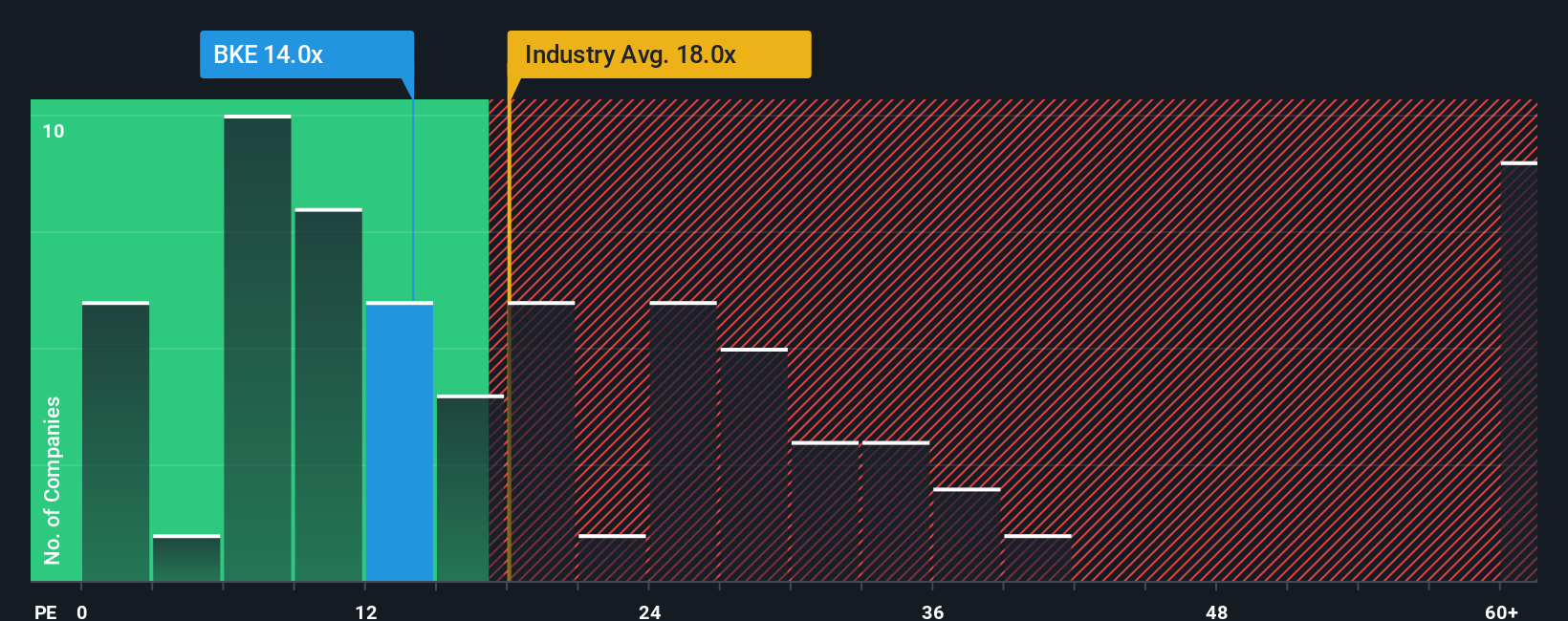

Buckle currently trades on a PE of about 13.98x, which sits below both the Specialty Retail industry average of roughly 18.46x and the broader peer group average of 21.27x. To move beyond simple comparisons, Simply Wall St also calculates a Fair Ratio of 12.99x, which estimates the PE Buckle should trade on given its specific mix of earnings growth, profitability, industry dynamics, size and risk profile. Because this Fair Ratio incorporates company level factors rather than just broad sector norms, it can be a more tailored benchmark than looking at peers or the industry alone.

Comparing Buckle's actual PE of 13.98x with the Fair Ratio of 12.99x suggests the shares trade modestly above that modelled fair level, pointing to a slightly rich valuation on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

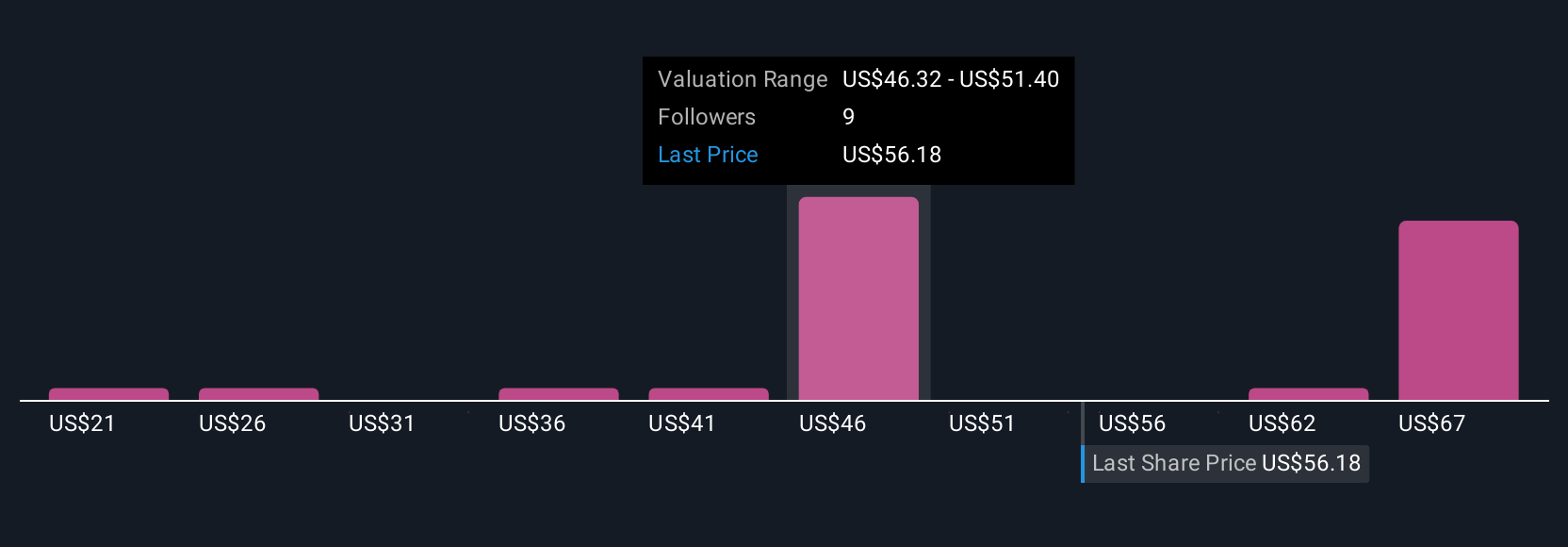

Upgrade Your Decision Making: Choose your Buckle Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to turn your view of Buckle into a clear story that links its business, a financial forecast, and a fair value. On Simply Wall St, Narratives live inside the Community page and let you spell out what you expect for Buckle's future revenue, earnings, and margins, then translate that into an estimated fair value you can compare with today’s share price to inform a buy, hold, or sell decision. Because Narratives update dynamically as new information like earnings reports or news is released, your story and its fair value stay current without you having to rebuild the whole model every time something changes. For example, one Buckle Narrative might assume 4 percent annual revenue growth, steady 16 percent margins, and a fair value close to the analysts' 54 dollars, while a more optimistic Narrative could lean on stronger digital momentum, better store productivity, and a higher future PE multiple to justify a fair value meaningfully above that level.

Do you think there's more to the story for Buckle? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Buckle might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BKE

Buckle

Operates as a retailer of casual apparel, footwear, and accessories for men, women, and kids under the Buckle and Buckle Youth brands in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026