- United States

- /

- Specialty Stores

- /

- NYSE:BBY

Best Buy (BBY): Assessing Valuation as Investor Momentum Cools

Reviewed by Kshitija Bhandaru

See our latest analysis for Best Buy.

While Best Buy’s share price dipped modestly over the past week, this fits a wider pattern as momentum has faded. Its 1-year total shareholder return is slightly negative, while longer-term gains from earlier periods haven’t held up. Investors seem cautious, watching for hints of renewed growth or improving sentiment before making their next moves.

If you’re weighing your next opportunity, why not explore what’s trending among fast-growing stocks with strong insider backing? Broaden your possibilities and discover fast growing stocks with high insider ownership

With Best Buy shares trading below analyst targets and fundamentals painting a mixed picture, the key question is whether the current price reflects opportunity for buyers or if the market has already factored in all potential upside.

Most Popular Narrative: 5.2% Undervalued

Best Buy’s most widely followed narrative pins its fair value above the last close, suggesting analysts believe there’s modest upside potential ahead from these levels. With shares lingering beneath the consensus price target, there’s renewed focus on what could drive outperformance.

"Best Buy is positioned to capitalize on the coming upgrade cycle in computing, driven by both the expiration of Windows 10 support in October and surging AI hardware innovation. This is expected to drive significant replacement demand, supporting top-line revenue growth and potentially higher-margin service attach rates."

Want to know what’s powering this valuation? The secret ingredients are surprising assumptions about future revenue, margins, and just how much the profit multiple could shrink. See what numbers turn a familiar retailer into a potential dark horse for growth. Dive in and uncover what’s behind the curtain.

Result: Fair Value of $79.76 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent online competition and rising labor costs could dampen Best Buy’s margin gains. This may threaten the path to stable long-term earnings growth.

Find out about the key risks to this Best Buy narrative.

Another View: Is the Market Telling a Different Story?

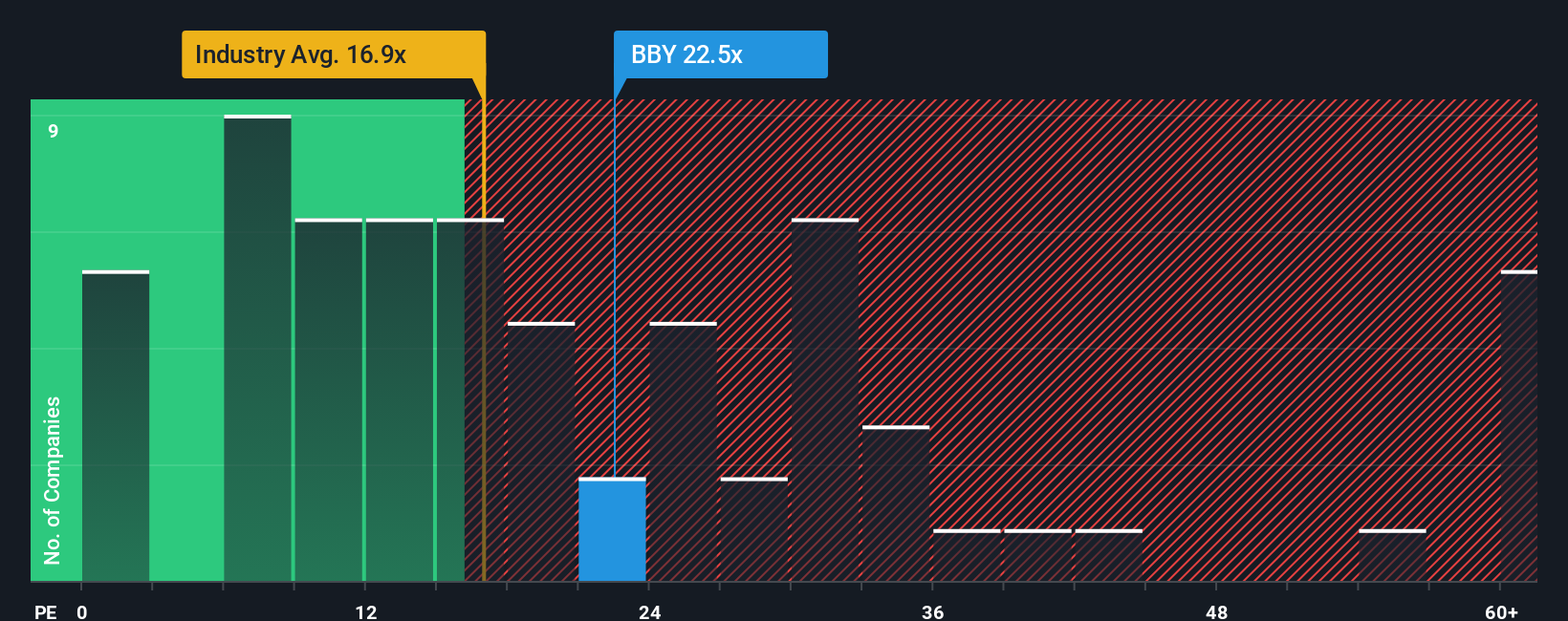

While analysts see upside based on discounted cash flows, a look at the company’s current price-to-earnings ratio reveals a more complicated picture. Best Buy’s ratio stands at 20.4x, which is above the industry’s average of 17.3x but lower than the peer average of 49.2x. Interestingly, this is also just below its “fair ratio” of 21.4x, a level the market could gravitate toward over time. This gap suggests that the market is weighing both caution and possibility. Will it move closer to the industry’s stance or reward Best Buy’s positioning in coming quarters?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Best Buy Narrative

If you see the numbers differently, or want to dig deeper on your own terms, it's quick and simple to craft your own take. Do it your way

A great starting point for your Best Buy research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let your next opportunity slip by. Put yourself in front of tomorrow’s market leaders by checking out tailor-made lists that match your goals.

- Capitalize on resilient cash flow potential as you scan these 893 undervalued stocks based on cash flows, which are trading well below their true worth.

- Tap into the explosive power of artificial intelligence with access to these 25 AI penny stocks, finding new ways to reshape industries.

- Secure reliable income streams by reviewing these 19 dividend stocks with yields > 3% with yields above 3%, handpicked for investors seeking lasting returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Best Buy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBY

Best Buy

Offers technology products and solutions in the United States, Canada, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives