- United States

- /

- Specialty Stores

- /

- NYSE:BBWI

Will BBWI’s Festive Milk Bar Collaboration Reveal New Strengths in Product Innovation and Customer Loyalty?

Reviewed by Sasha Jovanovic

- Bath & Body Works recently introduced a limited-edition holiday fragrance collection developed in collaboration with Milk Bar, featuring four dessert-inspired scents available across multiple product formats.

- This partnership expands on their earlier joint launch and highlights the brand’s ongoing efforts to drive consumer excitement through innovative seasonal offerings and experiential collaborations.

- We'll explore how the Milk Bar holiday collection launch may influence Bath & Body Works' investment outlook, particularly for product innovation and customer engagement.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Bath & Body Works Investment Narrative Recap

To own Bath & Body Works stock, you need to believe the company can consistently capture consumer interest and drive sales through creative product launches and high-impact collaborations. The new Milk Bar holiday fragrance collection aims to spark excitement among loyal shoppers and attract new audiences, but the impact on the company’s biggest current challenge, stemming sluggish same-store sales and igniting broader customer growth, may be limited in the near term unless it translates to measurable sales momentum.

Of recent announcements, the launch of Bath & Body Works-branded products in over 600 college campus stores stands out as most relevant. This move targets Gen Z and younger consumers, directly addressing the need for a broader customer base, something the company has identified as critical to its future, and a catalyst the Milk Bar partnership alone may not fully address.

On the other hand, investors should note the ongoing risk posed by rising operating expenses, especially as...

Read the full narrative on Bath & Body Works (it's free!)

Bath & Body Works' outlook suggests revenues of $8.1 billion and earnings of $860.7 million by 2028. This is based on a forecasted annual revenue growth rate of 3.1% and an earnings increase of $132.7 million from the current $728.0 million.

Uncover how Bath & Body Works' forecasts yield a $39.33 fair value, a 51% upside to its current price.

Exploring Other Perspectives

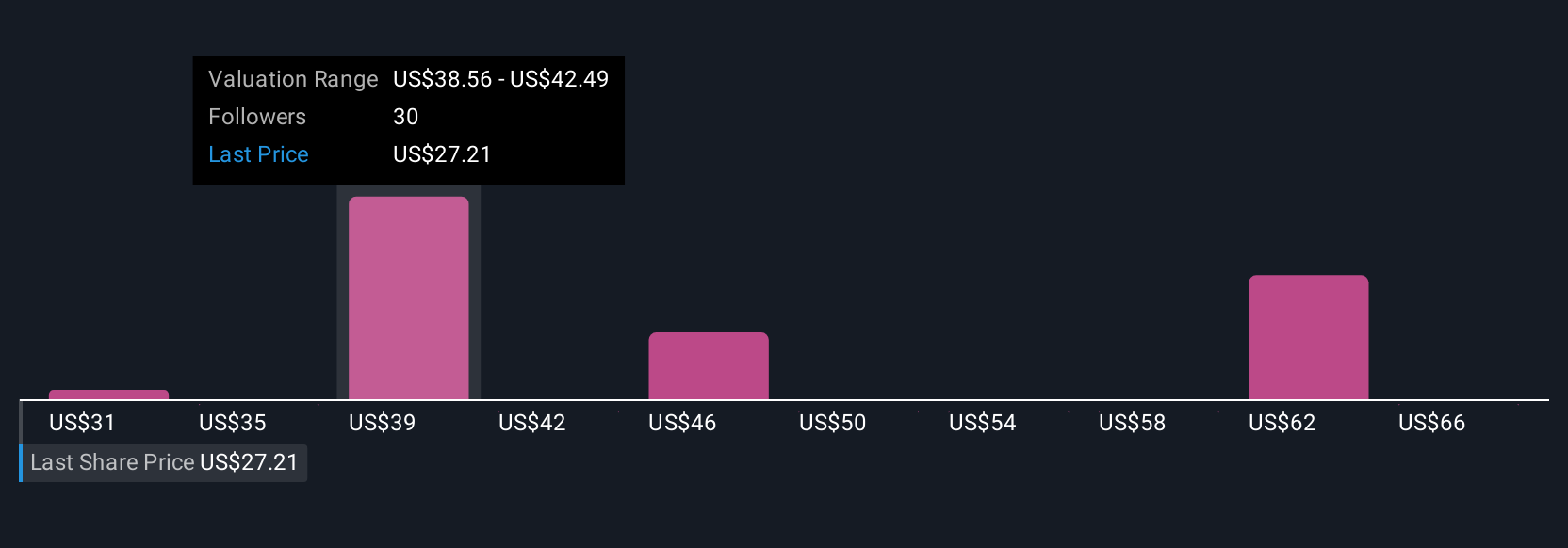

Ten members of the Simply Wall St Community estimate the fair value for Bath & Body Works stock between US$30.70 and US$70.00 per share. With this variety of individual outlooks, keep in mind that new customer acquisition remains a critical hurdle for long-term growth and performance, so it’s worth exploring multiple viewpoints when assessing the company’s prospects.

Explore 10 other fair value estimates on Bath & Body Works - why the stock might be worth over 2x more than the current price!

Build Your Own Bath & Body Works Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bath & Body Works research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Bath & Body Works research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bath & Body Works' overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bath & Body Works might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBWI

Bath & Body Works

Operates as a specialty retailer of home fragrance, personal and body care, soaps, and sanitizer products.

Undervalued second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives