- United States

- /

- Specialty Stores

- /

- NYSE:BKE

How Buckle’s (BKE) Strong Comparable Sales Growth Could Reshape Analyst Expectations

Reviewed by Sasha Jovanovic

- The Buckle, Inc. recently reported that for the 5-week period ended October 4, 2025, comparable store net sales increased by 6.9% and total net sales rose to US$108.4 million, marking a 7.8% year-over-year increase.

- Year-to-date figures show Buckle achieving a 6.5% growth in comparable store sales and a 7.3% climb in total net sales, highlighting continued retail momentum and customer demand for its apparel offerings.

- We'll explore how Buckle's strong comparable sales growth could influence its investment narrative and change analyst expectations going forward.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

Buckle Investment Narrative Recap

For someone considering Buckle as an investment, the core belief centers on sustained consumer demand for value-driven, specialty apparel and Buckle’s ability to balance profitable brick-and-mortar operations with digital growth. The recent uptick in both comparable and total net sales reinforces a key short-term catalyst, ongoing strength in physical retail sales, but has limited impact on offsetting the lingering risk posed by Buckle’s concentration in traditional mall locations, which remain exposed to softening traffic and higher costs.

Among recent developments, Buckle’s August announcement to open new stores and complete multiple remodels aligns directly with its push for improved store productivity and more desirable locations. This supports the near-term sales momentum reflected in the latest results, but also ties directly to longer-term questions about optimizing occupancy expenses and adapting to evolving retail traffic patterns.

Yet, despite these sales gains, investors should not overlook the persistent challenge of Buckle's exposure to underperforming malls, especially as ...

Read the full narrative on Buckle (it's free!)

Buckle's narrative projects $1.4 billion in revenue and $226.1 million in earnings by 2028. This requires 4.0% yearly revenue growth and an earnings increase of $24.5 million from current earnings of $201.6 million.

Uncover how Buckle's forecasts yield a $54.00 fair value, a 6% downside to its current price.

Exploring Other Perspectives

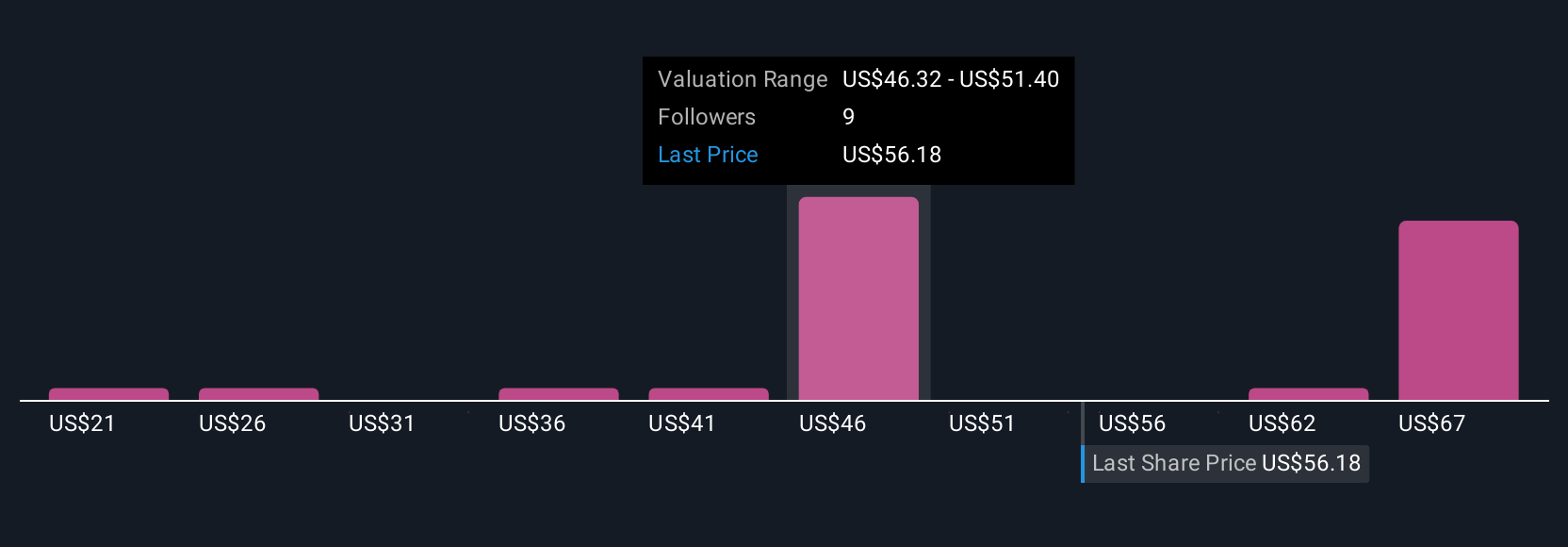

The Simply Wall St Community put forth nine fair value estimates for Buckle, ranging widely from US$20.90 to US$77.31 per share. While opinions clearly diverge, this breadth is even more relevant when considering Buckle’s ongoing reliance on brick-and-mortar formats and the pressures facing mall-based retailers, prompting you to explore a spectrum of views alongside the potential impact on long-term performance.

Explore 9 other fair value estimates on Buckle - why the stock might be worth less than half the current price!

Build Your Own Buckle Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Buckle research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Buckle research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Buckle's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Buckle might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BKE

Buckle

Operates as a retailer of casual apparel, footwear, and accessories for men, women, and kids under the Buckle and Buckle Youth brands in the United States.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives